- Baker Garrington and Liquid Capital Announce Recent Financings

- David Ebroon Admitted to the American College of Commercial Finance Lawyers as a Fellow

- Baker Garrington and Liquid Capital Announce Recent Financings

- NORD/LB, Siemens Financial Services, and GridStor Announce Close of $120 Million Financing Agreement

- FCI Announces Appointment of Deputy Secretary General - Betül Kurtuluş

TSL Express Daily Articles & News

To submit company news and press releases toTSL Express, email tslexpress@sfnet.com.

Today's Top Story

Featured

Valley Bank Hires Matthew Weidle to Lead Chicago and Midwest Markets

Valley Bank, a regional bank with operations along key East Coast markets and California, is expanding its Chicago office with the hiring of Matthew Weidle as First Senior Vice President and Midwest Regional President.

In this new role, Weidle will focus on expanding Valley’s Commercial Banking presence in the Chicago market and Midwest region. Valley inherited the talented and well-established Commercial Banking team through Valley’s merger with Bank Leumi USA in April 2022.

In this new role, Weidle will focus on expanding Valley’s Commercial Banking presence in the Chicago market and Midwest region. Valley inherited the talented and well-established Commercial Banking team through Valley’s merger with Bank Leumi USA in April 2022.

TSL Express Trending Story

Featured

Lenders Beware: Lender Liability

The past few years have seen strong liquidity in the marketplace coupled with unprecedented government support of certain borrowers; increased competition for secured transactions among banks and non-banks; and surprisingly fewer distressed transactions during the pandemic than would have been anticipated. As a result, lenders have not had to focus as much on managing distressed credits and the potential pitfalls and risks that are associated with them. As a few recent cases discussed below show, assertions of lender liability may arise in various contexts to an unsuspecting lender.

TSL Express Daily Headlines & News

-

ABLC Welcomes Jerry M. Klein, CPA as New Senior Field Examiner

May 7, 2024Asset-Based Lending Consultants (ABLC), a global leader in field examinations and ABL consultations, is pleased to announce the appointment of Jerry M. Klein, CPA, as its new Senior Field Examiner.

-

Amit Trehan Joins Cahill’s New York Office as a Bankruptcy and Restructuring Partner

May 7, 2024Cahill Gordon & Reindel LLP announced today that Amit Trehan has joined the firm as a partner in New York, strengthening its Bankruptcy & Restructuring practice.

-

Peapack Private Hires Jerry Dominguez as Senior Managing Director

May 7, 2024Peapack-Gladstone Financial Corporation (NASDAQ Global Select Market: PGC) and Peapack Private, a division of Peapack-Gladstone Bank, are proud to announce that Jerry Dominguez has joined Peapack Private’s New York City location as Senior Managing Director. Jerry is responsible for providing customized commercial banking solutions to a diverse set of businesses to help them achieve their financial goals.

-

Trinity Capital Inc. Launches Sponsor Finance Vertical with New Strategic Hires

May 7, 2024Trinity Capital Inc. (NASDAQ: TRIN) ("Trinity" or the "Company"), a leading provider of diversified financial solutions to growth-oriented companies, today announced the expansion of its business with the addition of a new Sponsor Finance vertical. This strategic expansion naturally extends the Company's established expertise in providing direct lending solutions to sponsor-backed companies across a range of industries.

-

Flushing Bank Expands Small Business Support with Addition of New Specialized SBA (Small Business Administration) Team

May 7, 2024Flushing Financial Corporation (the "Company") (Nasdaq:FFIC), the parent holding company for Flushing Bank (the "Bank"), announced today the addition of a dedicated team to expand SBA lending nationwide. This initiative underscores the company's commitment to fostering economic growth and providing tailored financial solutions to small businesses.

-

Jocelyn Lynch Promoted to Head of Western Alliance Trust Company, N.A.

May 7, 2024Western Alliance Bancorporation today announced the promotion of Jocelyn Lynch to the President and CEO of Western Alliance Trust Company, N.A. Lynch brings tremendous experience to her elevated role, having served previously as Managing Director in the Corporate Trust group at Western Alliance Trust Company, N.A.

-

Jared Talisman Joins Colbeck Capital as Managing Director and Head of Originations

May 7, 2024Colbeck Capital Management (“Colbeck”), a leading, middle-market private credit manager focused on strategic lending, today announced that Jared Talisman has joined the firm as a Managing Director and Head of Originations. Mr. Talisman most recently served as a Managing Director at Principal Alternative Credit, where he led and managed the sourcing, structuring, and due diligence of non-sponsored private credit investments.

-

PNC, TCW Partner To Expand Capabilities, Create Private Credit Platform

May 7, 2024The PNC Financial Services Group, Inc. ("PNC"), one of the largest diversified financial institutions in the U.S., and the TCW Group, Inc. ("TCW"), a leading global asset manager, today announced they are partnering to deliver private credit solutions to middle market companies.

-

Genesis Energy, L.P. Announces Public Offering of Senior Notes

May 6, 2024Genesis Energy, L.P. (NYSE: GEL) today announced the commencement, subject to market and other conditions, of a registered, underwritten public offering of $500,000,000 in aggregate principal amount of senior unsecured notes due 2032 (the “notes”).

-

Uniti Group Inc. Announces Private Offering of Senior Secured Notes

May 6, 2024Uniti Group Inc. (the “Company,” “Uniti,” or “we”) (Nasdaq: UNIT) today announced that its subsidiaries, Uniti Group LP, Uniti Fiber Holdings Inc., Uniti Group Finance 2019 Inc. and CSL Capital, LLC (together, the “issuers”), announced today the planned offering, subject to market and other conditions, of $300 million aggregate principal amount of 10.50% Senior Secured Notes due 2028 (the “notes”).

-

Scout Clean Energy Closes $100 Million Equipment Supply Loan

May 6, 2024Scout Clean Energy, a Colorado-based renewable energy developer, owner, and operator, is pleased to announce the closing of a $100 million equipment supply loan (ESL) with Rabobank.

-

FGI T.R.U.S.T.™ and Validis to Partner

May 6, 2024FGI Worldwide LLC (“FGI”), a global leader in commercial finance, and Validis, the open accounting API, have partnered to integrate their respective credit management and data extraction platforms.

-

BizCap® Fuels Quady Winery's Growth with $17MM Financing Package

May 6, 2024BizCap®, a commercial finance firm established in 2002, is proud to announce its successful collaboration with Quady Winery, a family-owned operation in Central Valley, CA, renowned for affordable Muscat grape-based fortified and sweet wines that are sold throughout the U.S. Among

-

Maxim Commercial Capital Promotes Fernando Rodriguez to Director - Vendor Sales

May 6, 2024Maxim Commercial Capital (“Maxim”) announced Fernando Rodriguez has been promoted to Director – Vendor Sales. In this role, Rodriguez manages vendor relationships, business origination, and sales for Maxim’s Truck and Equipment Financing divisions.

-

Kathleen O. Currey Elected as a Fellow to the American College of Commercial Finance Lawyers

May 6, 2024Commercial Finance Partner Kathleen O. Currey has been inducted into the American College of Commercial Finance Lawyers (“ACCFL”) at their annual meeting on April 5, 2024. ACCFL Fellows are lawyers who have achieved preeminence in the field of commercial finance law and those who have made substantial and sustained contributions to the promotion of learning and scholarship in commercial finance law, among other attributes.

-

Grant Thornton Announces new Leader for its Chicago Headquarters

May 6, 2024She also served as the Audit practice leader for the Chicago office, and most recently, she was the firm’s Midwest Geography leader, overseeing audit work for all clients served by the firm’s teams in Chicago, Minneapolis and Wisconsin. In this role, she helped the firm attain multiple years of record revenues while helping clients successfully navigate the challenges posed by the COVID-19 pandemic and the supply chain crisis.

-

BofA Survey: Majority of Small and Mid-Sized Business Owners Anticipate Revenue Growth This Year

May 6, 2024A majority of small and mid-sized business owners expect their revenues to increase this year, and their worries over a recession have declined substantially, according to the 2024 Bank of America Business Owner Report, conducted in partnership with Bank of America Institute.

-

Comerica Bank Appoints Floyd Kessler New Executive Vice President, Chief Business Risk and Controls Officer

May 6, 2024Comerica Incorporated (NYSE: CMA) announced that Floyd Kessler has been named to the new role of Executive Vice President, Chief Business Risk and Controls Officer. Kessler will report to Peter Sefzik, Chief Banking Officer.

-

Altriarch Empowers Dozens of Businesses Through Innovative Finance Strategies for Factors

May 6, 2024

-

Altriarch Empowers Dozens of Businesses Through Innovative Finance Strategies for Factors

May 6, 2024

The Secured Lender

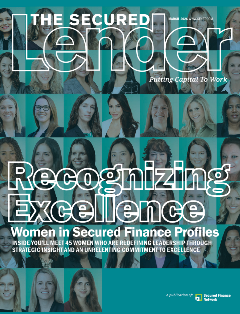

SFNet's The Women in Secured Finance Issue

© 2026 Secured Finance Network