- Marathon Asset Management Announces $615 Million Aircraft Securitization

- TSL Express Daily RSS Feed Reader Page

- J D Factors Provides $9.9 Million in New Factoring Facilities to 34 New Clients in January

- First Business Bank's Asset-Based Lending Team Funds $5 Million Credit Facility For Growing Healthcare Services Company

- Market Sizing & Impact Study 2023

TSL Express Daily Articles & News

To submit company news and press releases toTSL Express, email tslexpress@sfnet.com.

Today's Top Story

Featured

Siena Lending Group LLC (“Siena”) is pleased to announce the closing of a $78 million senior secured credit facility with an alcoholic beverage producer and distributor (the “Company”). The loans are being used to provide additional capital to refinance existing debt and support future growth opportunities.

The Company produces and sells distilled spirits and ready-to-drink cocktails on a private label and contract manufacturing basis, as well as a full line of its own branded products. Privately owned by the founding family for over 70 years, the Company was seeking a financing partner that could provide a flexible solution with added liquidity to complete its turnaround and support new operating initiatives.

TSL Express Trending Story

Featured

TSL Express Daily Headlines & News

-

TaxNow Announces Strategic Partnership with XEN to Enhance Financial Management Solutions

August 19, 2024TaxNow, an innovative tax underwriting and monitoring platform, is excited to announce its new strategic partnership with XEN, a renowned multi-platform loan management software provider for lenders. This collaboration aims to improve the financial management landscape for lenders by integrating comprehensive tax underwriting and monitoring solutions into XEN, creating efficiency for clients seeking streamlined processes for tax due diligence and compliance.

-

Construction Executive Ranks CohnReznick 10th Among Its Top Construction Accounting Firms

August 19, 2024CohnReznick LLP, one of the leading advisory, assurance, and tax firms in the United States, today announced it has been ranked the number 10 construction accounting firm by Construction Executive. This marks the fourth consecutive year the firm has received a top 10 ranking.

-

BRG Financial Institution Advisory Practice Adds Managing Director Michael Hollerich

August 19, 2024BRG announced today that Michael Hollerich has joined the firm’s Financial Institution Advisory practice as a managing director in Dallas. Hollerich brings over 25 years of leadership experience in financial services risk and consulting.

-

New NFIB Survey: Inflation Continues to Plague Main Street

August 19, 2024The NFIB Small Business Optimism Index rose 2.2 points in July to 93.7, the highest reading since February 2022. However, this is the 31st consecutive month below the 50-year average of 98. Inflation remains the top issue among small business owners, with 25% reporting it as their single most important problem in operating their business, up four points from June.

-

CIBC Innovation Banking Provides Growth Capital to Boosted.ai

August 19, 2024CIBC Innovation Banking announced today that it has provided $10 million in growth capital to Boosted.ai, a Toronto-based company that uses AI to automate investment management processes and increase productivity. Boosted.ai will use the funds to invest in product development and sales expansion in the Canadian and US market.

-

Tower Partners Lands Buyer for REV Capital’s U.S. Transportation Factoring Portfolio: The Financial Unit of Love’s Travel Stops

August 19, 2024Tower Partners, a lower-middle market investment bank with a focus on family, founder, and entrepreneurial-led businesses, announced today that it has successfully executed the sale of REV Capital’s U.S. transportation factoring portfolio to the financial services division of Love’s Travel Stops.

-

nFusion Capital Fuels Growth with Enhanced Junior Capital Facility from Haversine

August 19, 2024nFusion Capital Finance, LLC, a leading commercial finance company for entrepreneurs, announced that it has increased its junior capital credit facility to $17.5 million with Haversine Funding. Last month, nFusion announced that it had increased its senior secured credit facility with a consortium of lenders.

-

SSG Places Debt Financing for Pegasus Home Fashions

August 19, 2024SSG Capital Advisors, LLC (“SSG”) served as the investment banker to Pegasus Home Fashions, Inc. and its affiliated entities (collectively, “Pegasus” or the “Company”) in the private placement of a $25 million revolving credit facility with Ares Management, LLC. The financing enabled Pegasus to refinance existing indebtedness and will provide additional capital for growth.

-

King Trade Capital Upsizes Purchase Order Finance Facility to Dry Foods Manufacturer by 50%

August 15, 2024King Trade Capital (“KTC”) is pleased to announce the finance facility increase of $2.5MM for an existing dry baked goods manufacturing client.

-

Cliffwater Corporate Lending Fund Announces Completion of $1.370 Billion Investment Grade Secured Notes Offering

August 15, 2024Cliffwater Corporate Lending Fund ("CCLFX" or "the Fund"), a diversified interval fund focused on consistent income through corporate middle market direct lending, is pleased to announce the closing of its seventh privately-placed Senior Secured Notes (the "Notes") offering, totaling $1.370 billion in principal amount.

-

Prestige Capital Extends a $1,000,000 Facility to a Southeastern Based Technology Company

August 15, 2024A technology company that designs software for call centers required capital to support its growth. In partnership with the company's investor, Prestige Capital provided the necessary funds for this business to expand.

-

Monroe Capital Supports Medusind’s Add-on Acquisitions

August 15, 2024Monroe Capital LLC announced it acted as administrative agent and joint lead arranger on the funding of a senior credit facility to support the acquisitions of Billing Solutions, LLC (“Billing Solutions”) and edgeMED Healthcare (“edgeMED”) by Medusind Solutions Inc. (“Medusind”), an existing portfolio company of Alpine Investors.

-

ADMA Biologics Announces Partial Paydown of Revolving Credit Facility

August 15, 2024ADMA Biologics, Inc. (Nasdaq: ADMA) (“ADMA” or the “Company”), an end-to-end commercial biopharmaceutical company dedicated to manufacturing, marketing and developing specialty biologics, today announced it has repaid $30 million from its original $72.5 million revolving credit facility with Ares Capital.

-

Cannabis Operator TerrAscend Secures $140 million Loan

August 15, 2024TerrAscend Corp., a Canadian-headquartered cannabis operator with U.S. assets, has closed on a $140 million senior secured term loan from FocusGrowth Asset Management, a leading capital provider to the marijuana sector, and other members of a loan syndicate.

-

BHI Provides $35 Million In Financing to Naftali Group for A 70-Story Mixed Used Development

August 14, 2024BHI, the U.S division of Bank Hapoalim and a full-service commercial bank, today announced that it has provided $35 million to Naftali Group, a leading privately held, global real estate development and investment firm, in predevelopment financing for a 70-story tower located at 1016 NE 2nd Avenue in Miami Florida.

-

Sameer Kapoor Bolsters Parker Hudson’s Bankruptcy, Restructuring & Creditor Rights Practice

August 14, 2024Parker Hudson, a mid-sized law firm with an integrated collection of high value boutique business practices, is pleased to announce that Sameer Kapoor has joined the Firm’s Atlanta office as a partner in the Bankruptcy, Restructuring & Creditor Rights Practice Group.

-

SLR Healthcare ABL Provides $5MM Asset-Based Revolving Credit Facility to Large Regional Home Care Agency

August 14, 2024SLR Healthcare ABL has provided a $5MM asset-based revolving credit facility to a large regional home care agency providing Medicaid personal care services to over 1,200 elderly and disabled adults.

-

Commercial Credit Group Inc. Closes 18th Term ABS for $458,688,000 (CCGR Trust 2024-1)

August 14, 2024Charlotte-based equipment finance company closes its eighteenth asset-backed security transaction, providing funding for ongoing growth.

-

eCapital Provides $15 Million Facility to Support Water Brand’s Growth Through Accounts Receivable and Inventory Financing

August 14, 2024eCapital Corp. (“eCapital”), a leading finance provider across North America and the United Kingdom, today announced the funding of a $15 million confidential factoring plus inventory facility for a U.S.-based sponsor-backed beverage company.

-

Republic Business Credit Funds $4.25 Million Asset-Based Loan for Food and Beverage Manufacturer

August 13, 2024When a renowned beverage manufacturing company found itself with insufficient working capital from its lender, it partnered with Republic Business Credit to expand its access to flexible working capital.

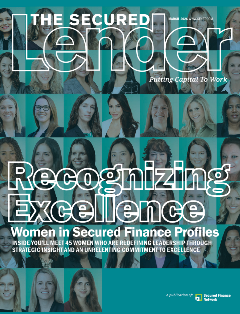

The Secured Lender

SFNet's The Women in Secured Finance Issue

.jpg?sfvrsn=8e30a70c_2)