TSL Express Daily News

The Secured Lender

SFNet's The 81st Annual Convention Issue

Intro content. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Curabitur iaculis sapien sagittis, accumsan magna ut, blandit massa. Quisque vehicula leo lorem, a tincidunt eros tempor nec. In quis lacus vitae risus egestas tincidunt. Phasellus nulla risus, sodales in purus non, euismod ultricies elit. Vestibulum mattis dolor non sem euismod interdum.

-

Top 5 Apps for Organizing

Mar 7, 2019If you’re like most of us, we try to stay organized in business and life, but it gets increasingly complicated…

-

The Importance of Stretching

Mar 7, 2019Every personal trainer and athletic coach I have ever worked with has stressed the importance of stretching. When working out…

-

SFNet's 40 Under 40 Award Winners Panel Recap

Mar 6, 2019Moderator: Samantha Alexander, regional underwriting manager, Wells Fargo Capital Finance’s Corporate Asset Based Lending group and 2016 CFA 40 Under…

-

SFNet's Inaugural YoPro Leadership Summit

Mar 6, 2019The Secured Finance Network brought together the next generation of commercial finance leaders for a full day of learning and…

-

It’s a Marathon, Not a Sprint

Aug 22, 2018I was recently invited to participate in an executive panel to answer questions from a credit training class comprised of...

-

It’s Not Too Late – Five Member Benefits to Cash In On Now

Aug 1, 2018As we hit the half way mark on calendar year 2018, it is a good time to take stock and…

-

It’s Time To Break Up With Your Phone

Jul 18, 2018Do I have your attention? Let’s be honest here: do you have the attention span to read this article? Compared…

-

Lien Management – What You Need to Know

Jun 6, 2018UCC filing is the cornerstone of all loans and every lien portfolio...

-

Potential Impacts of Blockchain on Commercial Lending

Jan 15, 2018By Raja Sengupta, Executive Vice President and General Manager, Wolters Kluwer’s Lien Solutions When it comes to the rising importance…

-

How to be a Good Leader

Dec 5, 2017I know what you’re thinking…another article about how to be a good leader? The short answer is yes…but this time,…

-

Fintech and Due Diligence – Disruptors and Established Firms Evolve

Oct 30, 2017The fintech sector has gone through a number of manifestations in the past two decades.

-

A Commercial Banker’s Tickler Transition Plan

Oct 18, 2017Just do a keyword search for “bank tickler,” and you’ll quickly realize that banks are still heavily reliant on manual…

-

Understanding and Developing Your Personal Brand: Four Steps to a More Intentional Career Progression

Sep 5, 2017It is imperative for individuals to have a general idea about their future career aspirations, just as companies should have clearly defined strategies.

-

Selecting a Technology Vendor: 3 Questions to Ask

Jul 5, 2017As with anything else at your bank, selecting a technology vendor can be a challenging decision. Users from across different…

-

Why Back-Office Lending Automation Enhances Customer Satisfaction

Apr 25, 2017Every bank strives to keep its customers happy. Of course, some institutions are better at achieving this goal than…

-

The Lost Art of the Loan Purchase

Mar 2, 2017Purchasing a loan directly from a bank whether at par or discount is a not-often-used technique that is easily…

-

Audit Prep: Why a Paperless Approach Makes Sense

Feb 15, 2017How much time does your financial institution spend preparing for audits? We recently surveyed 187 community banks, and the results…

-

Back Office Support Services: Helping you approve more clients

Feb 7, 2017How many times have you come across a potential client who’s financials are either not up to date, not accurate,…

-

“All Assets” is the Key When Drafting UCC-1 Financing Statement Collateral Descriptions

Jan 30, 2017Even when prepared by outside or in-house counsel, many lenders pay close attention to draft UCC financing statements before they…

-

Paper Loan Files: Does Your Bank Know the True Cost?

Jan 12, 2017Sure, there’s a tangible cost associated with deploying an electronic loan imaging system. Software, support, and scanning hardware are just…

June 7, 2021

Source: Businesswire

- Seventy percent of executives express optimism about the U.S. economy, up from 47 percent last quarter

- Hiring outlook increases significantly

- Inflation fears spike as raw material prices climb

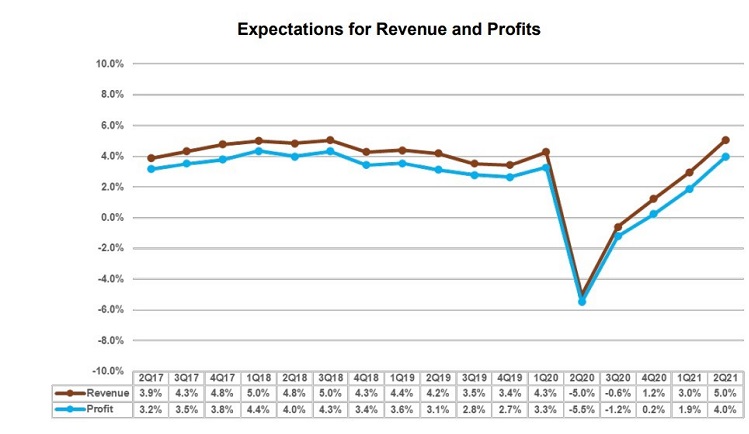

12-month profit and revenue growth expectations, as projected by the quarterly AICPA Economic Outlook survey over time. (Graphic: Businesswire)

Business executives are predicting the economy will roar back in the coming year, with revenue and profit growth expectations not seen since 2018, according to the second-quarter AICPA Economic Outlook Survey. The survey polls chief executive officers, chief financial officers, controllers and other certified public accountants in U.S. companies who hold executive and senior management accounting roles.

Seventy percent of business executives expressed optimism about the U.S. economy over the next 12 months, up from 47 percent last quarter, as government relief funds, vaccine rollouts and relaxed workplace restrictions have improved business conditions. It’s the first time a majority of executives have held a positive sentiment on the economy since the pandemic began in the first quarter last year, and it’s the highest level that measure has reached since the second quarter of 2018.

There are concerns, however. “Availability of skilled personnel” reemerged as the top-cited challenge for businesses as job recruitment turns up. And two-thirds of business executives now express concern about inflation, up from 44 percent last quarter,

Most of the outlook was overwhelmingly positive, however:

- Business executives’ optimism about their own organization’s prospects over the next 12 months rose to 76 percent from 58 percent last quarter

- Some 69 percent of executives say their companies plan to expand in the next 12 months, up from 58 percent last quarter

- Profits are expected to grow by four percent in the next 12 months, more than doubling last quarter’s 1.9 percent forecast. And revenues are expected to climb five percent, up from three percent. Both projections are at their highest level since 2018.

- The hiring picture is also significantly improved, with 33 percent of executives saying their companies planned to fill positions immediately, up from 19 percent last quarter. Another 14 percent said they have too few employees but are hesitant to hire. The percentage of executives who said their companies had too many employees declined from seven to four percent, quarter over quarter.

“What we’re seeing is a broad expectation that things will really open up in the second half of the year,” said Ash Noah, CPA, CGMA, VP and managing director of CGMA learning, education and development for the Association of International Certified Professional Accountants, representing the AICPA and CIMA. “Many issues remain, of course. Supply chains are still straining to meet demand in a number of sectors. The global response to the pandemic still contains many uncertainties, which impacts the United States. But we are clearly seeing growing confidence on the part of business executives that the worst is behind us.”

The AICPA survey is a forward-looking indicator that tracks hiring and business-related expectations for the next 12 months. In comparison, the U.S. Department of Labor’s May employment report, scheduled for release tomorrow, looks back on the previous month’s hiring trends.

The CPA Outlook Index—a comprehensive gauge of executive sentiment within the AICPA survey— now stands at 78, up 10 points from last quarter and its highest level since the third quarter of 2018. The index is a composite of nine, equally weighted survey measures set on a scale of 0 to 100, with 50 considered neutral and higher numbers signifying positive sentiment. Every component of the index rose at least six points in the past quarter.

Other key findings of the survey:

Some 50 percent of business executives expressed optimism about the global economy, up from 37 percent last quarter

After “availability of skilled personnel,” the top challenges cited by businesses are “materials/supplies/equipment costs” – No. 6 last quarter – and “domestic political leadership.”

Companies’ input prices are predicted to increase by 4.4 percent over the next 12 months, up from last quarter’s forecast of 3.1 percent. Conversely, the prices executives expect their companies to charge are expected to increase 2.7 percent in that timeframe, up from 1.8 percent.

Sectors seeing stepped-up hiring compared to last quarter include the category that includes pharmaceutical companies and medical device makers, manufacturing, and hospitality and entertainment. Those seeing increases ramp down a bit include banking and real estate.

Methodology

The second-quarter AICPA Business and Industry Economic Outlook Survey was conducted from April 27 to May 24, 2021, and included 770 qualified responses from CPAs who hold leadership positions, such as chief financial officer or controller, in their companies. The overall margin of error is less than 3 percentage points. A copy of the report can be found on aicpa.org.

About the Association of International Certified Professional Accountants, and AICPA & CIMA

The Association of International Certified Professional Accountants® (the Association), representing AICPA & CIMA, advances the global accounting and finance profession through its work on behalf of 696,000 AICPA and CIMA members, students and engaged professionals in 192 countries and territories. Together, we are the worldwide leader on public and management accounting issues through advocacy, support for the CPA license and specialized credentials, professional education and thought leadership. We build trust by empowering our members and engaged professionals with the knowledge and opportunities to be leaders in broadening prosperity for a more inclusive, sustainable and resilient future.

The American Institute of CPAs® (AICPA), the world’s largest member association representing the CPA profession, sets ethical standards for its members and U.S. auditing standards for private companies, not-for-profit organizations, and federal, state and local governments. It also develops and grades the Uniform CPA Examination and builds the pipeline of future talent for the public accounting profession.

The Chartered Institute of Management Accountants® (CIMA) is the world’s leading and largest professional body of management accountants. CIMA works closely with employers and sponsors leading-edge research, constantly updating its professional qualification and professional experience requirements to ensure it remains the employer’s choice when recruiting financially trained business leaders.

Contacts

Jeff May

212.596.6122

jeffrey.may@aicpa-cima.com

Gil Nielsen

212.596.6008

gil.nielsen@aicpa-cima.com

.jpg?sfvrsn=f1093d2a_0)