TSL Express Daily News

The Secured Lender

SFNet's The 81st Annual Convention Issue

Intro content. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Curabitur iaculis sapien sagittis, accumsan magna ut, blandit massa. Quisque vehicula leo lorem, a tincidunt eros tempor nec. In quis lacus vitae risus egestas tincidunt. Phasellus nulla risus, sodales in purus non, euismod ultricies elit. Vestibulum mattis dolor non sem euismod interdum.

-

Top 5 Apps for Organizing

Mar 7, 2019If you’re like most of us, we try to stay organized in business and life, but it gets increasingly complicated…

-

The Importance of Stretching

Mar 7, 2019Every personal trainer and athletic coach I have ever worked with has stressed the importance of stretching. When working out…

-

SFNet's 40 Under 40 Award Winners Panel Recap

Mar 6, 2019Moderator: Samantha Alexander, regional underwriting manager, Wells Fargo Capital Finance’s Corporate Asset Based Lending group and 2016 CFA 40 Under…

-

SFNet's Inaugural YoPro Leadership Summit

Mar 6, 2019The Secured Finance Network brought together the next generation of commercial finance leaders for a full day of learning and…

-

It’s a Marathon, Not a Sprint

Aug 22, 2018I was recently invited to participate in an executive panel to answer questions from a credit training class comprised of...

-

It’s Not Too Late – Five Member Benefits to Cash In On Now

Aug 1, 2018As we hit the half way mark on calendar year 2018, it is a good time to take stock and…

-

It’s Time To Break Up With Your Phone

Jul 18, 2018Do I have your attention? Let’s be honest here: do you have the attention span to read this article? Compared…

-

Lien Management – What You Need to Know

Jun 6, 2018UCC filing is the cornerstone of all loans and every lien portfolio...

-

Potential Impacts of Blockchain on Commercial Lending

Jan 15, 2018By Raja Sengupta, Executive Vice President and General Manager, Wolters Kluwer’s Lien Solutions When it comes to the rising importance…

-

How to be a Good Leader

Dec 5, 2017I know what you’re thinking…another article about how to be a good leader? The short answer is yes…but this time,…

-

Fintech and Due Diligence – Disruptors and Established Firms Evolve

Oct 30, 2017The fintech sector has gone through a number of manifestations in the past two decades.

-

A Commercial Banker’s Tickler Transition Plan

Oct 18, 2017Just do a keyword search for “bank tickler,” and you’ll quickly realize that banks are still heavily reliant on manual…

-

Understanding and Developing Your Personal Brand: Four Steps to a More Intentional Career Progression

Sep 5, 2017It is imperative for individuals to have a general idea about their future career aspirations, just as companies should have clearly defined strategies.

-

Selecting a Technology Vendor: 3 Questions to Ask

Jul 5, 2017As with anything else at your bank, selecting a technology vendor can be a challenging decision. Users from across different…

-

Why Back-Office Lending Automation Enhances Customer Satisfaction

Apr 25, 2017Every bank strives to keep its customers happy. Of course, some institutions are better at achieving this goal than…

-

The Lost Art of the Loan Purchase

Mar 2, 2017Purchasing a loan directly from a bank whether at par or discount is a not-often-used technique that is easily…

-

Audit Prep: Why a Paperless Approach Makes Sense

Feb 15, 2017How much time does your financial institution spend preparing for audits? We recently surveyed 187 community banks, and the results…

-

Back Office Support Services: Helping you approve more clients

Feb 7, 2017How many times have you come across a potential client who’s financials are either not up to date, not accurate,…

-

“All Assets” is the Key When Drafting UCC-1 Financing Statement Collateral Descriptions

Jan 30, 2017Even when prepared by outside or in-house counsel, many lenders pay close attention to draft UCC financing statements before they…

-

Paper Loan Files: Does Your Bank Know the True Cost?

Jan 12, 2017Sure, there’s a tangible cost associated with deploying an electronic loan imaging system. Software, support, and scanning hardware are just…

September 29, 2025

Source: The Wall Street Journal

Concerns mount that a frothy market is concealing signs of excess; sudden bankruptcies rattle investors

U.S. credit markets are running hot—maybe too hot.

Investors are gobbling up corporate debt like it is going out of style—even though the rewards, by some measures, are lower than they have been in decades. The frothy mood has some on Wall Street worried that the market is priced for perfection and ripe for a fall.

That is why any bad news is touching a nerve and raising the question of whether something more profound is ailing American borrowers. Two sudden bankruptcies in the auto world—of a subprime lender and a parts supplier—have triggered those conversations among bond investors and analysts.

So far, there is no sign of wider fallout—and each of those situations had unique characteristics that don’t point to broader trends. But combined with other challenges, such as persistent inflation and rising defaults in a hot Wall Street segment known as “private credit,” it is enough to give longtime traders pause.

“There’s been a very positive investment environment for a long time, with a large amount of money and a lot of optimism,” said Howard Marks, co-chairman of investment firm Oaktree Capital Management, which specializes in credit investing. He said that can lead to high pricing and declining quality. “The worst loans are made at the best of times.”

High-yield bond analysts at Barclays compared the current situation—with valuations so high and signs of stress emerging—to being in a Star Wars garbage chute with Princess Leia and Han Solo and “the walls compressing on all sides.”

One concern is that lending to riskier borrowers has been growing for years, first through traditional bonds and loans, then in the form of private credit and the revival of complex asset-backed debt. The longer that credit boom lasts, the more likely it is that defaults will rise. Likewise, the higher the valuations of corporate bonds and loans, the more susceptible they become to selloffs.

The fate of the market could depend on the direction of the economy. Some investors note that the current benign environment could continue if inflation pressures ease and there is no further deterioration in the labor market, allowing the Federal Reserve to boost economic activity by cutting interest rates and relieving pressure on borrowers.

Still, some investors have been expecting a shoe to drop and for corporate-debt valuations to decline. “I had a view that turned out to be wrong that September was going to be challenging,” said Joe Auth, head of developed fixed-income markets at fund manager GMO. “I don’t get it, why everything is [holding up] this well. It’s odd.”

Market excesses

The overarching concern on Wall Street is that the exceptionally high valuations for corporate debt are concealing excesses in the market and insufficiently compensating investors for taking risks.

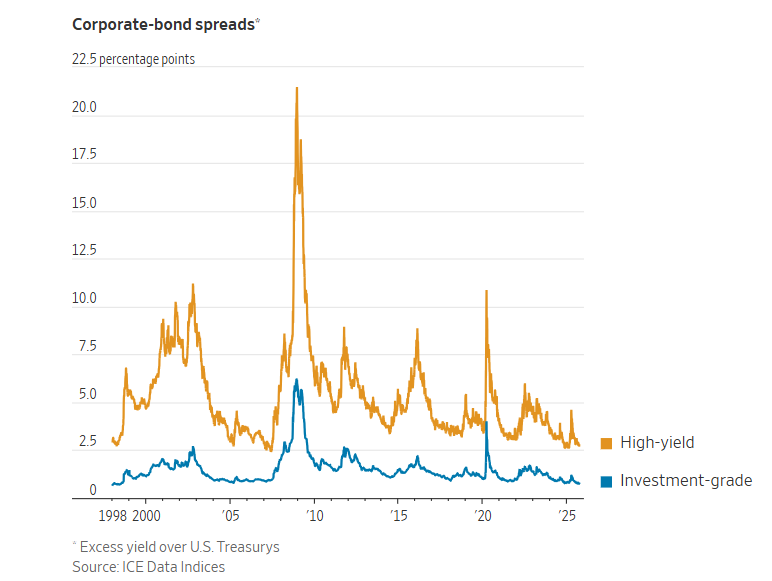

That is visible in the paltry additional yield, or spread, that investors are getting by holding investment-grade corporate bonds compared with ultrasafe U.S. Treasurys. That figure fell to 0.74 percentage point in September, its lowest level since 1998, according to ICE Data Indices. The spread for junk-rated bonds is about 2.75 percentage points, near the record low set in 2007.

Bond prices are going up because investors—from individual retirees to big pensions—are expecting yields to fall even further if the Fed continues to cut interest rates. While rates today are slightly lower than they were in 2007, they are still above the anemic levels during much of the past decade. Investors want to lock in today’s rates, an approach that is likely to continue to fuel demand.

“There’s still a tremendous amount of cash that needs to be put to work,” said Dan Mead, head of Bank of America’s U.S. investment-grade syndicate desk.

Companies with investment-grade credit ratings sold $210 billion of bonds in the U.S. market this month, making it the busiest September on record, according to Dealogic. Sales of junk bonds have been roughly the same as last year, but they are often used to finance private-equity takeovers and there are signs that buyout activity is picking up.

Private-equity firm Silver Lake and others are in advanced talks to buy Electronic Arts for roughly $50 billion, The Wall Street Journal earlier reported, in what would likely be the largest leveraged buyout of all time.

One sign of weakness was the quick collapse of Tricolor Holdings, which supplied auto loans to low-income buyers who lacked a credit history. The company filed for bankruptcy this month and began to liquidate after one of its securitization partners, Fifth Third Bank, publicly disclosed a roughly $200 million loss tied to alleged fraud by a warehouse lending client, which was soon identified as Tricolor. Lawyers representing Tricolor’s liquidation trustee couldn’t be reached for comment.

Tricolor had raised about $2 billion of asset-backed bonds over the past five years and some of the bonds traded for as little as 20 cents after the bankruptcy filing, according to CreditFlow market data. Days later, auto-parts supplier First Brands filed for bankruptcy, capping a crisis that saw its lenders lose confidence in its financial disclosures and use of off-balance-sheet debt.

One possible source of trouble in the case of Tricolor was that it was a “buy here, pay here” lender that also serviced its own loans. The lack of any third party valuing cars, collecting loan payments or reselling vehicles can create a “control issue” and leave “room for bad actors,” said Elen Callahan, head of research at the Structured Finance Association.

Rising defaults

Allegations of fraud at specific companies draw attention, but most loan losses happen because of broad economic forces. The larger concern on Wall Street is whether still-elevated interest rates, tapering growth, and inflation are making it harder for many borrowers to stay current on their debts.

Some analysts see the greatest risk in private credit, a source of financing that barely existed a decade ago and is fast approaching $2 trillion. Much of the market consists of loans made directly by private fund managers such as Apollo Global Management and Blackstone, mostly to companies but also to individual consumers and real-estate investors.

An increasing number of companies that took out private credit loans, especially smaller enterprises, lack the cash to make interest payments on their debts. Instead they have started issuing the equivalent of IOUs to their creditors, replacing cash interest with “payment-in-kind,” or PIK, distributions.

About 11% of all loans by business-development companies, or BDCs—a growing category of private-credit funds—were receiving PIK interest income at the end of 2024, even before the threat of tariffs sowed uncertainty among U.S. companies, according to S&P Global Ratings.

More concerning, private credit defaults, which spiked during the pandemic but had started to subside since then, have been on the rise. Fitch’s privately monitored rating default rate hit 9.5% in July, before receding slightly.

Write to Matt Wirz at matthieu.wirz@wsj.com and Sam Goldfarb at sam.goldfarb@wsj.com.

.jpg?sfvrsn=f1093d2a_0)