- TSL Subscriber Only Content

- Alliant Energy Enters $400 Million Term Loan Agreement with U.S. Bank

- Attain Finance Enters into a Second Canadian Credit Facility

- Solifi Launches Solifi Document Intelligence, Enabling Up to 70% Reduction in Document Verification Time in Secured Finance

- Simon® Announces $5.0 Billion Revolving Credit Facility and Amendment to $3.5 Billion Revolving Credit Facility

TSL Express Daily Articles & News

To submit company news and press releases toTSL Express, email tslexpress@sfnet.com.

Today's Top Story

Featured

Corcentric Secures $315 Million Senior Credit Facility

Corcentric, a leading global provider of best-in-class procurement and finance solutions, announced today it secured a new $315 million senior credit facility. The capital raise consists of a $250 million senior secured asset-based loan revolver from Bank of America and JPMorgan Chase & Co. and a $65 million term loan from TCW Private Credit Group.

TSL Express Trending Story

Featured

Fighting Misinformation: Don’t believe Everything You Read on the Internet

Borrowers face an uphill battle when conducting an internet search for capital. Lee Haskin of Crossroads Financial discusses the misinformation out there and offers clarifications concerning certain types of finance products.

TSL Express Daily Headlines & News

-

First Citizens Bank Provides $74 Million for Multifamily Building in Downtown Brooklyn

May 28, 2024First Citizens Bank today announced that its Commercial Real Estate business served as sole lender on a $74 million senior secured loan to Lonicera Partners on a 23-story, class A multifamily building in Downtown Brooklyn, New York.

-

Comvest Partners Announces Investment In Senior Helpers

May 28, 2024Comvest Partners, a leading middle-market private equity and credit investment firm, is pleased to announce that its direct lending platform, Comvest Credit Partners, is acting as Administrative Agent on a senior secured credit facility (the “Financing”) for Senior Support Holdings (Franchise) Acquisition, Inc. (“Senior Helpers”), a Towson, Md.-based national leader in home care and wellness offerings for seniors.

-

Axiom Bank Announces Factoring Facility for Transportation and Logistics Company

May 28, 2024Axiom Bank announced it provided a $4,625,000 transportation factoring facility for a multi-state transportation and logistics company.

-

First Citizens Middle Market Banking Names Erik Langeland Relationship Manager and Market Leader for Northern California

May 28, 2024First Citizens Bank today announced that its Middle Market Banking group has named Erik Langeland as a relationship manager and market leader focused on building new business in Northern California. Langeland will be responsible for developing and maintaining a portfolio of middle market banking relationships, as well as delivering a full suite of commercial banking products and services.

-

Eclipse Business Capital Closes $170MM ABL Credit Facility To A Specialty Retailer

May 28, 2024Eclipse Business Capital LLC (“EBC”) announced that it has provided a $170 million senior secured ABL credit facility to a specialty retailer. The credit facility is secured by accounts receivable and inventory. The transaction will refinance the Company’s existing credit facilities and provide additional liquidity for working capital purposes.

-

AFC Gamma Provides Senior Secured Credit Facility to Women-Owned Grön Edibles

May 28, 2024AFC Gamma, Inc. (NASDAQ:AFCG) (“AFC Gamma”) today announced that it has provided a senior secured credit facility to Grön Holdings Inc. (“Grön” or “Grön Edibles”), one of North America’s largest producers of adult-use cannabis-infused edibles. Grön intends to use the proceeds from the new credit facility to expand its business into new states.

-

MidOcean Partners Provides Structured Capital to Fund the Growth of GridHawk, a Premier Provider of Utility Damage Prevention Services

May 28, 2024MidOcean Partners (“MidOcean”), a premier New York-based alternative asset manager specializing in middle-market private equity, structured capital, and alternative credit investments, today announced it has made a preferred equity investment in GridHawk Holdings (“GridHawk” or the “Company”), a premier provider of damage prevention services for critical utility infrastructure across the U.S.

-

Recurrent Energy Secures Landmark Green, Multi-currency Financing for up to €1.3 Billion to Accelerate European Renewable Energy Portfolio

May 28, 2024ecurrent Energy, a subsidiary of Canadian Solar Inc. ("Canadian Solar") (NASDAQ: CSIQ) and a global developer and owner of solar and energy storage assets, today announced that it has secured a landmark multi-currency revolving credit facility valued at up to €1.3 billion with ten banks for the construction of renewable energy projects in several European countries. Recurrent Energy and the participating financial institutions signed the agreement in Seville, Spain.

-

Comvest Partners Announces $70 Million Senior Credit Facility For Nationwide Energy Partners to Support Growth Strategy

May 28, 2024Comvest Partners, a leading middle-market private equity and credit investment firm, is pleased to announce that its direct lending platform, Comvest Credit Partners, is acting as Administrative Agent and is the Sole Lender on a $70 million senior secured credit facility (the “Financing”) for Nationwide Energy Partners (“NEP”, or the “Company”), an Ohio-based provider of utility management services to the multifamily market.

-

Capital Group and KKR Form Exclusive Strategic Partnership to Create Public-Private Investment Solutions

May 28, 2024Leading global investment firms, Capital Group and KKR, today announced an exclusive, strategic partnership to bring new ways for investors to incorporate alternative investments into their portfolios. Capital Group and KKR intend to make hybrid public-private markets investment solutions available to investors across multiple asset classes, geographies and channels.

-

Assembled Brands Capital Closes Line of Credit with Happy Dad Hard Seltzer & Tea

May 23, 2024Assembled Brands is celebrating a new substantial facility with Happy Dad Hard Seltzer & Tea. With access to a flexible line of credit, the California-based company is well prepared to grow its inventory positions and scale the business month over month without limitation.

-

Assembled Brands Capital Provides Substantial Line of Credit to Luxury Sleepwear Brand Lunya

May 23, 2024Assembled Brands is celebrating the closing of a new revolving line of credit with Lunya, a luxury sleep and loungewear brand that has become a favorite among retail partners and digital shoppers alike. Through this partnership, the apparel company will further extend its marketing efforts, and continue to expand its inventory assortment.

-

Allegion Completes Extension and Increase of Revolving Credit Facility

May 23, 2024Allegion plc (NYSE: ALLE), a leading global security products and solutions provider, has successfully completed the extension and increase of its existing senior unsecured revolving credit facility.

-

Thurston Group Portfolio Company, Gen4 Dental Partners, Secures $315M Credit Facility

May 23, 2024Thurston Group ("Thurston"), a leading private equity firm specializing in healthcare investments, is pleased to announce its portfolio company, Gen4 Dental Partners ("Gen4"), has closed on a $315 million credit facility. The financing which was used to refinance existing indebtedness and fund acquisitions under LOI, was significantly oversubscribed and led by Man Varagon.

-

H2O Innovation Announces the Closing of a US $85M Blue Loan Credit Facility

May 23, 2024H2O Innovation Inc. (“H2O Innovation” or the “Corporation”) is proud to announce that it has entered into an agreement with National Bank of Canada, acting as lead arranger, sole bookrunner, administrative agent and Sustainability Structuring Agent of a syndicate of three banks including Scotiabank and the Toronto-Dominion Bank, to increase the Corporation’s revolving credit facility to $85M, a rise of $30M since the previous loan increase.

-

Frontier Announces Amendment to its Revolving Credit Facility

May 23, 2024Frontier Communications Parent, Inc. (NASDAQ: FYBR) (“Frontier” or the “Company”) today announced the execution of an amendment to its revolving credit facility. The amendment increases the amount of new securitization debt the company may issue and requires that a portion of the proceeds be used to refinance first lien debt.

-

Gridiron Capital-Backed GSM Outdoors Acquired Dobyns Rods

May 23, 2024Gridiron Capital, LLC (“Gridiron Capital”), an investment firm focused on partnering with founders, entrepreneurs, and management teams, is pleased to announce that its portfolio company, Good Sportsman Marketing Outdoors (“GSM,” “GSM Outdoors,” or the “Company”), an outdoor enthusiast platform, has acquired Dobyns Rods (“Dobyns”).

-

Womble Adds Financial Services Partner in New York

May 23, 2024In further expansion of its financial services regulatory and technology capabilities, Womble Bond Dickinson today announced the addition of partner Louis Froelich to the Capital Markets group. Froelich joins in New York, where he has worked in legal and business roles for the better part of two decades.

-

US Capital Global Securities Announces $10MM Convertible Note Offering for Cyber Security Firm, RedShift Networks

May 23, 2024US Capital Global Securities LLC, an SEC-registered affiliate of renowned global financial group US Capital Global, is pleased to present eligible investors with a unique investment opportunity to participate in an investment round of up to $10 million for RedShift Networks (“RedShift” or the “Company”).

-

QuickFi Wins Best of Show at Finovate Spring 2024

May 23, 2024QuickFi® was recognized as Best of Show at Finovate Spring 2024. QuickFi participated with over 50 companies at Finovate Spring 2024, a leading fintech event series held annually in San Francisco, New York City, Asia, and Europe.

The Secured Lender

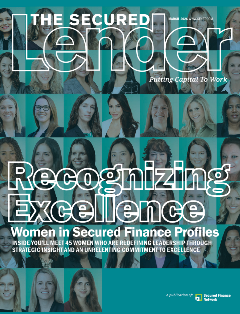

SFNet's The Women in Secured Finance Issue

© 2026 Secured Finance Network