- SixCap Healthcare Finance Launches Integrated Healthcare Capital Platform Combining Asset-Based Lending and Real Estate

- The Power of Mentorship: A Conversation with Frank Grimaldi

- Interview With SFNet’s Supply Chain Finance Convergence '26 Keynote, Financial Times' Robert Smith

- Appointing Independent Directors to Distressed Companies: An Alternative to Bankruptcy

- Gordon Brothers Bolsters Investment Committee with Janet Jarrett Appointment

SFNet Annual Convention Highlights - Master Disruption and Charge Ahead in 2023 (With Some Caution)

By Susan Carol

SFNet’s Annual Convention was held in Austin from November 9-11. This article provides an overview of the key topics addressed.

Listening to Convention keynoter Peter Zeihan’s geopolitical perspectives is a reminder of the many global and economic disruptors possible and all that one can’t control. However, in keeping with the event’s theme of "Mastering Disruption, Putting Capital to Work in the New Global Environment,” the breakout sessions triggered healthy discussion about what a new global environment for lending could look like, how data could be more strategically used to protect cross-border interests or prevent fraud, and how new supply chain models are forming. The factoring and asset-based lending sessions presented ways to master their markets while facing recessionary headwinds.

Besides the many opportunities to network with peers and clients, attendees in Austin, TX, could absorb others’ views on economic conditions affecting the industry and dive into niche topics of strategic importance.

How Factoring and ABL Leaders Reposition for a Recession

Presenters on an asset-based lending (ABL) panel at the November convention said their companies are more judicious with capital today and they are choosier with whom they do business, anticipating a recession. “We had a great year helping our clients restructure,” said one panelist, but supply chains are still creating issues such as unpredictability. Some businesses did not adapt well to inventory fluctuations, so lenders are waiting to see what the holiday season will look like for them.

Energy prices in particular will affect the transportation sector, which is already under pressure due to inventory values dropping, the speakers noted.

The lines between bank and non-bank lenders are no longer as blurred as they may have been. The independents view risk rating models and risk as two different things; if the banks pull back, it opens the door for more non-bank business.

In 2023 the opportunities will go to those with more creative structures, but at the same time, these lenders said money must have a purpose and they will be monitoring asset values far more frequently than in the past.

In another session on the current factoring environment, speakers said they too are preparing for a recession that seems to already be at their doorstep. As they prepare for an increase in distressed accounts, they have positioned operations staff to identify risks as early as possible. While they may keep advance rates the same, some may look for an equity contribution to make up for tighter margins.

In addition to recession planning, the panelists said there is focus on skills training, potential acquisitions and new products or regions in which to expand. One speaker said her company specifically wants to identify possible clients with scalable business, for example.

While automation is increasingly embraced at all customer touchpoints, really knowing customers and being connected to a customer’s decision makers will be valuable in the event of default. The speakers pointed out that something as simple as an asset delivery date change can have a huge impact, especially for businesses involved in seasonal commerce.

The lines are blurring between ABL and factoring as hybrid facilities are developed, a change driven by larger clients in lower-market deals.

A major issue raised was the challenge of new disclosure rules popping up in various states that one panelist said will create “a bit of a Wild West.” The new rules add burdensome administrative costs and present hurdles especially because requirements differ by state. (Editor’s note: SFNet has created a guide to assist members who must comply with the CA financial disclosure law that goes into effect December 9.)

Another issue: The younger generation has never experienced managing business risks in a recession. They rely on seasoned leaders for guidance. In turn, the panelists with many years of experience said they benefit from the next generation’s ease in gathering and manipulating data to be used strategically.

Last year at this annual conference, many workers were still operating from home and there were worries about when employees would return to offices. The ABL panelists agreed that this year, the youngest of their employees seem to want to be in the office now and enjoy interacting and celebrating the wins. Their companies have adopted hybrid models that offer flexibility so employees can work from home when it is advantageous. Panelists also discussed the business benefit of diversity and the need for more DEI at upper echelons of management.

Supply Chain’s New Normal

In another session focused on the many challenging supply chain problems that have come to the forefront, a panel discussed the hope for a better future with regional networks being developed, new models, and more transparency and knowledge of the “logistical plumbing,” as it was described. Retailers are already paying much more attention to where goods are sourced, and they have increased their inventory and abandoned outdated “just-in-time” factory ordering.

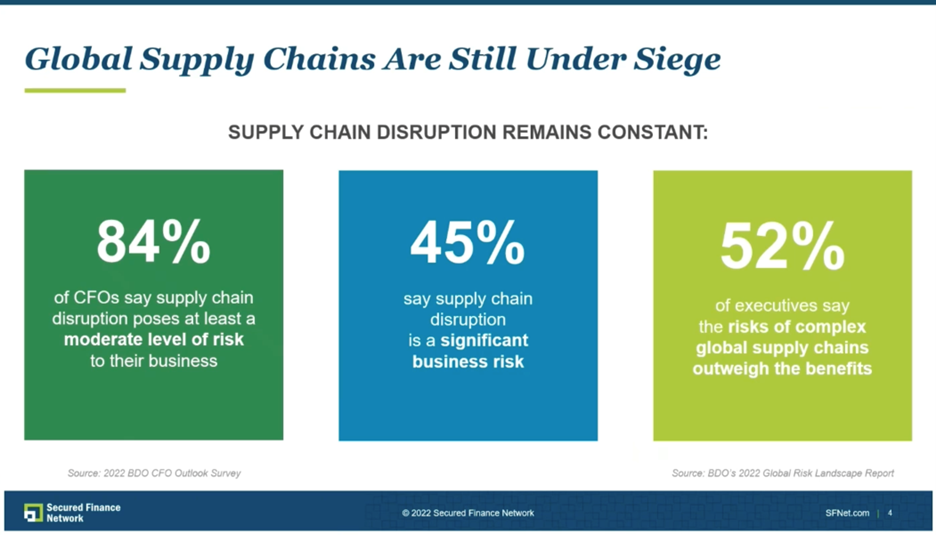

A BDO survey of CFOs indicated that 84 percent consider supply chain a “moderate risk.” The presenter of the findings said that in the company’s 20 years of doing the survey, it has never seen supply chain be such a front-and-center matter. The survey also found that 45 percent of CFOs considered it a significant risk and 52 percent said the complexity of just-in-time sourcing outweighs its benefits. The challenges are clear: risk of delays, supply shortages, transportation costs and demand unpredictability.

Geopolitical tensions also are a factor leading to new onshoring initiatives. According to one speaker, the most significant impact since the financial crisis likely will be the CHIPS Act, a bipartisan legislation with the intent of bringing semiconductor manufacturing back to the U.S. Purchasing under this act will be guaranteed by a combination of state and federal incentive awards, creating good opportunities for lenders.

Also addressed at the Convention was the need for more advanced planning in the manufacturing process to ensure new models are more agile and labor adequate to meet fluctuating demand. One presenter noted that there are some 6,000 job openings in the U.S. for planners with this skillset.

Improved quality in manufacturing at the Mexican border represents a way to get goods into the U.S. with duty-free benefits and to help build labor opportunity in Mexico.

Regional supply chains will be the “wave of the future,” according to panelists. And there is no chance of going back to past strategies while Russia’s war in Ukraine continues, along with shutdowns in China. The future also will include higher levels of inventory, more sophisticated tools to monitor supply chains in real time, blockchain for transparency and greater focus on maintaining a reliable workforce.

Clearly, there is a realization that logistics and financing must be forever married to create new creative structures.

Fraud: The Devil is in the Details

New creative structures and scaling business also raise the issue of fraud prevention. How to prevent it is always on the minds of the panelists, led by moderator Don Clarke, president of Asset Based Lending Consultants. (Pictured below holding of bill of accounts receivables that could be fraudulent and cash that could be lost)

The panelists provided examples of real-life experiences distinguishing between fraud that begins at the start with a deliberate strategy to steal and the case where business was good, then suddenly took a turn from which the owner couldn’t recover. This may be spotted as delays in reporting, pushing off a field examiner or being out sick at key moments. Details and trend lines are important, as well as relationships. “Everyone has policies and procedures, but it’s the execution on them that matters,” said one presenter.

Portfolio review is needed by all levels of management and if business is growing, you can’t rely on gut alone, the speakers said, adding, “What you are looking for are variations in patterns.” The best approach is a blend of human and systems intelligence. The panelists agreed that fraud prevention can’t be fully automated. One said: “How do you know if what you see now is what will be happening 45 days out?”

From the audience, there was advice from a company president with 35 years of experience who said that when a client invites him to lunch, his company has learned to review that client’s account. There was usually a problem developing. “Beware of the free lunch,” he advised.

The 78th Annual Convention helped attendees unpack the uncertainty experienced during the last three years and provided the tools and information to prepare for unsettled times ahead. Mark your calendar for SFNet’s 2023 Annual Convention in Orlando, November 8-10.

.jpg?sfvrsn=f1093d2a_0)