TSL Express Daily News

The Secured Lender

SFNet's The 81st Annual Convention Issue

Intro content. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Curabitur iaculis sapien sagittis, accumsan magna ut, blandit massa. Quisque vehicula leo lorem, a tincidunt eros tempor nec. In quis lacus vitae risus egestas tincidunt. Phasellus nulla risus, sodales in purus non, euismod ultricies elit. Vestibulum mattis dolor non sem euismod interdum.

-

Top 5 Apps for Organizing

Mar 7, 2019If you’re like most of us, we try to stay organized in business and life, but it gets increasingly complicated…

-

The Importance of Stretching

Mar 7, 2019Every personal trainer and athletic coach I have ever worked with has stressed the importance of stretching. When working out…

-

SFNet's 40 Under 40 Award Winners Panel Recap

Mar 6, 2019Moderator: Samantha Alexander, regional underwriting manager, Wells Fargo Capital Finance’s Corporate Asset Based Lending group and 2016 CFA 40 Under…

-

SFNet's Inaugural YoPro Leadership Summit

Mar 6, 2019The Secured Finance Network brought together the next generation of commercial finance leaders for a full day of learning and…

-

It’s a Marathon, Not a Sprint

Aug 22, 2018I was recently invited to participate in an executive panel to answer questions from a credit training class comprised of...

-

It’s Not Too Late – Five Member Benefits to Cash In On Now

Aug 1, 2018As we hit the half way mark on calendar year 2018, it is a good time to take stock and…

-

It’s Time To Break Up With Your Phone

Jul 18, 2018Do I have your attention? Let’s be honest here: do you have the attention span to read this article? Compared…

-

Lien Management – What You Need to Know

Jun 6, 2018UCC filing is the cornerstone of all loans and every lien portfolio...

-

Potential Impacts of Blockchain on Commercial Lending

Jan 15, 2018By Raja Sengupta, Executive Vice President and General Manager, Wolters Kluwer’s Lien Solutions When it comes to the rising importance…

-

How to be a Good Leader

Dec 5, 2017I know what you’re thinking…another article about how to be a good leader? The short answer is yes…but this time,…

-

Fintech and Due Diligence – Disruptors and Established Firms Evolve

Oct 30, 2017The fintech sector has gone through a number of manifestations in the past two decades.

-

A Commercial Banker’s Tickler Transition Plan

Oct 18, 2017Just do a keyword search for “bank tickler,” and you’ll quickly realize that banks are still heavily reliant on manual…

-

Understanding and Developing Your Personal Brand: Four Steps to a More Intentional Career Progression

Sep 5, 2017It is imperative for individuals to have a general idea about their future career aspirations, just as companies should have clearly defined strategies.

-

Selecting a Technology Vendor: 3 Questions to Ask

Jul 5, 2017As with anything else at your bank, selecting a technology vendor can be a challenging decision. Users from across different…

-

Why Back-Office Lending Automation Enhances Customer Satisfaction

Apr 25, 2017Every bank strives to keep its customers happy. Of course, some institutions are better at achieving this goal than…

-

The Lost Art of the Loan Purchase

Mar 2, 2017Purchasing a loan directly from a bank whether at par or discount is a not-often-used technique that is easily…

-

Audit Prep: Why a Paperless Approach Makes Sense

Feb 15, 2017How much time does your financial institution spend preparing for audits? We recently surveyed 187 community banks, and the results…

-

Back Office Support Services: Helping you approve more clients

Feb 7, 2017How many times have you come across a potential client who’s financials are either not up to date, not accurate,…

-

“All Assets” is the Key When Drafting UCC-1 Financing Statement Collateral Descriptions

Jan 30, 2017Even when prepared by outside or in-house counsel, many lenders pay close attention to draft UCC financing statements before they…

-

Paper Loan Files: Does Your Bank Know the True Cost?

Jan 12, 2017Sure, there’s a tangible cost associated with deploying an electronic loan imaging system. Software, support, and scanning hardware are just…

October 21, 2021

Source: GlobeNewswire

ATLANTA, Oct. 20, 2021 (GLOBE NEWSWIRE) -- Gray Television, Inc. (“Gray,” “we,” “us” or “our”) (NYSE: GTN) announced today that in connection with its pending acquisition of the Local Media Group of Meredith Corporation (“Meredith LMG”), Gray is proposing, subject to market and other conditions, to enter into an amendment and restatement of its existing senior credit facility (the “Senior Credit Facility”). Gray also announced updates to certain of its previously announced guidance for the third quarter of 2021, based on preliminary information available to date.

Comments on Proposed Senior Credit Facility Amendment and Incremental Loans:

Gray expects to amend its Senior Credit Facility through some or all of the following, which would:

Provide for an additional $1.5 billion seven-year incremental term loan under the Senior Credit Facility to finance, in part, the acquisition of Meredith LMG, and

Amend and restate certain terms of its revolving credit facility to increase borrowing capacity under the facility from $300 million to up to $500 million, which would consist of (i) a $425 million credit facility with five year commitments, and (ii) a $75 million credit facility with commitments expiring January 2, 2026.

We cannot provide any assurance about the timing, terms, or interest rate associated with the planned financing, or that the financing transactions will be completed.

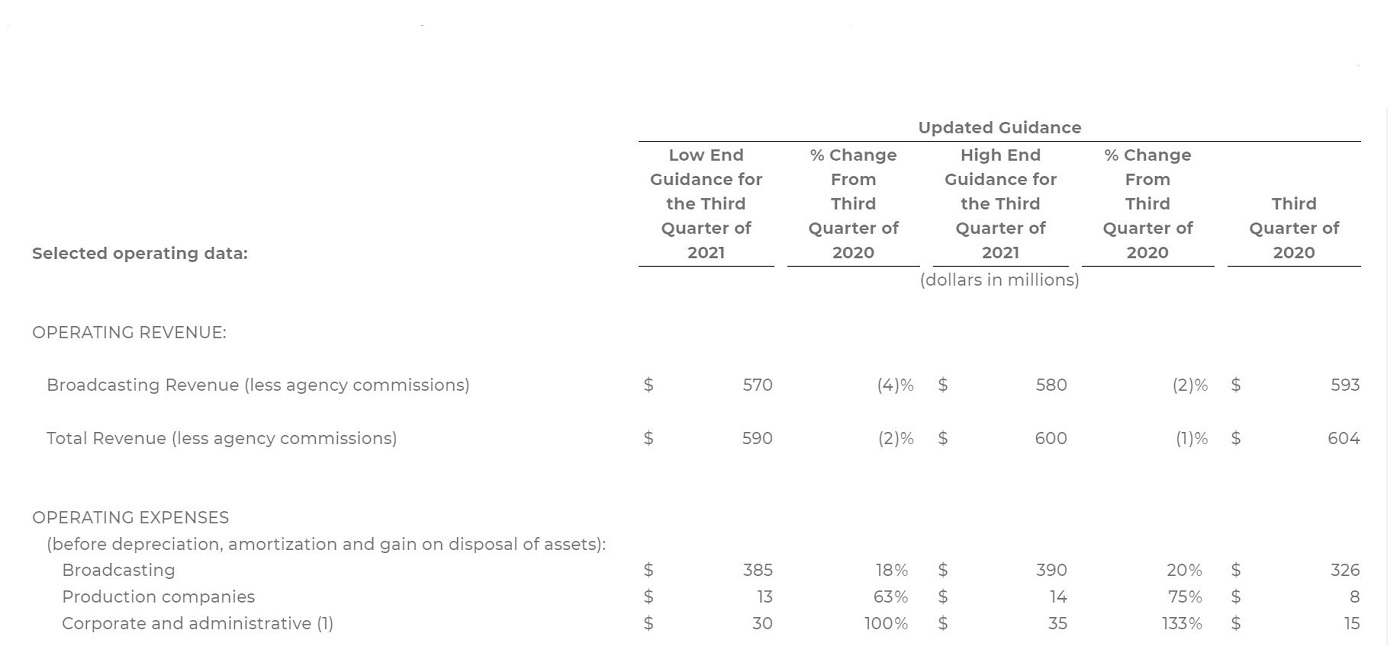

Comments on Updated Third Quarter 2021 Guidance:

Gray initially issued guidance for third quarter 2021 on August 5, 2021. While Gray is continuing the process of finalizing its financial results for the third quarter of 2021, Gray today is updating its guidance on its estimated results of operations as set forth below. This updated guidance represents the most current information and estimates available to Gray as of the date of this release. We have not yet completed our normal financial closing and review process; therefore, these estimates are subject to change upon finalization. As a result, our actual results may be different and such differences could be material. Investors should exercise caution in relying on the information contained herein and should not draw any inferences from this information regarding financial or operating data that is not presented below.

(1) Corporate and administrative expenses include approximately $11 million of transaction related expenses

Including the impact of our acquisition of Quincy Media, Inc. and related divestitures that occurred on August 2, 2021, our previous guidance range for broadcasting revenue was from $571 million to $581 million; our previous guidance range for broadcasting expenses was from $387 million to $390 million; our previous guidance range for production company expenses was from $12 million to $13 million, and our previous guidance range for corporate and administrative expenses was from $27 million to $30 million.

As of September 30, 2021, we currently expect to report approximately:

$322 million of cash on hand

$1,785 million principal amount of secured debt; and

$4,035 million principal amount of total debt (excluding unamortized deferred financing costs and premium).

We currently anticipate that our total leverage ratio, as defined under our Senior Credit Facility, measured on a trailing eight quarter basis, netting all cash on hand, and giving pro forma effect for all acquisitions completed through the date of this release, will be between 4.15 times and 4.20 times as of September 30, 2021.

The Company

Gray Television, headquartered in Atlanta, Georgia, is the largest owner of top-rated local television stations and digital assets in the United States. Upon the closing of its acquisition of Meredith Corporation’s local media group, Gray will become the nation’s second largest television broadcaster, with television stations serving 113 markets that reach approximately 36 percent of US television households. The pro forma portfolio includes 79 markets with the top-rated television station and 101 markets with the first and/or second highest rated television station according to Comscore’s audience measurement data. Gray also owns video program production, marketing, and digital businesses including Raycom Sports, Tupelo Honey, and RTM Studios, the producer of PowerNation programs and content and is the majority owner of Swirl Films.

Gray Contacts:

www.gray.tv

Jim Ryan, Executive Vice President and Chief Financial Officer, 404-504-9828

Kevin P. Latek, Executive Vice President, Chief Legal and Development Officer, 404-266-8333

.jpg?sfvrsn=f1093d2a_0)