TSL Express Daily Articles & News

To submit company news and press releases toTSL Express, email tslexpress@sfnet.com.

Today's Top Story

Featured

MidCap Financial Closes $325mm Senior Revolving Credit Facility to Revlon

MidCap Financial, a leading commercial finance company focused on middle market transactions, today announced it has provided a $325mm senior revolving credit facility to Revlon Intermediate Holdings IV LLC. (“Revlon” or “Company”) in connection with Revlon’s successful emergence from Chapter 11.

TSL Express Trending Story

Featured

SFNet Launches In the Know Video Podcast

The Secured Finance Network is excited to launch a new video podcast today, in partnership with respected industry veteran Barry Bobrow, and sponsored by Hilco Global. “Our members continue to seek valued insights on issues critical to their businesses,” said SFNet CEO Rich Gumbrecht. “This new resource will complement existing sources of expert analysis and information SFNet provides to our community in an energizing new format.”

TSL Express Daily Headlines & News

-

NXT Capital Credit Facility Provides to Shoreline Equity Partners’ Acquisition of Prime Meats

April 29, 2024NXT Capital announced today that it has provided a unitranche credit facility to support Shoreline Equity Partners’ acquisition of Prime Meats, LLC. NXT Capital acted as the Administrative Agent, Sole Lead Arranger, and Sole Bookrunner on this transaction.

-

Change Capital Welcomes Paul Durosko as Head of Lending Operations

April 29, 2024Change Capital is pleased to announce the appointment of Paul Durosko as Senior Vice President and Head of Lending Operations. With over three decades of experience in the commercial finance and lending industry, Mr. Durosko brings a wealth of expertise to the firm, an innovative and fast-growing commercial lender and capital provider.

-

Axiom Bank Expands Factoring Team with Addition of Norman Brame of Charlotte, NC

April 29, 2024Axiom Commercial Finance, a subsidiary of Axiom Bank, a Maitland-based bank, has just expanded its team once again, with the hiring of Norman Brame as Vice President, Business Development Officer in its factoring division, headquartered in Dallas.

-

Altriarch Empowers Dozens of Businesses Through Innovative Finance Strategies for Factors

April 29, 2024Altriarch Asset Management, LLC (“Altriarch”), a private credit manager headquartered in Charleston, South Carolina, continues to redefine the landscape of factoring with its innovative and bespoke financing solutions in 2024.

-

Business First Bancshares, Inc. to Acquire Oakwood Bancshares, Inc. and Oakwood Bank

April 29, 2024Business First Bancshares, Inc. (NASDAQ: BFST) (“Business First” or the “Company”), the holding company for b1BANK, today announced that it entered into a definitive agreement to acquire Oakwood Bancshares, Inc. and its wholly-owned bank subsidiary, Oakwood Bank (together, Oakwood), in an all-stock transaction for total consideration value of approximately $85.7 million based on the Company’s closing price of $21.57 per share on April 22, 2024.

-

Brightwood Capital Provides Financing to Accelerate Allegiance Mobile Health’s Growth Strategy

April 29, 2024Allegiance Mobile Health (the “Company” or “AMH”), the largest private Texas-based provider of medical transportation and 911 emergency services, and Brightwood Capital Advisors, LLC (“Brightwood”), a private credit firm with over $5 billion in assets under management, today announced that Brightwood provided AMH with debt and equity financing to support the Company’s organic and inorganic growth strategy.

-

Conterra Networks Completes $580 Million Debt Capital Raise

April 29, 2024Conterra Ultra Broadband Holdings, Inc. ("Conterra Networks", "Conterra" or "the Company"), a national leader in providing fiber-optic network-based infrastructure and services, announced today the completion of a debt capital raise totaling $580 million, which will be used to refinance existing credit facilities, optimize Conterra's capital structure, and provide additional capacity to support Conterra's growth.

-

Tillman Infrastructure Secures $1 Billion in Financing to Drive Growth

April 29, 2024Tillman Infrastructure, LLC ("Tillman Infrastructure"), a leading provider of wireless communication infrastructure, today announced the successful completion of a financing package totaling $1 billion. The proceeds will be used to refinance existing loans and provide additional growth capital to support its wireless carrier and wireless internet service provider (WISP) customers' infrastructure needs.

-

Methanex Renews and Adds New Tranche to Revolving Credit Facility

April 25, 2024Methanex Corporation (TSX:MX) (NASDAQ:MEOH) announced today that it has renewed its US$300 million revolving credit facility, which replaces the Company’s existing revolving facility, and added an additional US$200 million tranche. The facility has been arranged with a syndicate of banks and will expire April 24, 2028 with the US$200 million tranche expiring April 24, 2026. RBC Capital Markets was the Arranger for the facility.

-

Blackstone Selling Student Housing Portfolio to KKR for $1.6B

April 25, 2024Blackstone Real Estate Income Trust (BREIT) is selling a portfolio of 19 student-housing properties to funds managed by KKR for $1.64B. The portfolio, which encompasses more than 10,000 beds, includes purpose-built student housing assets anchored to 14 four-year public universities across 10 states, the companies announced on Thursday.

-

SLR Equipment Finance Expands its Business Development Capabilities and Announces That Douglas Slagle has Joined the Company

April 25, 2024SLR Equipment Finance is pleased to announce Douglas Slagle has joined our company as Senior Vice President, Direct Sales. In his role, Douglas will help grow SLR Equipment Finance’s leasing and lending activities in California, Oregon, Washington, Idaho, Nevada, Arizona, Utah, Wyoming, Montana, & Alaska. Douglas began his career with Matrix Funding Corporation.

-

Brean Capital Serves as Co-Manager on $75.0 Million Securitization for Credibly

April 25, 2024Credibly, the fintech lending company that champions small and medium-sized businesses (SMBs), announced the successful close of its third securitization totaling $75 million in additional funding capacity. This milestone marks a significant achievement for the Company, with KBRA assigning a “AA” credit rating to the senior notes.

-

Mitsubishi HC Capital America Reveals Key Factors Shaping Adoption of Robotics-as-a-Service in 2024

April 25, 2024As robotics and automation expand rapidly into industries from healthcare to warehousing to food service, recent research shows that the global robotics-as-a-service (RaaS) market is projected to grow at a CAGR of 17.4% through 2028 to more than $4 billion.

-

US Capital Global Securities Announces $10MM Convertible Note Offering for Global Award-Winning Premium Tequila Brand

April 25, 2024US Capital Global Securities LLC, an SEC-registered affiliate of renowned global financial group US Capital Global, is pleased to announce an exclusive investment opportunity for eligible investors. A convertible note offering of up to $10 million is now available for participation in Etéreo Tequila Spirit Limited (“Etéreo”), an award-winning Tequila brand that aims to redefine luxury with its fusion of Mexican heritage, European sophistication, and Mediterranean lifestyle.

-

Monroe Capital Supports Trivest Partners’ Epika Fleet Services

April 25, 2024Monroe Capital LLC today announced it acted as sole lead arranger and administrative agent on the funding of a senior credit facility and equity co-investment to support the future growth of Epika Fleet Services (“Epika”), an existing portfolio company of Trivest Partners.

-

HREF Appoints new Vice President and Senior Business Development Consultant

April 25, 2024Hilco Real Estate Finance (HREF) has promoted Patrick Davenport-Jenkins (pictured above), to vice president and appointed Alexey Shokin as senior business development consultant. Patrick joined HREF as an associate in 2023 when the division was launched, after six years working in real-estate and financial services.

-

Blackstone Credit and Insurance Appoints Dan Leiter as Head of International

April 25, 2024Blackstone (NYSE:BX) today announced the appointment of Dan Leiter as Head of International for Blackstone Credit and Insurance (BXCI). In this role, reporting to Gilles Dellaert, Global Head of BXCI, Mr. Leiter will lead the activity and expansion of BXCI in EMEA and APAC. Additionally, Michael Carruthers is appointed as European Head of Private Credit, reporting to Mr. Leiter.

-

PCF Insurance Services Secures $400 Million in Incremental Financing as Part of New Delayed Draw Term Loan

April 25, 2024PCF Insurance Services, a top 20 U.S. insurance brokerage, has closed $400 million in incremental debt financing led by Blue Owl, a global alternative asset manager that acted as lead arranger and administrative agent. The financing was materially oversubscribed and was upsized from $300 million to $400 million in response to strong demand from new and existing lenders.

-

Apollo’s ATLAS SP Announces Investment from MassMutual

April 25, 2024Apollo (NYSE: APO) and MassMutual today announced that MassMutual has become a minority equity owner in ATLAS SP Partners (ATLAS) and a capital partner to the ATLAS platform. ATLAS is the warehouse finance and securitized products business majority owned by Apollo funds. As part of the multi-billion-dollar commitment, MassMutual has also agreed to invest in Apollo’s Asset-Backed Finance (ABF) franchise.

-

SFNet Member Spotlight: Cost Reduction Solutions

April 24, 2024CRS offers due diligence and agreed upon procedures services, such as collateral field examinations, to all financial lenders as well as offering separate accounting & forensic services.

The Secured Lender

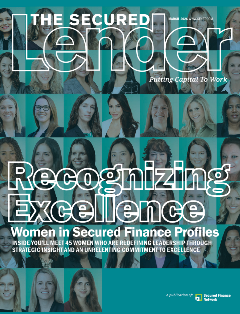

SFNet's The Women in Secured Finance Issue

© 2026 Secured Finance Network