TSL Express Daily News

The Secured Lender

SFNet's The 81st Annual Convention Issue

Intro content. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Curabitur iaculis sapien sagittis, accumsan magna ut, blandit massa. Quisque vehicula leo lorem, a tincidunt eros tempor nec. In quis lacus vitae risus egestas tincidunt. Phasellus nulla risus, sodales in purus non, euismod ultricies elit. Vestibulum mattis dolor non sem euismod interdum.

-

Top 5 Apps for Organizing

Mar 7, 2019If you’re like most of us, we try to stay organized in business and life, but it gets increasingly complicated…

-

The Importance of Stretching

Mar 7, 2019Every personal trainer and athletic coach I have ever worked with has stressed the importance of stretching. When working out…

-

SFNet's 40 Under 40 Award Winners Panel Recap

Mar 6, 2019Moderator: Samantha Alexander, regional underwriting manager, Wells Fargo Capital Finance’s Corporate Asset Based Lending group and 2016 CFA 40 Under…

-

SFNet's Inaugural YoPro Leadership Summit

Mar 6, 2019The Secured Finance Network brought together the next generation of commercial finance leaders for a full day of learning and…

-

It’s a Marathon, Not a Sprint

Aug 22, 2018I was recently invited to participate in an executive panel to answer questions from a credit training class comprised of...

-

It’s Not Too Late – Five Member Benefits to Cash In On Now

Aug 1, 2018As we hit the half way mark on calendar year 2018, it is a good time to take stock and…

-

It’s Time To Break Up With Your Phone

Jul 18, 2018Do I have your attention? Let’s be honest here: do you have the attention span to read this article? Compared…

-

Lien Management – What You Need to Know

Jun 6, 2018UCC filing is the cornerstone of all loans and every lien portfolio...

-

Potential Impacts of Blockchain on Commercial Lending

Jan 15, 2018By Raja Sengupta, Executive Vice President and General Manager, Wolters Kluwer’s Lien Solutions When it comes to the rising importance…

-

How to be a Good Leader

Dec 5, 2017I know what you’re thinking…another article about how to be a good leader? The short answer is yes…but this time,…

-

Fintech and Due Diligence – Disruptors and Established Firms Evolve

Oct 30, 2017The fintech sector has gone through a number of manifestations in the past two decades.

-

A Commercial Banker’s Tickler Transition Plan

Oct 18, 2017Just do a keyword search for “bank tickler,” and you’ll quickly realize that banks are still heavily reliant on manual…

-

Understanding and Developing Your Personal Brand: Four Steps to a More Intentional Career Progression

Sep 5, 2017It is imperative for individuals to have a general idea about their future career aspirations, just as companies should have clearly defined strategies.

-

Selecting a Technology Vendor: 3 Questions to Ask

Jul 5, 2017As with anything else at your bank, selecting a technology vendor can be a challenging decision. Users from across different…

-

Why Back-Office Lending Automation Enhances Customer Satisfaction

Apr 25, 2017Every bank strives to keep its customers happy. Of course, some institutions are better at achieving this goal than…

-

The Lost Art of the Loan Purchase

Mar 2, 2017Purchasing a loan directly from a bank whether at par or discount is a not-often-used technique that is easily…

-

Audit Prep: Why a Paperless Approach Makes Sense

Feb 15, 2017How much time does your financial institution spend preparing for audits? We recently surveyed 187 community banks, and the results…

-

Back Office Support Services: Helping you approve more clients

Feb 7, 2017How many times have you come across a potential client who’s financials are either not up to date, not accurate,…

-

“All Assets” is the Key When Drafting UCC-1 Financing Statement Collateral Descriptions

Jan 30, 2017Even when prepared by outside or in-house counsel, many lenders pay close attention to draft UCC financing statements before they…

-

Paper Loan Files: Does Your Bank Know the True Cost?

Jan 12, 2017Sure, there’s a tangible cost associated with deploying an electronic loan imaging system. Software, support, and scanning hardware are just…

August 18, 2025

Source: S&P

Equity research analysts ratcheted up their 2025 loan growth outlook for the US bank sector after better-than-expected financial reports during the second-quarter earnings season.

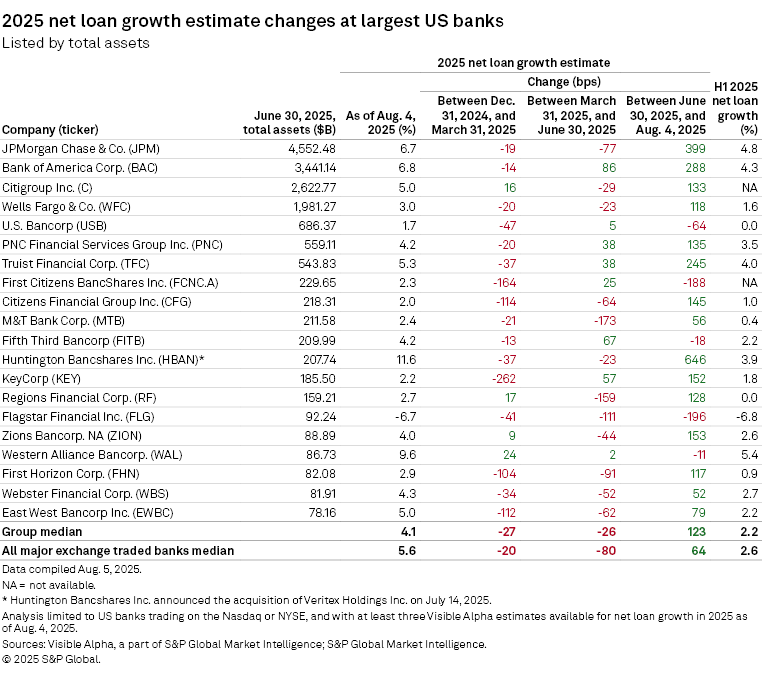

Analysts' net loan growth rate expectations for the full year rose 123 basis points — to 4.1% on a median basis — as of Aug. 4 from June 30 for the 20 US public banks with the most assets at the end of the second quarter, according to an S&P Global Market Intelligence analysis of Visible Alpha data. Visible Alpha is a part of S&P Global Market Intelligence. The group of all major exchange-traded banks had a smaller increase of 64 basis points since June 30 but a loftier estimated loan growth rate of 5.6%.

The analysis was limited to US banks with at least three Visible Alpha estimates for 2025 net loan growth as of Aug. 4. While the full-year loan growth expectations increased, second-half estimates dipped after the second-quarter totals exceeded forecasts, the analysis found.

The actual second-quarter growth eclipsed the change in estimates for all but four of the top 20 banks: Citizens Financial Group Inc., Huntington Bancshares Inc., KeyCorp and Flagstar Financial Inc. On an aggregate basis, the actual growth was higher than the change in estimate by $12.90 billion for the top 20 banks and by $64.65 billion for the larger selection of banks.

Still, the increase in full-year estimates marks a reversal as analysts lowered loan growth numbers earlier in 2025.

Median loan growth estimates for 2025 declined during the first half of the year, as President Donald Trump's April 2 announcement of a new US tariff plan sent stock values down amid elevated market uncertainty. For the top 20 banks, the median net loan growth estimate fell 27 basis points in the first quarter and another 26 basis points in the second quarter. For all exchange-traded banks, the estimate fell 20 basis points in the first quarter and 80 basis points in the second quarter.

Best Q2 2025 loan growth rates

JPMorgan Chase & Co.'s net loans grew $56.55 billion sequentially in the second quarter to $1.387 trillion. This 4.3% growth rate was the biggest among the 20 largest banks. Most of the growth was in the wholesale category, with smaller increases in credit card and consumer, excluding credit card. For the second half of 2025, analysts are forecasting JPMorgan to add another $24.65 billion to its net loan balance, bringing the full-year growth to 6.7%.

Truist Financial Corp. had the second-highest growth rate among the 20 largest banks, at 3.4% in the second quarter. More than half of the increase was from the commercial and industrial (C&I) book. During a July 18 earnings call, Truist Executive Chairman and CEO William Rogers Jr. said, "Average C&I growth was driven by all of our industry banking groups with particular strength in [financial institutions group] and energy, middle market lending and structured credit." Truist also experienced growth in all consumer categories as well as commercial real estate. Overall, analysts are projecting weaker net loan growth in the second half of the year: 1.3% relative to the balance at June 30.

Bank of America Corp. was the only other top 20 bank to exceed 3% linked-quarter loan growth. CFO Alastair Borthwick said on the company's July 16 earnings call that all commercial lending segments grew during the quarter. For middle-market lending, there was "a nice increase in revolver utilization during the quarter as clients navigated the current environment." For global corporate banking, Bank of America "had a little more demand from our larger corporate clients," Borthwick said. Analysts are projecting second-half loan growth of 2.4%, down from 4.3% in the first half.

Highest expected growth rates for the rest of 2025

Among the top 20 banks, Huntington has the highest expected second-half growth rate at 7.3%, heavily influenced by the bank's pending acquisition of Dallas-based Veritex Holdings Inc., which was announced July 14 and is expected to close early in the fourth quarter. Veritex reported $9.41 billion in net loans as of June 30, mostly covering the estimated $9.80 billion in second-half growth for Huntington.

Huntington had one of the best first-half growth stories in the sector, with period-end net loans growing 3.9%, well above the 2.2% median for the top 20 banks. C&I drove the growth, with the auto segment also a notable contributor. The company's initiatives — including but not limited to Texas, the Carolinas, the financial institutions group and fund finance — comprised about 40% of average loan growth in the second quarter and approximately half in the first quarter. On a stand-alone basis as of July 18, Huntington raised its average loan growth guidance for 2025 to a range of 6% to 8%, up from the April 17 guidance range of 5% to 7%.

When excluding acquisitions that are expected to affect second-half growth, Western Alliance Bancorp. has the highest loan growth trajectory in the top 20 group. Analysts are estimating 4.1% growth in the second half of 2025 after 5.4% growth in the first six months of the year. More than two-thirds of the second-quarter growth was from C&I, according to Western Alliance Vice Chairman and CFO Dale Gibbons on the company's July 18 earnings call. Gibbons said the company continues to gather momentum in the innovation and technology banking segment, which showed quarterly growth of over $150 million, "following competitor disruptions over the past two years."

Analysts are projecting that both Regions Financial Corp. and East West Bancorp Inc. will grow net loans by 2.7% in the second half of 2025. Regions Financial kept its net loan balance steady at $95.71 billion from year-end 2024 to June 30, while East West racked up 2.2% growth.

Potential loan growth headwind

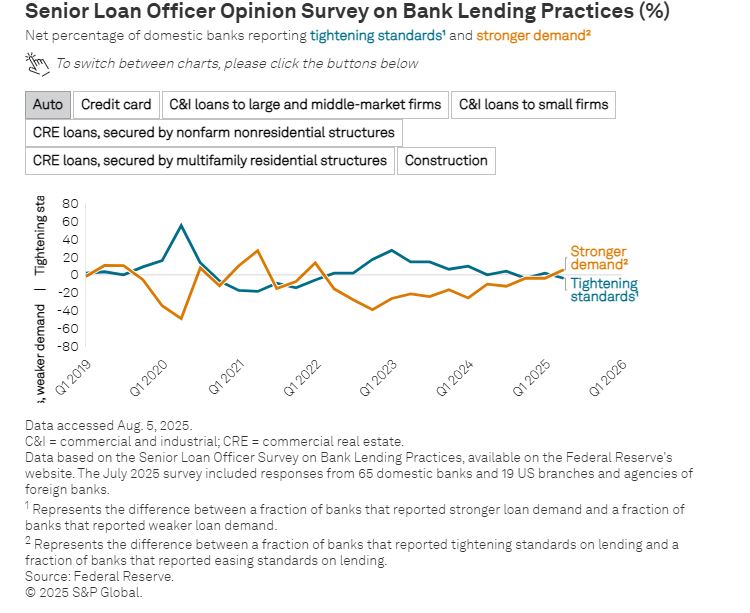

Results from the most recent Senior Loan Officer Opinion Survey on Bank Lending Practices indicated that many banks reported some loan demand softness.

A greater percentage of banks that responded to the survey — which was conducted from June 18 to July 2 — reported less demand for C&I loans, which was a driving force for large bank loan growth in the second quarter.

The Federal Reserve said reasons given for softer demand included "lower customer investment in plant or equipment as well as decreased customer financing needs for merger or acquisition and inventory." The Fed also noted that banks "cited customers’ decreased accounts receivable financing needs, lower precautionary demand for cash and liquidity, higher internally generated funds, and alternative sources for borrowing as important reasons for weaker demand."

Additionally, banks reported that demand for CRE lending across the spectrum declined in the second quarter, while demand was up for auto loans.

.jpg?sfvrsn=f1093d2a_0)