- Tiger Group Announces Major Geotechnical Equipment Auction

- Christopher “Chris” Babcock, Former ~25 Year Director from BNY Mellon Asset Management, Joins Star Mountain Capital as Managing Director

- Baker Garrington and Liquid Capital Announce Recent Financings

- Market Sizing Study

- Gateway Completes a Record 39 Stretch Deals in 45 Days Totaling $15 Million

TSL Express Daily Articles & News

To submit company news and press releases toTSL Express, email tslexpress@sfnet.com.

Today's Top Story

Featured

Steven Janson and Mark Buren Join Cadence Business Finance

Cadence Business Finance, a subsidiary of Cadence Bank (NYSE: CADE), today announced the addition of Steven Janson and Mark Buren as managing directors, expanding the company’s footprint for asset-based lending solutions to middle-market companies.

TSL Express Trending Story

Featured

Trends of 2021 Are Here to Stay: Inflation, Labor Issues, Commodity Price Changes, Supply Chain

As companies and lenders evaluate performance risk and expectations for 2022, the trends previously considered to be emerging need to be considered a permanent part of the 2022 business environment. At this point, it is unrealistic to consider inflation transitory, or to believe there is a magic switch that will eliminate labor and supply chain issues.

TSL Express Daily Headlines & News

-

Citizens Holding Company Announces Sale and Leaseback Transaction

January 23, 2024Citizens Holding Company (the “Company”) (OTCQX:CIZN), the holding company for The Citizens Bank of Philadelphia (the “Bank”), today announced it has executed an agreement for sale-leaseback of 3 of its currently owned properties.

-

Culain Capital Funding Closes $3MM Factoring Facility, Enabling New York Mechanical Services Company to Acquire Another Firm

January 23, 2024More and more businesses in need of fast, flexible working capital solutions beyond typical bank lending are turning to Culain Capital Funding. The latest is a mechanical services company based in NY, which recently received a $3MM accounts receivable factoring facility through Culain.

-

Ormat Technologies Secures $75 Million From BHI to Help Fund The Company’s Acquisition of Enel Group’s U.S. Geothermal Portfolio For $271 Million

January 23, 2024BHI, a full-service commercial bank, announced that it has entered into an agreement with Reno, Nevada-based Ormat Technologies (NYSE: ORA) to provide a new $75 million term loan for the company.

-

Zions Bancorporation Completes Asset-Based Lending Deal With North American, Distributor

January 23, 2024Zions Bancorporation, N.A., through its Utah division, Zions Bank closed and funded a $50MM credit facility for a distributor of oil and natural gas and service company. The credit facility consisted of a multi-year revolving line of credit.

-

Zions Bancorporation Completes Asset-Based Lending Deal with a North American Distributor of Control Valves

January 23, 2024Zions Bancorporation, N.A., through its Texas division, Amegy Bank, closed a $12,000,000 credit facility for a distributor of control valves, actuators, and related equipment for various industries. The credit facility consisted of a $10,000,000 multi-year revolving line of credit and a $2,000,000 term loan facility.

-

Garrington Capital Announces $8.3 Million Term Loan to a Regional Trucking Company

January 23, 2024Garrington Capital (garringtoncapital.com), a leading provider of capital solutions to middle-market companies in the United States and Canada, is pleased to announce the closing of a $8.3 Million Senior Secured Term Loan (the “Loan”) to a third-generation, family-owned short/long-haul regional trucking company.

-

Babcock & Wilcox Enterprises Announces New $150 Million Senior Secured Credit Facility; Reaffirmed Credit Rating of BB+

January 23, 2024Babcock & Wilcox Enterprises, Inc. ("B&W" or the "Company") (NYSE: BW) today announced that, effective January 18, 2024, it has entered into a new three-year senior secured credit agreement with Axos Bank (“Axos”) under which Axos has provided an asset-based revolving credit facility of up to $150 million that can be used to support letters of credit, renewable energy growth initiatives and potential accretive business purposes.

-

As It Begins its Thirteenth Year, Abacus Finance Announces the Promotions of Joseph Lee to Senior Vice President and Austin Rendell to Vice President and the Hiring of Matthew Campanella as an Analyst

January 23, 2024Abacus Finance Group, LLC, a leading provider of cash flow-based, classic senior debt for sponsor-led buyouts of lower middle-market companies, today announced the promotions of Joseph Lee to Senior Vice President and Austin Rendell to Vice President and the hiring of Matthew Campanella as an Analyst.

-

Goldman Sachs Boosts FundPark's Credit Facility Cumulatively to $500 Million

January 22, 2024Goldman Sachs has increased the credit facility of FundPark, a fintech firm that specializes in financing for small and medium-sized enterprises (SMEs) engaged in cross-border e-commerce, cumulatively to $500 million. This move significantly bolsters FundPark's ability to support the growth and operational needs of SMEs by leveraging their cash flows and inventories as collateral.

-

GoodRx Announces Proposed Refinancing of First Lien Credit Facilities

January 22, 2024GoodRx Holdings, Inc. (Nasdaq: GDRX) (“GoodRx” or the “Company”), the leading destination for prescription savings, today announced its intention to refinance its first lien credit facilities.

-

Rodwick Joins CohnReznick as Financial Services Tax Partner

January 22, 2024CohnReznick LLP, one of the leading advisory, assurance, and tax firms in the United States, today announced that Peter Rodwick, CPA has joined the firm as a tax partner in its Financial Services practice. Based in Los Angeles, Rodwick has nearly two decades of experience providing tax services to large and mid-size alternative investment funds and their management companies.

-

Alleon Healthcare Capital Provides a $5,000,000 Debtor in Possession Financing ABL to a Texas-based Specialty Pharmacy

January 22, 2024Alleon Healthcare Capital (“Alleon”), a specialty finance company focused on providing healthcare accounts receivable financing, medical accounts receivable factoring, and cash flow solutions to medical providers in the U.S., recently closed a $5,000,000 debtor in possession asset-based loan to a specialty pharmacy in Texas (“Company”).

-

KCP Advisory Group Joins With Altman and Company

January 22, 2024KCP Advisory Group, the restructuring and financial consulting organization that offers creative solutions nationally, announces its merger with Altman and Company LLC. The merger of KCP Advisory Group and Altman and Company creates a national consulting firm providing a wide range of services including: crisis and turnaround management, financial advisory, performance improvement, interim management, lender portfolio management advisory, forensic accounting and litigation support.

-

Andrew Pontano Named Leader of Dechert's Asset Finance & Securitization Group

January 22, 2024Dechert has named global finance partner Andrew Pontano as leader of the firm’s asset finance & securitization group. Mr. Pontano's appointment reinforces the team’s strategic aim of delivering comprehensive service to clients, encompassing innovative deal formation, creative funding approaches and streamlined execution.

-

Accomplished Legal Executive Richard Maletsky Joins Hilco Global as Executive Vice President and General Counsel

January 22, 2024Hilco Global, a privately held diversified financial services firm, announced today the appointment of Richard "Rick" Maletsky as its new Executive Vice President and General Counsel. Mr. Maletsky succeeds Eric Kaup, who will be transitioning to the newly created role of Co-Chief Commercial Officer at the diversified financial services holding company.

-

Lenders Not Ready to Signal “All-Clear” When It Comes to the Economy, According to New FTI Consulting Survey

January 22, 2024FTI Consulting, Inc. (NYSE: FCN) today announced the findings of its 2024 Leveraged Loan Market Survey, which offers insight into bank and non-bank lenders’ perspectives on the U.S. loan industry and highlights expectations for leveraged credit market conditions in the year ahead.

-

Maxim Commercial Capital Reports Strong 2023 Results, Michael Kianmahd Promoted to Chief Executive Officer

January 22, 2024Maxim Commercial Capital (“Maxim”) announced strong results for the year 2023. The hard asset secured lender reported an 86% increase in funded deals during the year as compared to 2022. Maxim is a national provider of loans and leases from $10,000 to $3 million collateralized by class 6 and 8 trucks, trailers, heavy equipment, and real estate.

-

Magnite Announces Intention to Refinance Existing Credit Facilities

January 22, 2024Magnite (NASDAQ: MGNI), the world's largest independent sell-side advertising company, today announced its intention to refinance its outstanding senior secured credit facilities.

-

Principal® Direct Lending Business Reaches $2 Billion in Borrower Commitments

January 22, 2024Its direct lending investment team, known as Principal Alternative Credit, has now closed on over 115 transactions as of December 31, 2023, and has exceeded $2 billion in total borrower commitments since its inception in July 2020. This milestone represents an important step in the company’s long-term strategic plan of providing flexible financing solutions across the middle market direct lending industry.

-

Dave & Buster’s Entertainment, Inc. Announces Opportunistic Term and Revolving Loan Repricing

January 22, 2024Deutsche Bank Securities Inc., JPMorgan Chase Bank, N.A., Wells Fargo Securities, LLC, BMO Capital Markets Corp., Truist Securities Inc., Capital One, N.A. and Fifth Third Bank, National Association acted as joint lead arrangers and joint bookrunners for the transaction.

The Secured Lender

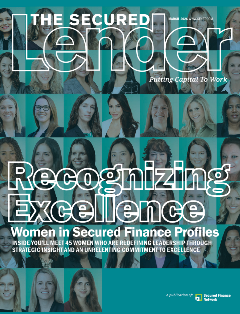

SFNet's The Women in Secured Finance Issue

© 2026 Secured Finance Network