- Gateway Completes a Record 39 Stretch Deals in 45 Days Totaling $15 Million

- Franklin Capital Announces Promotion of Steven Damon to Senior Vice President of Operations and A/R Department Head

- Tiger Group to Auction Assets from Closed Xytel Plant Starting March 10

- CohnReznick Names Scott G. Sachs Private Equity Practice Leader

- Monroe Capital Supports IMMEC’s Investment in Helton Electrical Services

TSL Express Daily Articles & News

To submit company news and press releases toTSL Express, email tslexpress@sfnet.com.

Today's Top Story

Featured

MidCap Financial Closes Senior Revolving Credit Facility to Shimmick

MidCap Financial, a leading commercial finance company focused on middle market transactions, today announced it has provided a senior revolving credit facility to SCCI National Holdings, Inc. (“Shimmick” or “Company”). Proceeds from the MidCap credit facility will provide for the business’ ongoing working capital needs.

TSL Express Trending Story

Featured

Maryland Financial Disclosures Bill Dies in Committee

Leslie J. Polt, Esq., Adelberg Rudow, provided the following analysis of Maryland’s Commercial Financing Transactions Act (SB825). He can be reached at lpolt@adelberg.com.

SFNet will continue to track this along with all other state disclosure legislation and work to influence favorable outcomes for our industry.

TSL Express Daily Headlines & News

-

Landsea Homes Announces Commencement of Private Offering of Senior Notes

March 18, 2024andsea Homes Corporation (Nasdaq: LSEA) (“Landsea Homes” or the “Company”) announced today that it intends to offer $300,000,000 aggregate principal amount of senior notes due 2029 (the “Notes”), subject to market conditions and other factors. The Notes will be guaranteed, jointly and severally, on a senior unsecured basis, by all of the Company’s material wholly owned subsidiaries as of their issuance (the “Guarantors”) and will rank pari passu with all other unsecured and unsubordinated indebtedness of the Company and Guarantors.

-

FCPT Announces New $85 Million Term Loan Under Existing Credit Facility

March 18, 2024Barclays Bank PLC acted as Syndication Agent and Joint Lead Arranger on the Term Loan with J.P. Morgan Chase Bank, N.A. remaining as administrative agent. The additional lenders acting as Joint Lead Arrangers and Co-Documentation Agents were The Huntington National Bank, Mizuho Bank, Ltd, Raymond James Bank, Truist Bank, and Wells Fargo Bank, N.A..

-

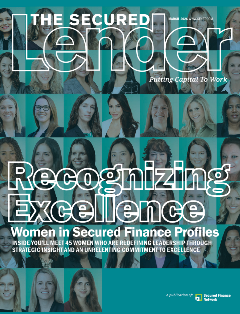

Greenberg Traurig's Julia Frost-Davies Named Among The Secured Lender's 2024 Women in Secured Finance

March 18, 2024Boston attorney Julia Frost-Davies is among 56 U.S. women honored in the "Recognizing Excellence: Women in Secured Finance 2024" issue of The Secured Lender, a publication of The Secured Finance Network.

-

Darleen Gillespie of First Bank Promoted to Executive Vice President

March 18, 2024First Bank has promoted Darleen Gillespie to Executive Vice President. Gillespie, who previously served as Chief Retail Banking Officer, has been instrumental in driving First Bank’s Retail Division to new heights since joining in 2022.

-

New York State to Consider Safe Harbor Amendment to Disclosure Law

March 18, 2024Working with state legislators, SFNet has been successful in getting a new safe harbor amendment introduced. Similar to California, it would provide an explicit safe harbor protecting asset-based lenders and factors who provide a good faith estimate of APR in compliance with the regulations from any liability should that estimate differ from the actual APR.

-

Houlihan Lokey Appoints Rafael Pereira as a Senior Advisor

March 18, 2024Houlihan Lokey, Inc. (NYSE:HLI), the global investment bank, announced today that Rafael Pereira has been appointed as a Senior Advisor to assist the firm with its expansion in Brazil.

-

Wingspire Capital Provides $75 Million Revolving Line of Credit to Signature Brands

March 18, 2024Wingspire Capital provided a $75 million revolving line of credit to Signature Brands. The senior secured credit facility was used to refinance an existing debt facility and provide enhanced liquidity by tailoring the structure to the seasonality of the business.

-

Bow River Capital Supports Growth Catalyst Partners and Shift Paradigm With Acquisition Financing

March 18, 2024Bow River Capital, a Denver-based alternative asset manager, is pleased to announce that its Private Credit Team has provided funds to support acquisition financing for Shift Paradigm ("Shift" or the "Company"). Shift is backed by Growth Catalyst Partners ("GCP") a middle-market private equity firm investing in information, marketing, and tech-enabled services businesses.

-

Katten Expands Litigation Team With Kevin Broughel in New York

March 18, 2024Katten announced today that seasoned litigator Kevin P. Broughel has joined the firm's Financial Markets Litigation and Enforcement practice as a partner in New York.

-

BlackArch Partners Announces Recent Promotions

March 18, 2024BlackArch Partners, a leading middle-market investment bank, is pleased to announce that Will Mackvick has been promoted to Managing Director and Brandon Boor has been promoted to Director.

-

CIBC Innovation Banking Provides Growth Capital to Skedda

March 18, 2024CIBC Innovation Banking announced today that it has provided growth financing to Skedda, a leading global space management and scheduling platform focused on serving employees in today’s hybrid work environment. This funding will drive product innovation and further fuel Skedda’s global expansion.

-

Crafts Retailer Joann Files for Chapter 11 Bankruptcy Protection

March 18, 2024In addition to Monday’s filing in U.S. Bankruptcy Court, Joann said it had received about $132 million in new financing and expected to reduce its balance sheet’s funded debt by about $505 million.

-

SSG Advises St. Cloud Capital LLC in the Sale of Renters Warehouse to GA Technologies

March 18, 2024SSG Capital Advisors, LLC (“SSG”) served as the investment banker to one of the funds of St. Cloud Capital LLC (“St. Cloud”), the senior secured lender of Renters Warehouse (the “Company”), a United States-based single-family home rental services platform. SSG provided debt advisory services to St. Cloud that facilitated the sale of the assets of RW OpCo, LLC, t/a Renters Warehouse to GA Technologies Co. Ltd. through its subsidiary GA Technologies USA Inc.

-

WSFS Announces Jamie Tranfalia as Senior Vice President and Senior Middle Market Team Leader

March 18, 2024WSFS Bank, the primary subsidiary of WSFS Financial Corporation (Nasdaq: WSFS), is pleased to announce the hire of Jamie Tranfalia as Senior Vice President and Senior Middle Market Team Leader, reporting to Jim Gise, Senior Vice President, Middle Market, Syndications and Capital Markets.

-

Cambridge Wilkinson spins out BCB Equity Partners, an Independent Private Equity Firm

March 18, 2024Cambridge Wilkinson ("CW" www.cambridgewilkinson.com) is pleased to announce the spin out and full support of an affiliate, BCB Equity Partners ("BCB" www.bcbequitypartners.com), an independent private equity firm which will pursue control and buyout transactions in the lower middle market. The geographic focus of BCB will be North America initially.

-

BoxPower Secures Credit Facility from VerisFi Capital and Energy Capital Partners to Expand Remote Microgrid Portfolio

March 14, 2024BoxPower, a leading provider of microgrids, is pleased to announce the successful closing of a credit facility in collaboration with VerisFi Capital and ECP ForeStar, the sustainable lending platform of Energy Capital Partners (ECP). This strategic financial arrangement will empower BoxPower to accelerate the expansion of its remote microgrid portfolio, furthering the company’s commitment to providing safe, reliable, and affordable clean energy solutions.

-

Mynaric Increases USD 75 million Borrowing Capacity on Loan Agreement by USD 20 million

March 14, 2024Mynaric AG (NASDAQ:MYNA; ISIN: US62857X1019)(FRA:M0YN; ISIN: DE000A31C305) (the "Company") today decided on an amendment to its existing US$75 million loan agreement with its US-based lenders, which are funds affiliated with a U.S.-based global investment management firm (the "Lenders"), to increase the borrowing capacity on the loan agreement by US$20 million

-

PNC Names Michael Thomas Head of Corporate & Institutional Banking

March 14, 2024PNC Bank today announced that Michael Thomas has been named head of Corporate & Institutional Banking (C&IB), effective immediately. Based in Pittsburgh, Thomas will report to Michael P. Lyons, president. Thomas succeeds Lyons in the role, after Lyons was appointed president Feb. 20, 2024.

-

SLR Business Credit Funds $20 Million Credit Facility

March 14, 2024SLR Business Credit is pleased to announce the funding of a $20,000,000 ABL RLOC for an eighty-eight-year-old electronics products manufacturer. The funds were used to provide additional working capital for growth.

-

HSBC Appoints Andrew Fullam as Chief Financial Officer for the US and Americas

March 14, 2024HSBC announced today the appointment of Andrew Fullam as Chief Financial Officer (CFO) for the US and Americas. In this role, he will be responsible for the region’s financial operations, including accounting, regulatory reporting, stress testing and capital management.

The Secured Lender

SFNet's The Women in Secured Finance Issue

© 2026 Secured Finance Network