- SixCap Healthcare Finance Launches Integrated Healthcare Capital Platform Combining Asset-Based Lending and Real Estate

- The Power of Mentorship: A Conversation with Frank Grimaldi

- Interview With SFNet’s Supply Chain Finance Convergence '26 Keynote, Financial Times' Robert Smith

- Appointing Independent Directors to Distressed Companies: An Alternative to Bankruptcy

- Gordon Brothers Bolsters Investment Committee with Janet Jarrett Appointment

Guarded Optimism Prevails as Executives Chart the Future

August 1, 2019

By TD Bank

Ten years is a long time, but for many business leaders the Great Recession's stark impact on credit availability lingers in memory. As the supply of credit rapidly diminished in 2009, companies had difficulty securing needed external capital for growth and innovation, such as market expansion and operational improvements. For some companies, the severe credit crunch affected their ability to remain in business.

Constantly reminded that another recession is to be expected, business leaders worry about the availability and price of debt once it emerges. Indicators of an approaching recession include the May 2019 report of a slowdown in employment and the occasional rearing of the inverted yield curve, an interest rate environment in which long-term debt has a lower yield than short-term debt.

Yet, the U.S. economy certainly appears to be in excellent shape, evidenced by a healthy GDP growth rate, scant evidence of inflation, and near-historic low unemployment. Still, no one disputes that a recession is inescapable; the questions are when it will occur, how bad it will be, and how long it will last.

To gauge how financial decision-makers are preparing for challenges and opportunities in the market—particularly as it relates to their investment strategies and long-term growth plans—TD Bank surveyed more than 300 CFOs, treasurers and other financial professionals in May 2019.

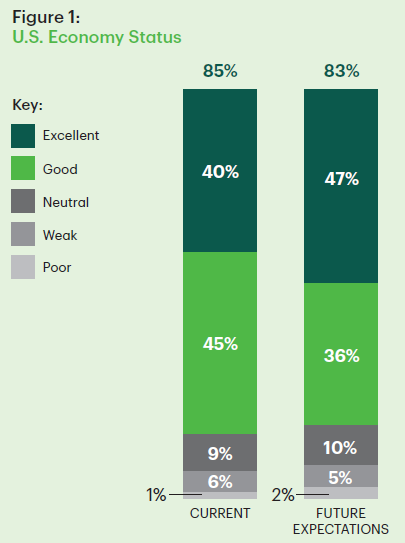

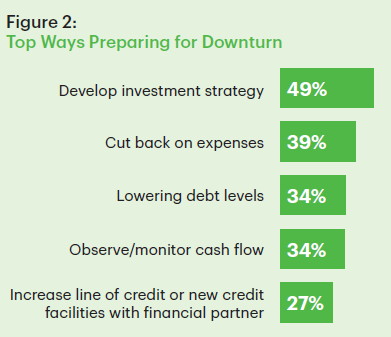

While the great majority of survey respondents (85 percent) have a positive outlook on the future of the U.S. economy, more than half (58 percent) are preparing for an economic downturn. (See Figure 1). Chief among these preparations is the development of an investment strategy to weather the economic downturn, with 49 percent of respondents taking this position. Other plans include cutting expenses and reducing debt levels. (See Figure 2).

Despite the respondents' generally upbeat economic outlook, the harsh realities of the prior recession have compelled deeper thinking on an investment strategy that will support plans for growth and innovation. As Stephen Foley, head of corporate banking at TD Bank, interprets the survey findings, “The best time to prepare for the potential of a downturn is when business is going well."

Imperatives for Business Transformation

Few business leaders would disagree that it's a great time to be in business. Notwithstanding recent economic volatility generated by geopolitical wrangling on trade and tariffs, most metrics of economic health are positive. Interest rates, for example, remain at near-historic lows, with inklings by the Federal Reserve to hold the lid down on future incremental rate hikes.

“We're almost ten years into the recovery cycle and still the economy continues to hum along, evident in low unemployment, minimal evidence of inflation, and even the prospect of the Federal Reserve reducing interest rates, reversing recent actions," said Foley. “We've also yet to see a sustained inverted yield curve—historically a precursor to a recession."

These factors figure into the high degree of optimism over current economic conditions. Of the 85 percent of financial decision-makers surveyed by TD Bank who have either an “excellent" or “good" impression of the U.S. economy, a full 83 percent believe the economy will remain in positive territory for the foreseeable future.

Of course, no one can predict where the economy will be five years from now, much less a year away. Nevertheless, it appears the respondents' bullish outlook is driven by their respective companies' business health. An astonishing 94 percent of the executives consider the strength of their business to be “excellent."

With past as prologue, the majority of survey respondents are planning actions just in case the economy doesn't hold up as expected. “It's prudent to be downturn-ready, making sure everything is battened down financially so when the recession eventually surfaces, you can ride out the cycle," Foley explained.

These actions include the development of an investment strategy to continue needed investments in growth and innovation, with nearly half the survey respondents (49 percent) undertaking this approach. Other actions include cutting back on business expenses (39 percent of respondents), reducing debt levels (34 percent), monitoring cash flows (34 percent), and increasing lines of credit (27 percent).

Financing a Digital Transformation

In these deliberations, companies are cognizant of the importance of external sources of debt capital to pursue growth and innovation. The latter goal is exemplified by widescale investments in digital transformation—the use of innovative digital technologies to solve traditional business problems, make more insightful business decisions, and deliver greater value to customers.

Nearly every company today (94 percent) has made digital transformation a strategic imperative, according to a 2018 study by Deloitte. These organizations are beginning to use tools like machine learning and robotics process automation (RPA) to automate highly manual repetitive processes, freeing up employees to focus on the strategies that drive the business forward. Other tools, like predictive analytics, assist a better understanding of business health to improve capital allocation determinations and other business decisions. A 2019 study by PwC suggests that fully half of companies today have become “digitally fit," meaning their functions are equipped with data-driven tools providing real-time business insights.

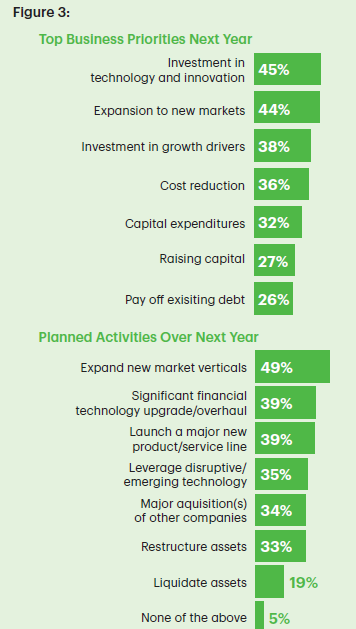

TD Bank's survey affirms that investments in technology rank high among the major investment priorities of finance professionals in the coming year. Nearly half the respondents (45 percent) cited these investments as their top business priority over the next year, with 39 percent of them planning a significant financial technology upgrade or overhaul and 34 percent expecting to leverage a disruptive or emerging technology. (See Figure 3).

Another top business priority is market expansion, cited by 44 percent of respondents, with nearly half (49 percent) of them projecting expansion into new markets in the coming year. Nearly four in ten (39 percent) respondents said their organizations also plan to launch a major new product or service line within the year, and 34 percent have plans to make one or more company acquisitions.

These sanguine plans are offset by internal challenges putting pressure on capital. Roughly four in ten respondents (39 percent) consider their ability to achieve planned growth and innovation as a major internal challenge, with this percentage higher among large corporations with revenues exceeding $500 million.

Added up, the survey respondents—while highly optimistic about their companies' financial health and the state of the overall economy, and certainly mindful of the need to capitalize growth and innovation strategies—are being careful in their preparations for a recession—perhaps overly cautious. In fact, nearly half the survey respondents (44 percent) who expressed a negative economic outlook plan to cut expenses as part of their groundwork.

“There appears to be some consternation about pulling the capital trigger on a new line of business, an acquisition, or entering a new market that looks promising," Foley said. “The potential for an economic downturn is creating a bias toward pause and inaction on top-line capital plans."

While nearly every company is looking to achieve growth and seize innovations technologies to be responsive to business opportunities and customers, the blistering pace of technological development and growing geopolitical tensions over trade and tariffs, are restraining their capital-spending strategies.

“The high cost of growth and innovation, in addition to fears over known and unknown market disruptors, is having an effect in the assessments of how much capital to risk," Foley said. “Nobody wants to be caught over-spending or having the wrong technologies in place when the next recession surfaces and credit potentially dries up."

Consequently, companies are confronted with a conundrum: If they rush to invest in growth and innovation before the recession rears, they may make ill-informed investments; if they pursue a deliberative approach, access to ample credit at decent rates to invest in growth and innovation may deteriorate in the next recession.

A Delicate Balancing Act

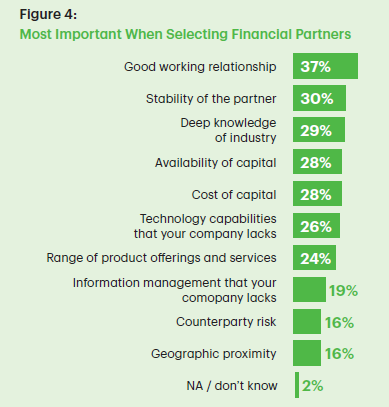

Given these complex circumstances, what can companies do to ensure the best investment decisions? The answer is to strengthen the relationships they currently have with their financial partners. “Pending a downturn, the survey respondents affirmed that choosing the right financial partner to support them through any economy, good and bad, is crucial," Foley said. (See Figure 4).

Aside from primary sources of funding for capital spending like equity financing and retained earnings, major supplemental sources include secured debt financing, accounts receivable securitization, and supply chain financing. Both supply chain financing and accounts receivable securitization provide a viable way for companies to optimize working capitalGiven the low interest-rate environment, the reliance on these supplementary funding sources is not surprising. However, when the economic downturn arrives, potentially constricting the availability and cost of credit, many companies' liquidity will suffer. The businesses that enjoy a longstanding relationship with a trusted financial partner that understands their business are the outliers. “There's just a much better strategy to have a financial partner that's willing to assist their working capital needs through creative solutions," Foley said.

The upshot for companies to fund growth and innovation during the next credit-crunching recession is to nurture and strengthen their relationship with a stable financial partner that has deep knowledge of its business and industry. Said Foley, “The time is now to work with a financial partner to determine viable debt and cash flow plans."

.jpg?sfvrsn=f1093d2a_0)