TSL Express Daily News

The Secured Lender

SFNet's The 81st Annual Convention Issue

Intro content. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Curabitur iaculis sapien sagittis, accumsan magna ut, blandit massa. Quisque vehicula leo lorem, a tincidunt eros tempor nec. In quis lacus vitae risus egestas tincidunt. Phasellus nulla risus, sodales in purus non, euismod ultricies elit. Vestibulum mattis dolor non sem euismod interdum.

-

Top 5 Apps for Organizing

Mar 7, 2019If you’re like most of us, we try to stay organized in business and life, but it gets increasingly complicated…

-

The Importance of Stretching

Mar 7, 2019Every personal trainer and athletic coach I have ever worked with has stressed the importance of stretching. When working out…

-

SFNet's 40 Under 40 Award Winners Panel Recap

Mar 6, 2019Moderator: Samantha Alexander, regional underwriting manager, Wells Fargo Capital Finance’s Corporate Asset Based Lending group and 2016 CFA 40 Under…

-

SFNet's Inaugural YoPro Leadership Summit

Mar 6, 2019The Secured Finance Network brought together the next generation of commercial finance leaders for a full day of learning and…

-

It’s a Marathon, Not a Sprint

Aug 22, 2018I was recently invited to participate in an executive panel to answer questions from a credit training class comprised of...

-

It’s Not Too Late – Five Member Benefits to Cash In On Now

Aug 1, 2018As we hit the half way mark on calendar year 2018, it is a good time to take stock and…

-

It’s Time To Break Up With Your Phone

Jul 18, 2018Do I have your attention? Let’s be honest here: do you have the attention span to read this article? Compared…

-

Lien Management – What You Need to Know

Jun 6, 2018UCC filing is the cornerstone of all loans and every lien portfolio...

-

Potential Impacts of Blockchain on Commercial Lending

Jan 15, 2018By Raja Sengupta, Executive Vice President and General Manager, Wolters Kluwer’s Lien Solutions When it comes to the rising importance…

-

How to be a Good Leader

Dec 5, 2017I know what you’re thinking…another article about how to be a good leader? The short answer is yes…but this time,…

-

Fintech and Due Diligence – Disruptors and Established Firms Evolve

Oct 30, 2017The fintech sector has gone through a number of manifestations in the past two decades.

-

A Commercial Banker’s Tickler Transition Plan

Oct 18, 2017Just do a keyword search for “bank tickler,” and you’ll quickly realize that banks are still heavily reliant on manual…

-

Understanding and Developing Your Personal Brand: Four Steps to a More Intentional Career Progression

Sep 5, 2017It is imperative for individuals to have a general idea about their future career aspirations, just as companies should have clearly defined strategies.

-

Selecting a Technology Vendor: 3 Questions to Ask

Jul 5, 2017As with anything else at your bank, selecting a technology vendor can be a challenging decision. Users from across different…

-

Why Back-Office Lending Automation Enhances Customer Satisfaction

Apr 25, 2017Every bank strives to keep its customers happy. Of course, some institutions are better at achieving this goal than…

-

The Lost Art of the Loan Purchase

Mar 2, 2017Purchasing a loan directly from a bank whether at par or discount is a not-often-used technique that is easily…

-

Audit Prep: Why a Paperless Approach Makes Sense

Feb 15, 2017How much time does your financial institution spend preparing for audits? We recently surveyed 187 community banks, and the results…

-

Back Office Support Services: Helping you approve more clients

Feb 7, 2017How many times have you come across a potential client who’s financials are either not up to date, not accurate,…

-

“All Assets” is the Key When Drafting UCC-1 Financing Statement Collateral Descriptions

Jan 30, 2017Even when prepared by outside or in-house counsel, many lenders pay close attention to draft UCC financing statements before they…

-

Paper Loan Files: Does Your Bank Know the True Cost?

Jan 12, 2017Sure, there’s a tangible cost associated with deploying an electronic loan imaging system. Software, support, and scanning hardware are just…

March 23, 2021

Source: Businesswire

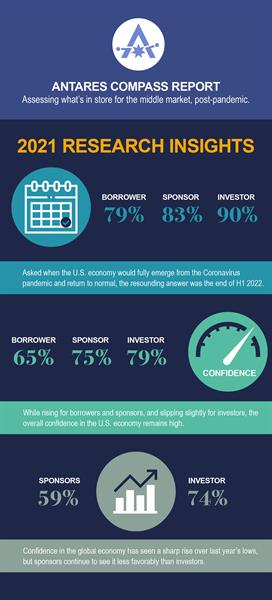

Survey results suggest the middle market is ripe with opportunity in 2021 with heightened expectations for deal-making as well as widespread global economic optimism

Antares today announced the launch of its fifth annual outlook survey, Compass 2021 https://www.antares.com/compass-report-2021/ presenting analysis of perspectives on the middle market from portfolio companies, private equity sponsors and investors.

The report suggests confidence in the U.S. economy and private markets has returned to pre-Covid levels, despite some lingering financial stress in some areas.

2021 Will See Strong Economic Rebounds

Despite market uncertainty at the height of the pandemic, positive economic sentiments have sharply rebounded in 2021. 59% of sponsors and 74% of investors are confident in the global economy over the next 12 months, up dramatically from 24% and 55% for the same groups, respectively, in 2020. Participants also report a 2021 recession is “very unlikely” despite lingering levels of financial stress in borrower portfolios.

“Middle market participants expect high levels of deal activity, as well as revenue and EBITDA growth as we emerge from Covid-19’s headwinds,” said David Brackett, chief executive officer of Antares Capital. “Although survey results indicate a few bearish perspectives, participants see fiscal and monetary stimulus coupled with high infrastructure spending as strong tailwinds against potential challenges like rising taxes and regulation.”

New External Business Challenges Emerge for Borrowers

Borrowers see new business challenges emerging in 2021. Covid-related restrictions, lingering challenges to the supply chain and raw material cost increases were the highest expected business challenges for the year. Industry headwinds and geopolitical risks, typically seen as highly problematic external business factors, ranked lower on the list than in years prior.

Widespread Middle Market Resiliency

Survey results highlight increased investor interest in private debt due to higher yield premiums, favorable middle market performance throughout the stress of 2020 and a desire to tilt toward floating rate assets to hedge against inflationary risk. The report suggests a significant uptick of investors expect leveraged loan volume to rise this year, with 74% predicting volumes to increase in 2021 compared to only 19% in 2020.

Interestingly, the survey suggested higher demands from private equity sponsors selling portfolio companies to a SPAC rather than raising money for such a company. Findings suggest 60% of private equity sponsors might sell their portfolio company to a SPAC, while a lesser 20% said they might raise funds to establish one.

Deal Activity and M&A Expectations on the Rise

Most sponsors and investors expect M&A activity to pick up in 2021, with about 2/3rds expecting upticks in LBO’s and add-ons activity – up sharply from last year’s reading.

Key factors that indicate rising middle market M&A volume include increased capital market liquidity year-over-year and consistent levels of dry powder going into 2021. These influences are supplemented by a backlog of delayed transactions caused by the pandemic. Sponsors’ portfolio company sales are also likely to increase in 2021 with 67% expecting higher exits compared to a reported 21% in 2020.

“Today’s middle market features favorable conditions for private equity transactions,” said Brackett. “Survey participants are eager to deploy dry powder. We continue to expect higher than average capital market liquidity leading to significant deal-making in the near-term.”

About Antares Compass

The full survey results, including additional analysis and survey methodology, is available by visiting https://www.antares.com/compass-report-2021/

Antares Compass provides a holistic view of the health and outlook of the middle market. It combines insights from a fundamental set of 100+ middle market participants and spans several industries and end markets. Participant groups include middle market companies, private equity sponsors, and investors that identify as a bank, BDC, CLO, insurance company, mutual fund, or non-bank leader.

About Antares

With approximately $30.8 billion of capital under management and administration as of December 31, 2020, Antares is a private debt credit manager and leading provider of financing solutions for middle-market private equity-backed transactions. In 2020, Antares issued approximately $14 billion in financing commitments to borrowers through its robust suite of products including first lien revolvers, term loans and delayed draw term loans, 2nd lien term loans, unitranche facilities and equity investments. Antares’ world-class capital markets experts hold relationships with more than 400 banks and institutional investors allowing the firm to structure, distribute and trade syndicated loans on behalf of its customers. Since its founding in 1996, Antares has been recognized by industry organizations as a leading provider of middle market private debt. The company maintains offices in Atlanta, Chicago, Los Angeles, New York and Toronto. Visit Antares at www.antares.com or follow the company on LinkedIn at http://www.linkedin.com/company/antares-capital-lp. Antares Capital is a subsidiary of Antares Holdings LP, (collectively, “Antares”).

Contacts

Antares Capital

Carol Ann Wharton

475-266-8053

carolann.wharton@antares.com

.jpg?sfvrsn=f1093d2a_0)