- Eclipse Business Capital Announces the Promotions of Ralph Shin, Denise Rodriguez and Kenya Hall Across Key Departments

- The New Wave of Leaders: Rewriting the Playbook for ABL and Factoring

- Cesar Silva Joins nFusion Capital as Senior Vice President, Business Development

- Patient Capital in Action: An Interview with Cambridge Savings Bank’s Yvonne Kizner and Cal Navatto

- The Growing Impact of Supply Chain Finance: Insights from SFNet's 2025 Market Sizing Study

Is a Corporate Default Wave Ahead In 2022?

November 11, 2021

Some turnaround and M&A leaders are predicting the second quarter of 2022 could be when the “default boom” hits. Asset-based lenders, factors, and other secured lenders will need to be at the ready to handle turnaround deals.

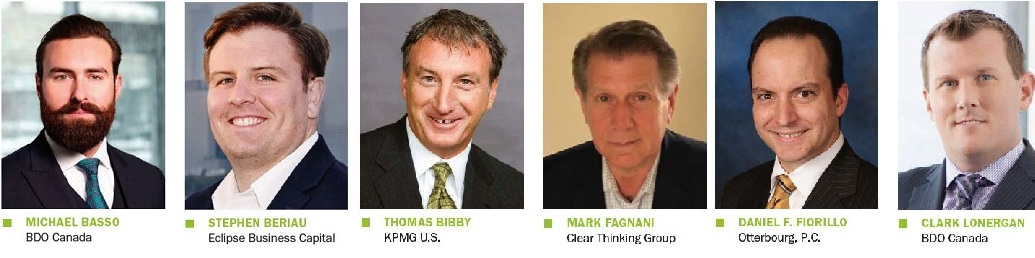

The economic picture might be improving overall, but retail, hospitality, travel, and transportation businesses are still dealing with the impact of shutdowns caused by COVID-19. 2020 is in the rearview mirror, but supply chain disruptions, semi-conductor shortages, manufacturing delays and labor scarcities, all lingering effects of the pandemic, continue to leave some companies on uneven footing. Of course, the holiday shopping season is a time for retailers and many other businesses to make up shortfalls they may have experienced during the year. But this year might be different if staffing shortages continue and low inventory results in fewer products to ship and sell, notes Mark Fagnani, senior managing director for Clear Thinking Group. And, while the pandemic may be waning in the U.S. as of this writing, he adds that many of the countries where goods are manufactured are still not seeing their populations vaccinated in large numbers, and worker health issues abroad are likely to cause additional delays in shipping products stateside.

Liquidity Problems Ahead

So, what does this all mean for secured lenders? Turnaround and M&A leaders are predicting the second quarter of 2022 just may be the time when the business community will experience a spate of corporate defaults, and asset-based lenders, factors, and other secured lenders will need to be at the ready to handle turnaround deals.

The stage may have been partially set in 2020 when the Office of the Comptroller of the Currency instructed banks to avoid labeling any loan as a Troubled Debt Restructuring (TDR) asset and not to throw the loan into the special lending or special assets category through 12/31/21. A TDR label is permanent and cannot be removed before the loan is liquidated and removed from the lender’s books. But according to Fagnani, the likelihood that the OCC will extend the guidance, already extended once, is very unlikely. With the guidance not in effect, he is expecting secured lenders will need to deal with a wave of bad loans some time in the second quarter of 2022.

Many struggling businesses were able to ride out much of the pandemic with the help of PPP loans. Without that safety net continuing, Fagnani notes that some companies will soon find themselves once again dealing with liquidity issues. “If you’re financing with an asset-based lender and that line of credit is tied to your collateral, accounts receivable, or inventory and you need to borrow more than those assets generate, because you need more money, it’s certainly the beginning of a bigger issue,” he adds. “It’s a Catch-22. You can’t borrow against inventory or accounts receivable that you don’t have.” While it’s not necessarily a death knell for a company, Fagnani notes that it does present a quandary for secured lenders, particularly as they see a drop in outstandings.

Assessing the Situation

Daniel F. Fiorillo, chairman of the workout and restructuring department at Otterbourg P.C., notes that secured lenders will need to deal with each problem loan on a case-by-case basis. Secured lenders should look at the strength of the relationship with the borrower, competence of the borrower’s management team, viability of the business and other creditors in the borrower’s capital structure who might be willing to assist the distressed borrower and that a troubled company isn’t necessarily a candidate for bankruptcy.

According to Fiorillo, a lender’s decision to forbear from exercising its default rights, or to otherwise agree to “amend and extend” the credit facility with a distressed borrower is heavily influenced by the circumstances surrounding the distressed credit and the availability of viable exit strategies from the distressed loan. For example, if the borrower is unable to comply with its lending arrangements, but is willing to operate under an agreeable budget and conduct a sale or marketing process, that could result in the business being sold and the proceeds from the transaction used to repay the secured lender’s debt. Then the lender might be willing to enter a forbearance arrangement with the borrower, giving the borrower time to execute on its plan. The secured lender will generally get additional protections and potential credit enhancements in the situation as well.

In the short run, Fiorillo does see more workouts, debt restructurings, distressed collateral sales and borrower bankruptcy filings within loan portfolios on the horizon, assuming the credit default wave materializes. “I think it depends on the business and the applicable terms of the credit facility,” he adds. “However, there is still a lot of money circulating in the marketplace, and we have observed sponsors, investors and other parties deeply imbedded in a distressed company’s capital structure extend rescue loans and other emergency funding arrangements to ‘keep the plates spinning on those poles’ in the hope of a turnaround,” he adds. So, the extent of the increase in workouts and borrower bankruptcies secured lenders might face might not be as significant as one might expect.

Who’s at Risk?

Industries that were adversely impacted by the pandemic and, therefore, relied upon the banks to waive or forbear from exercising default rights, would be at risk, as the banks may have tightened the credit terms with these borrowers when the banks had the leverage to do so. For banking players in the asset-based lending space, however, they’ve typically fared better than other forms of bank lending. Fiorillo notes that, generally speaking, secured lenders might be better situated to weather a credit default storm than, say, other lending platforms within the bank, as the bank’s exposure (if underwritten conservatively), should be covered by the value of the collateral.

That said, secured lenders still might want to start taking a hard look at their portfolios with a focus on the borrowers most susceptible to being on the wrong side of the default deluge. Fiorillo notes that depending on the terms of the credit arrangements, the lenders might want to ask for updated projections and a business plan that gives the lender an opportunity to examine the feasibility of the company’s road map. The lender may also want to update appraisals, field exams and collateral reporting to better ascertain its current loan exposure.

If the consumer experiences material headwinds, then a number of consumer-based lenders, with bundled and syndicated loans to access a lower cost of capital, could face additional pressure. Michael Basso, vice president and senior manager at BDO Canada, notes, “We anticipated this early in the pandemic for auto financing and buy now-pay later and the like, but, given the government support for the consumer, this never materialized. Industries and companies that took on the most debt during this period should also be worried, as not only do profits have to return to pre-pandemic levels, but exceed those levels to service this additional debt. Additionally, those industries that were already under a paradigm shift in their business model, such as brick-and-mortar stores moving to online sales, see the shift crystalized or accelerated due to the pandemic, and these companies, and their lenders, should also be worried.

Putting the Team in Place

Increased shadowing of troubled accounts by the banks’ work-out groups will assist in early identification of those companies which may need help now and allow the bank and their advisors more time to assist and help avoid potential liquidation scenarios, says Clark Lonergan, partner and senior vice president for financial advisory services at BDO Canada LLP. Proactive management is key, he adds, and getting in early to assist allows for more effective and efficient restructuring and other options, such as refinancing, a sale of the business, equity injection, or asset dispositions. He also notes that secured lenders need to be cognizant of “what the new world looks like and how their customers’ capital structure has changed” to help predict potential future distress.

Of course, lenders consistently evaluate collateral positions for distress and degradation in value, but the laser focus on troubled assets is particularly essential when there may be so many companies facing the same dilemma. Thomas Bibby, KPMG U.S. partner, restructuring, notes, “The importance of communication between borrower and lender cannot be emphasized enough, especially when a problem occurs.” Generally, lender prefers to work through the issue instead of forcing an immediate liquidation, he notes. Lenders are likely to continue working cooperatively and diligently with troubled borrowers to remedy the situation.

Plus, secured lenders have been through economic and industry cycles many times over and understand the impact on their clients. Secured lenders will focus on identifying which loans within their system need to be monitored more closely. He also notes that communication is vital within the lender’s organization regarding monitoring and timely action, as well as externally, to articulate timely and clear messages to individual borrowers.

The Resiliency of Secured Lenders

Secured lenders will be at the ready, staffing up special-situation teams with experienced workout team professionals to go through each loan to maximize value, while others will package and sell entire portfolios of troubled loans. Bibby adds, “Often, lenders boost workout bandwidth by requiring outside turnaround firms to be engaged by borrowers as part of a forbearance agreement.” He adds that some defaulted borrowers will be pushed to a quick sale, refinance, or even liquidation, while other secured lenders may exert patience and work through problems over a longer period.

If predictions for a deluge of defaults come true, Bibby notes that “M&A activity will be a mechanism used to try and preserve enterprise value for stakeholders.” In the case where the enterprise value is inadequate, there may be rise in bankruptcy activity to create or preserve value for the stakeholders and reset secured loan values to the current market valuation. But, he adds that lenders are generally prepared to handle and manage troubled loans, as they have in energy, retail, and real estate at various times over the past several years.

According to Stephen Beriau, senior managing director at Eclipse Business Capital, the labels on loans will certainly change along with the Fed’s guidance, but he argues that secured lenders are very capable of managing these tougher credits. “It’s only a more recent practice for banks to manage away these TDRs and that’s mainly due to reserve requirements changed over the past 15 years. For the time being, keeping these credits should help net interest margin.” And, says Beriau, non-bank groups have the capacity to support these credits.

Plus, partner organizations, appraisal firms and turnaround consultants are at the ready to assist secured lenders in the days, weeks, months, and years ahead, as always. “The past 18 months has come in fits and starts for our market, and most organizations were prepared entering 2021,” says Beriau. And while no one could have ever predicted what the pandemic’s impact on business could be, government intervention during the shutdown really did put business on a much more stable footing, he adds. But with less government intervention in the future and a possible increase in the Fed funds rate, Beriau does suspect more restructuring and turnaround transactions in 2022.

A Differing Perspective

Not everyone agrees there will be deluge of corporate defaults. One senior banking executive said: “We are far removed from the recession, and there’s a rebound in the economy and an influx of liquidity into the markets and into the balance sheets of these companies listed as troubled assets.” And, he adds that the sectors most sensitive to the business risks related to the pandemic, such as hospitality and leisure, are not heavily represented in the portfolios of asset-based lenders.

Additionally, it’s not just about relabeling troubled assets according to the OCC. He notes distressed assets are simply at a cyclical low and that most secured lenders do not expect to see a large rise in them. “The economy really has rebounded very sharply, and it’s helping all kinds of companies.” While there certainly are some companies that are having a problem because of supply chain issues, he notes companies have been able to refinance their debt at a much lower cost, and between that and PPP loans, companies have more liquidity and more room to run their business.

A survey of asset-based lenders seems to concur with this perspective. Results from the Secured Finance Network’s Q2 2021 Asset-Based Lending Survey indicate lenders appear optimistic about the year ahead with overall lender confidence remaining high as of 2Q 2021, and “continuing laterally from last quarter’s three-year high.” Lenders also reported positive expectations for U.S. business conditions and improvements to current client utilization. The survey also revealed that nonaccruing loans, as a percentage of loans outstanding, fell by 12 basis points in 2Q 2021. Compared to the same quarter last year, the percentage of non-accruing loans among survey respondents decreased by 33 basis points.

Additionally, Fiorillo notes the banks and secured lenders that have seen a wave of defaults in the past know how to be proactive with their troubled credits. “They’ve used the defaults as a basis to get the borrower back to the negotiation table to get better visibility into the borrower’s business operations and financial condition, as well as improve the collateral position and legal protections and limit credit exposure where possible. And, if secured lenders continue to use discipline, they should be able to weather the ups and downs inevitable in any market.

.jpg?sfvrsn=f1093d2a_0)