- Eclipse Business Capital Announces the Promotions of Ralph Shin, Denise Rodriguez and Kenya Hall Across Key Departments

- The New Wave of Leaders: Rewriting the Playbook for ABL and Factoring

- Cesar Silva Joins nFusion Capital as Senior Vice President, Business Development

- Patient Capital in Action: An Interview with Cambridge Savings Bank’s Yvonne Kizner and Cal Navatto

- The Growing Impact of Supply Chain Finance: Insights from SFNet's 2025 Market Sizing Study

When Art Meets Finance

By Eileen Wubbe

Pictured: Joseph Ingrassia (left) and Brad Feinstein

TSL Express’ senior editor sat down with Capstone Business Credit’s managing member, Joseph Ingrassia, and Romulus Entertainment’s founder and CEO, Brad Feinstein, to discuss a unique partnership in film finance.

Joe, can you provide some background on Capstone and on your career?

Ingrassia: Capstone’s been in business now for almost 30 years. We started in 1991 in the area of trade finance. When Y2K came up, we decided to vertically integrate with factoring, because we were using a lot of small factors at the time, and we entered into a refactoring agreement with GE Capital. In 2003, GE Capital was purchased by CIT and we brought in some of their management team that didn’t go with CIT, to run our side of the factoring business. By 2007, the relationship with CIT had matured to the point where we were able to run the credit and our factoring division independently, and we’ve been doing it ever since. I’ve been with Capstone from the beginning so that’s pretty much my entire career.

What interested you in film and entertainment financing?

Ingrassia: Brad and I were introduced to each other by a third party in May 2016. He had just finished a film called The Birth of a Nation.

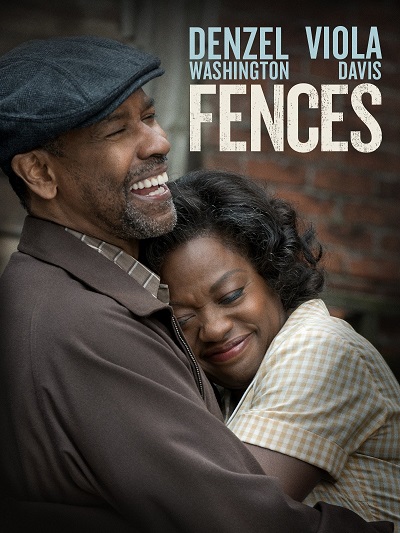

Feinstein: I was working for Bron Studios. It’s a big production finance company based out of Canada. I was running the U.S. business at the time. We had finished a big movie, and we had a large receivable from Fox Searchlight that needed to be financed. Simultaneously, we were shooting another film, Fences, which ultimately won an Academy Award for Viola Davis. We were looking for a finance partner and through that third party I met Joe. Based on the receivable from The Birth of a Nation, Capstone was able to put money up to put into the film Fences, and it worked out pretty well for Capstone and Bron. Capstone then funded another film with me, which is now called All Rise that will be coming out this in the Spring of 2020. At the end of 2016 we talked and he suggested the idea of setting up this new entity together. I left Bron, Joe became my partner and we started Romulus. I was amazed when I met Joe. I had never met anybody who picked up the business so quickly and understood it. Joe was able to compare it to construction finance, the capital structure, the waterfalls (cash flow) and the way things are done are very similar. Joe reads every word of every document, which most people do not. Because he reads, he understood all the details of each aspect of film finance and was able to integrate film finance into Capstone’s current business model.

Ingrassia: One advantage we had is that Capstone had the back office to service the film loans. We were able to use the Capstone account management team and the accounting department to originate, monitor and service the film loans. Our account management team monitors the film budgets weekly spend, and if there’s any problems that come up, they are able to manage the issues together with the production team. It allowed Romulus to be very lean.

When you have an operating back office, it’s efficient to keep adding on additional accounts that you can service and create economies of scale.

For those that might be new to film investing, can you walk me through the process from a script to the final film production?

Ingrassia: Typically, a talent agency sends Brad a complete package, which means there’s a script that’s been vetted, the copyright related to the film, which in a real estate transaction would be the equivalent of a title report, has been checked to some degree that it’s clear of liens and encumbrances, or if it isn’t clear, the title report provides information to determine who may have a lien on the title and what it might take to clear the lien and create a marketable title. With a packaged film there may be a producer, a director and the key talent and a budget all associated with the film. Once that package comes in, the script is reviewed. Brad, I think you do about 300 scripts a year to get four or five films?

Feinstein: Yes, I think 300 or 400 scripts a year.

Ingrassia: There’s a number of reasons why we want agents representing a properly packaged script. There are risks associated with reviewing unsolicited scripts if similar content is produced later. The originator of the unsolicited script could accuse you of stealing their idea. So, Brad is careful, and he typically rejects them out of hand because there is too much liability associated with receiving and reviewing unsolicited scripts.

Assuming a packaged script gets through the review process the next step is to find a bonding company that will issue a completion bond to guarantee Capstone that the film will be completed and delivered Following the vetting and the participation by the bonding company Brad has to get the participation of a foreign and domestic sales agent who can sell the film and predict what the revenue numbers are going to be for the film.. The foreign and domestic sales generate the cash flow that serves to retire the film loan. The underwriting process probably takes somewhere between three or four months and the closing process takes about six weeks.

Feinstein: Hopefully.

Ingrassia: To date, each film that Capstone has financed is completed with principal photography in a range of 20 to 28 days, followed by editing lasting about 120 to 180 days.

Feinstein: Most of our films have six to eight weeks of prep, and probably five to eight weeks of shooting, and then the director’s cut is another 10 weeks. Then probably some additional editorial which gets you to about 22 weeks of editorial on the movie. Then we’ll take them out to market and exhibit them at various film festivals. I think 12,000 films a year get made and about 20 to 30 feature films go to each of the major festivals, not including documentaries and international films.

It’s a competitive space and we’ve been able to have films that have been able to get accepted consistently, which is a testament to the work that we’re doing, the partners we have, and the quality of the films that we’re making.

Ingrassia: Sometimes there are arguments following the completion of the editing process between the directors and the producers. On each film there are multiple producers and, in many cases, everyone has an opinion from the director to the editor. Brad’s goal is getting everyone involved to agree on the final cut of the film and at the same time release a film that the public wants to go see and pay to see it.

Feinstein: There is a very delicate balance in managing the various ideas and personalities. Someone might want to make an auteur film that probably is not very commercial. We always want to make the best possible version of the film because that is the one you can sell. While we want to make great art, the bottom line is that we treat this like a business, and we need to get our capital back out. We did our job of getting the capital in and supporting our partners, and allowing them to make their vision, but the support has to go two ways and we have to have a version of the movie that is commercial and the public will want to see.

Ingrassia: As a non-creative type, the best way for me to describe the final review process is like when you read a book and have your own vision of how the words materialize in your mind. When you read a script, the same thing happens, you see the characters as certain types of people and the interactions between the characters in a certain way. When you have eight or ten people who are involved in the process of making a film, they have eight or ten different perspectives. Brad has to figure out a way to lobby a few of them to get a majority to agree on what looks like the best ending based on the material that has been filmed and is available. The final cut of a film is so far past principal photography, in terms of time, that Brad can’t go back and make a new ending. He has to create the ending out of what he has available from principal photography.

Feinstein: Studios do a lot of reshoots and then they assemble the shoots while there’re editing. There is not just the director’s cut of the movie, there are many additional elements to complete a film like sound, color, music, and all the deliverables to mix in. The process of adding in all the remaining elements following editing take another few months of finishing the film in order to complete it and get it delivered.

How is the loan originated?

Ingrassia: There is a lot of documentation that goes into making the loan and to getting the film distributed. There is a constant paper chase. Aside from the promissory note, security agreement and the copyright mortgage, which most lenders can relate to because they take often IP as collateral in many asset-based loan transactions they originate. There are nuances in film finance that one must be aware of and make sure you are dealing with the right foreign and domestic distributors who can produce the sales numbers they projected for the film. You are relying on them and the budget is agreed to based on their best estimate of the sales the film will produce when delivered.

In this instance, a film loan is more like an asset-based loan structure than a factoring transaction. The initial transactions that we funded were factoring transactions, where we bought the receivable from 21st Century Fox and the proceeds were used for Fences. The film finance transactions that we are funding now, are specifically asset-based lending transactions that more closely resemble a construction loan. Because of our experience factoring construction-related accounts receivable, when the structure of a film loan came, it was very easy for Capstone to understand the risks and the safety mechanisms that were part of a typical film finance structure. We were able to transition into film finance without a big learning curve. The documents are a little different, but essentially you still have a note and security agreement and instead of having an inter-creditor agreement, you have an inter-party agreement. All the money from foreign and domestic sales are captured into an escrow agreement that is run by a third party so it’s the equivalent of a lockbox, but it’s not called that. There’s a lot of similarities between and asset-based loan and a film loan, it’s just a matter of changing a few of the terms and acronyms.

What are some of the challenges merging finance and film?

Ingrassia: It’s difficult to navigate many aspects of what goes on in Hollywood without having someone who has a lot of past experience. The culture is a little different than what we’re used to in the finance world. Brad bridges that gap and has over 25 years of experience. He has literally seen it all over his career and is very capable in dealing with whatever issue may come up.

Feinstein: I always say this business is where art meets finance, and we have to help navigate those waters of being able to connect those two groups of people. Artists respond to things from a different side of the brain than those working in finance. So, my role throughout the course of my career has been kind of the intermediate area to that. I came from the finance world, but I live in the world of art, so I’m able to cross all sides of it. I think for Joe it’s understanding how to navigate the waters of Hollywood and how things get done and the time and effort that has to go into it. There needs to be an understanding that you are making art, but you are making it for a price, and you need to be very specific about what you’re doing and what you are running up against.

Let’s talk about the Tribeca Film Festival. In 2019, Romulus had three films previewing there, Dreamland, Gully and Georgetown.

Feinstein: We had a partner on Georgetown, but Joe fully financed Dreamland and Gully, and we are really fortunate to have Joe as a partner, believing in the creative content that we’re building. The films were really well received.

We’ve also been fortunate to have films at every major festival so far. We’ve had Sundance, Venice Film Festival, which is highly prestigious, and Toronto, but we hadn’t had a film at Tribeca, which is in our backyard, so it was exciting to have not one, but three movies there this year. The opportunity to do it on our home turf and to make a real showing there was great for us to just be home and have these films at Tribeca.

Dreamland stars Margot Robbie who is fantastic in it and also produced the film with me. It’s a great movie, set in the Dust Bowl in the 1920s, and is like a Bonnie and Clyde. Georgetown, which is Christoph Waltz’s directorial debut, is based on a true story about a man who comes to the U.S. from Germany, meets and marries a woman who’s significantly older than him, and he kills her for money. That movie had originally been with HBO, and they decided to put it into turnaround. We got the project and made the film. Gully is the directorial debut of Nabil Elderkin, who is probably one of the top music video directors in the world. The film is a dystopian view of LA in the vein of Clockwork Orange meets Kids, meets Boyz n the Hood. It takes a hard look at the violent effect of video games and disenfranchised youth and all the things that are happening in the community. We shot it in South Central Los Angeles, in the middle of it all. So it was a pretty amazing opportunity to do that.

After films premiere at festivals what is the next step?

Feinstein: The agencies that represent them are now out talking to distributors about buying them and putting them out. So we’re fielding offers to distribute films right now. Georgetown has been bought and we have offers for others. As soon as those deals are ultimately closed, we’ll be able to talk about where they’re going and the release plan for them. And our movie, Driven, the story of automobile designer John DeLorean, came out August 16.

Ingrassia: It took two years to get the films to their release date, but now they’re starting to be delivered to the foreign and domestic distributors and they are being schedule for release.

What kind of films do you look to invest in and why?

Ingrassia: There’s a certain element in the finance world that is drawn to all that glitz and glamour that Hollywood and movie stars seem to offer, if you are drawn to film finance for those reasons, you’ll probably end up losing a lot of money. Basing a funding decision on which movie star you might meet is a recipe for disaster. Film finance decisions have to be made based on the essential aspects of the budget, on the potential performance of the film, and the rate of return the film will produce over its life cycle. We tend to focus on what the foreign and domestic sales are going to be, what the rate of return needs to be, what the term of the loan is going to be, and with all that mixed in together, what’s the safest loan to value for a given film. We have to make sure that after 24 months we collect our loan proceeds. That’s what must go into the underwriting of a film loan-- who is going to be the guarantor, which bonding company will be used, what is their credit profile, all those things are essential components of properly underwriting for a film loan. From our viewpoint, it’s a business. We approach it that way. It’s a loan. There are always risks with loans and we try to mitigate as many of the risk factors as possible.

Many of the storylines are based on true stories, so as a result of that people can relate to the films and their themes because they are usually amazing true stories. When you are dealing with true stories, they have an impact on the audience. You can compete with Marvel movies because adults want to see a drama or an elevated action film every now and then versus a comic strip-themed action movie.

Feinstein: I think that’s a great point. What we do is really counterprogramming to superhero movies and tent pole franchises. If you look at the 52 weeks a year, probably 50-plus of those 52 weeks are led by an animated film, a superhero movie or a tent pole franchise. So to have to work against that, you really want to be counterprogramming to those audiences who don’t look for that type of material, but it still feels big, commercial and theatrical enough that people are going to go to the theater to see it and not wait it out on video.

Ingrassia: Adult dramas and elevated action films are the only two genres that Brad produces because they have worldwide interest, appeal and marketability. The films financed must be sold in every market throughout the world to recover the budget and to make a profit.

Feinstein: We try not to take domestic box office risk. The way these films get made, there’s the domestic sale and international everywhere else. Hopefully the loan is enough that you’re covered by the international and domestic sales, and that by the time the film gets to the box office we’re at least out of our investment.

Ingrassia: We fund those films because they have worldwide appeal. A horror film or a comedy is limited to the culture you’re filming it in, and so it doesn’t have worldwide appeal. Although some of the comedies get sold everywhere, a lot of the foreign audiences can’t relate to the jokes.

What was shocking to me is that on a set it takes approximately 300 people to make a film. That’s a very intense period of 28 days of living together, displaced from their families and homes making a movie. One of the things Brad’s been able to do is keep a core group of that support team together so that when he selects Georgia or Massachusetts, or wherever there’s a tax credit, his team is assembled and ready to work together. He doesn’t have to spend two weeks getting the production staff trying to get to know each other, whereas in a few hours they’re working together, and he has a cohesive team.

What are some of the risks within film finance and how are those mitigated?

Ingrassia: One of the ways we mitigate risk is having Brad physically present as a producer onset. It’s not like we’re just financing one-off films, hoping for the best outcome. Brad has a very specific plan going into the film, during the filming. At the same time, the Capstone account management team is monitoring the budget and the amount spent. He’s there making sure that if they’re supposed to do 20 scenes in a day that 20 get done so there’s no overtime and handling whatever issues come up during the production period. He is also dealing with unions that represent the crew and the unions and management teams that represent the actors, writers and producers.

Feinstein: When we step into a film, I make sure that we have final decision making on all creative and financial issues, the final cut of the movie, everything. We must sign off on every budget and script change, so you are never going to end up with a movie that is not what you signed up for. I am responsible for making sure that the movie comes in on time, it’s on budget and there are no overages or surprises. I physically produce everything we make because I really feel like that’s the best way to manage the quality control and quality is the best way to get out. If you have a movie that is broken that you can’t sell, it makes it a lot harder to get your capital back.

What are your goals and future plans for Romulus?

Feinstein: Romulus is going on our 13th movie now, so we’ve gotten a lot done over 30 months. We recently had a very large sale of a movie we just did to Apple. It’s going to be the first Apple original and the first movie on the streaming service. They’re going to do a theatrical release, plus an awards campaign for the film, so it’s really going to help change the future of Romulus and get us into the next level of conversation. I don’t really think there is anyone in New York making more movies than we are at this point. I think we’re pretty much one of the largest independent studios out there now. And now having sold a film to Apple and the possibility of Samuel L. Jackson being nominated for an Academy Award for his acting in the film it is another calling card after all of the hard work of making a very special movie that is really going to be an important film. Things are moving forward at a very nice pace here.

.jpg?sfvrsn=f1093d2a_0)