- Patient Capital in Action: An Interview with Cambridge Savings Bank’s Yvonne Kizner and Cal Navatto

- The Growing Impact of Supply Chain Finance: Insights from SFNet's 2025 Market Sizing Study

- Secured Finance at Scale: Why the SFNet 2025 Market Sizing Study Matters More Than Ever

- Tiger Group Launches Investment Banking Division Led by Special Situations Veteran Jamie Lisac

- 2025 Ends on a High Note for Syndicated ABL: Strong Finish Despite Uneven Trends

Commercial Finance M&A in a Pandemic: What a Difference a Year Makes

By Tim Stute and T.J. Humes

Pictured: Tim Stute and T.J. Humes

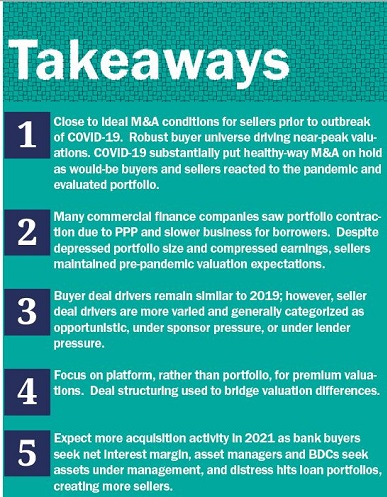

This year was off to a great start. M&A market conditions were close to ideal. There was a robust buyer universe that included banks business development companies (BDCs), credit funds and strategic buyers. Banks were interested in independent specialty finance companies in an effort to find yield and new borrowers. Flush with liquidity, BDCs and credit funds were enthusiastic to deploy capital and build assets under management (AUM).

Strategic buyers were looking to accelerate growth and diversify product offerings. The result was a crescendo of sorts that had built over the last decade, and deal multiples were at pre-Great Recession levels. We were feeling confident as well with seven completed specialty finance M&A transactions in 2019, two in early 2020, and a strong pipeline of engaged deals with a number of additional pitches on the horizon. Ironically, at the beginning of the year, we wrote in a different article that “We do not see evidence suggesting a rapid drop from a peak M&A market to the recession era M&A that unfurled in 2008.” But then – March happened.

Practically overnight, thanks to COVID-19, buyer and seller expectations changed and deal drivers shifted, putting most of our healthy-way M&A pipeline on hold. While a number of groups went ominously silent, generally, there was still plenty of buyer interest, particularly by groups that (perhaps by luck) recently raised capital. Now, buyers see today as an attractive time to invest in good companies that can be sold when M&A markets improve. However, buyers previously open to meaningful premiums are now looking for a good deal. Buyers also grapple with the question of why a “good” company is looking to sell now. Looking backward, buyers are approaching a target company’s existing portfolio with extreme caution, and buyer interest is directed toward companies that can demonstrate credit has held up through the pandemic, thus far. It is fairly telling that the announced acquisition of Kabbage, a financial technology company providing cash flow management solutions to small businesses, by American Express, explicitly excluded the preexisting loan portfolio.

For some sellers, it’s perhaps more notable that expectations have not changed. At the onset of the pandemic and anticipated economic decline, defaults and credit losses seemed to be the natural threat for lending institutions. However, portfolio contraction, due to PPP and slower business for borrowers, quickly became a mounting challenge for asset-based lenders. Reduced revenue and a fixed overhead put considerable pressure on earnings. While there are portfolio challenges, the dynamics with PPP and other programs have led many asset-based lenders to generally maintain credit quality. Despite portfolio and earnings dynamics, many would-be sellers have maintained pre-pandemic valuation expectations.

For sellers with higher valuation expectations and no pressure to transact, pursuing a sale is largely on hold. While the outbreak of the pandemic caused a pause, there is M&A activity, albeit with evolving deal drivers. In many ways, buyer deal drivers remain the same as 2019. Banks continue to operate in a low-interest environment, and see specialty finance companies as an opportunity to enhance net interest margin. Asset-based lenders and factoring companies present an easier asset to assess relative to commercial real estate in today’s environment. Many BDCs and credit funds have substantial liquidity and are motivated to build AUM and their loan product offering. During the first few months of the pandemic, many non-depository lenders implicitly or explicitly ascribed a “pandemic risk premium” of sorts to all new acquisition or lending opportunities. This dynamic seems to have subsided as these funds remain under pressure to deploy capital. However, buyer interest has to be considered with the backdrop of acquirers managing existing portfolios — buyer interest is different from buyer conviction to close.

In the current environment, seller deal drivers are more varied. We would generally categorize sellers in today’s environment as opportunistic, under sponsor pressure, or under lender pressure. Opportunistic sellers are generally niche-focused and/or smaller platforms that performed well during the pandemic, so far. These sellers are not under pressure to sell and perceive little reputational risk if a deal is not consummated. Similar to opportunistic sellers, we have seen a few situations where a sponsor has elected to push forward with a sale of a portfolio company that is performing well despite the current M&A market challenges. There is typically a well-considered answer to the “why now?” question, but investment hold period and fund life are common underlying motivations. Pressure from lenders, both senior and subordinated, has been modest yet evolving. While operating across a spectrum, lender finance groups were largely accommodating in the early months of the pandemic. Regulatory treatment of COVID-affected loans gave banks more flexibility, and stimulus programs provided an extended runway to address problem assets. The “we are in it together” and “how can we help” mentality was refreshing. However, depending on future stimulus or other intervention, eventually these assets will need to work through the system. We believe this could lead to a cornucopia of distressed deal flow. Many buyers are keeping a close eye on this third category of sellers.

As we move forward, premium pricing for sellers is no longer going to be the norm, but, in our view, still attainable in today’s market. Buyers have consistently ascribed premium value to companies with certain characteristics. As a gating item, for a company to achieve a premium sale price in the current market, its portfolio has to be clean with visibility on the impact of COVID and broader economic challenges. Some exceptions may exist for younger companies, ironically, that don’t have a large loan portfolio of unknown credit losses.

In certain M&A transactions, buyers are ascribing premiums based on portfolio value, with the platform value being secondary. Anticipating asset sale deal flow from distressed lenders and new origination opportunities, portfolio premiums are less likely. Thus, the opportunity for meaningful premiums shifts to value of the platform. The quality of the team is always a top factor. Beyond team, platforms with differentiated origination channels, proprietary technology, and unique product offerings garner the greatest opportunity for outsized valuations.

Another consideration in the current environment is structure. Buyers will not want to step into new problems through acquisitions, and therefore will frequently use credit reserves, hold backs, or exclusions to cover credit concerns. This does not always sit well with sellers who lose control of the asset; however, it may be necessary to bridge bid/ask spreads. Likewise, earn-outs and other deferred compensation are a way to provide sellers with a premium based on the performance of a platform and loan portfolio. This presents the same control challenge as holdbacks, but it is effective in delivering a premium in a challenging M&A environment.

Looking to the future, the balance of 2020 will largely be a time of additional discovery — election outcome, further stimulus, uptick in COVID cases, etc. Any M&A transactions will likely have a clear strategy. In 2021 and beyond, an uptick in M&A can be anticipated. The treatment of distressed platforms and portfolios will be a major determinant of the form of such deals. Scale and efficiency will remain themes driving strategic M&A. The various “U” and “V” shape analogies for economic recovery apply to specialty finance valuation multiples as well, and some sellers will elect to test the market if they cannot wait for a longer recovery.

About the authors:

Tim Stute is a Managing Director and Head of Specialty Finance in the investment banking group at Hovde Group and is based in the fi rm’s McLean, Virginia office Prior to joining Hovde, he was a member of Houlihan Lokey’s Financial Institutions Group. He has nearly 20 years of experience providing capital markets and M&A advisory services to the financial institutions sector, with a particular emphasis on the specialty finance industry, including equipment leasing companies, asset-based lenders, accounts receivable factoring companies, and non-mortgage consumer lenders. Before joining Houlihan Lokey, Mr. Stute was a Managing Director and Principal at Milestone Advisors, LLC in Washington, D.C., which was acquired by Houlihan Lokey in 2012. Mr. Stute holds a B.S. in Finance from Wake Forest University. Mr. Stute is licensed with the Financial Industry Regulatory Authority as a registered representative and holds the following licenses: Series 7, 63, and 79. He can be reached at tstute@hovdegroup.com.

T.J. Humes is a Director in Hovde’s Specialty Finance investment banking group based in the McLean, Virginia office. He provides investment banking services, including capital markets solutions and M&A advisory, to financial institutions nationwide. He has particular emphasis on the specialty finance industry, including commercial finance, small business finance, residential mortgage finance, and financial technology companies. He has advised clients on sell-side and buy-side of M&A transactions and has facilitated debt and equity capital markets transactions. Prior to helping found the specialty finance group at Hovde in 2017, Mr. Humes was a member of Houlihan Lokey’s Financial Institutions Group. He joined Houlihan Lokey through its acquisition of Milestone Advisors at the end of 2012. He holds a B.S. in Economics with concentrations in Finance and Marketing from the Wharton School of the University of Pennsylvania. Mr. Humes is licensed with the Financial Industry Regulatory Authority as a registered representative and holds the following licenses: Series 7, 63, and 79. He can be reached at 703-214-8522.

.jpg?sfvrsn=f1093d2a_0)