- The Growing Impact of Supply Chain Finance: Insights from SFNet's 2025 Market Sizing Study

- Secured Finance at Scale: Why the SFNet 2025 Market Sizing Study Matters More Than Ever

- Tiger Group Launches Investment Banking Division Led by Special Situations Veteran Jamie Lisac

- 2025 Ends on a High Note for Syndicated ABL: Strong Finish Despite Uneven Trends

- Loeb Promotes Eric Schwartz to President

Six Actions Your Retail Clients Can Take Now to Counter Economic Volatility

May 18, 2022

By Bill Kearney

After historic GDP growth and retail sales in 2021, are the days of unprecedented growth over for your retail clients? The short answer: It’s complicated.

If the last two years have shown us anything, it is that uncertainty is the new normal. When COVID shut down the economy in March 2020, the impact on the retail sector was profound. In some parts of the country, brick and mortar stores were closed for up to 90 days and in-person sales ground to a halt for all but the most essential items.

By year’s end, stores had re-opened, people were back at work, and trillions of dollars in government stimulus funds had been pumped into the economy. As a result, shoppers flung open their wallets and holiday sales went through the roof. For the next year, the spending frenzy not only continued, but accelerated.

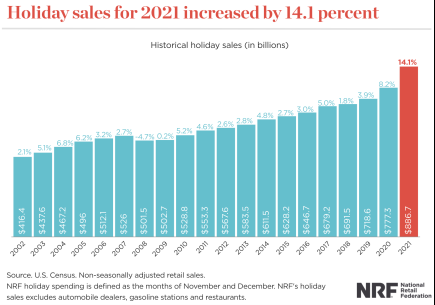

Typically, holiday retail sales grow at an average rate of 3.5% from year to year. According to the National Retail Federation, in 2020 that figure jumped to 8.3%. In 2021, it skyrocketed to an unprecedented 14.1%. Retailers went from mandated store closures to windfall profits, with two back-to-back record-setting years. However, the writing was on the wall that these glory days were numbered.

The stark economic realities of 2022 are now upon us. Stimulus spending has ended. The Fed is curtailing quantitative easing and interest rates are on the rise for the first time in three years. U.S. inflation is worse than it has been in four decades, which accelerated to 8.5% in March as reported by Bloomberg. Supply chain disruptions continue to strain the timely delivery of goods. Additionally, there is the war in Ukraine fueling even more uncertainty on the world stage. It’s a more complex economic puzzle than ever.

CFOs and other financial professionals in the retail sector are feeling the strain, as they try to set budgets for the next fiscal year in an environment where their typical forecasting methods have gone out the window. Clearly, expectations for 2022 will be lower, but by how much? In May 2022, retail giants Wal-Mart and Target both announced very disappointing first quarter earnings results tied to increased costs and continued supply chain issues. If these companies are struggling, it is likely middle market retailers results could be similar.

As economic data comes in, we are beginning to see a softening of retail sales in some categories, as gasoline prices surge and other inflationary pressures on goods and services cut into consumers’ purchasing power. We anticipate this will worsen in the coming months as inflation and market uncertainty make people more cautious about their spending.

For the last year or so, retailers have for the most part been able to raise the prices on goods with little pushback from consumers. But that is starting to change, at least in certain product categories, as consumers tighten their belts. While higher-end shoppers are more willing to absorb the price hikes, there is increasing price resistance for lower-cost items and basic goods.

For example, The Wall Street Journal recently reported that “Macy’s tried to raise the price on an entry-level sofa by $100, from $499 to $599, and customers pushed back on that. But Macy’s was able to raise the price of its more expensive sofa from $2,000 to $2,200. So, the higher-end shopper is still willing to pay up, but you’re starting to see at the lower end some price resistance from shoppers.”

Clearly, navigating the retail landscape in the year ahead will be tricky, but there are a number of financial strategies that your retail clients can employ to help weather the storm:

- Communicate expectations. Retailers need to be proactive in communicating with their lenders, investors and owners so they clearly understand how the budget plans align with new market realities and sales expectations moving forward.

- Prepare for continued supply chain volatility. These issues are not going away any time soon, so retailers need a plan for dealing with delayed orders, unsold seasonal inventory and other worst-case scenarios.

- Build higher freight costs into budgets. While shipping container pricing may be down from last year’s peak, companies should assume these costs will remain high in the year ahead – perhaps double (or more) their 2019 levels.

- Prepare to carry more inventory. Retailers hate to hear this, but the reality is that inventory can now be held up on the water for 60, 90 or even 120 days. Previously effective just-in-time inventory management practices may no longer be effective. Many companies learned this the hard way when they lost out on critical Christmas sales in 2020 and 2021.

- Plan for up-front or in-transit payment requirements. As shipments take significantly longer to get from overseas suppliers to U.S. store shelves, retailers are increasingly being asked to pay for product that is still in transit. This can cause big problems in cash-flow. There are now flexible in-transit inventory financing options available that can provide a lifeline to retailers during these periods.

- Get financing in place now to stay liquid. In retail, cash is king, and liquidity is more important than ever in a volatile market. Advise your clients to work with you in advance to ensure they have an adequate financial cushion to withstand any surprises.

The biggest challenge for retailers right now is that there are five or six major economic factors working against them and there is no one-size-fits-all solution. The threats facing off-price department stores are quite different than those for high-end apparel companies. The same is true for companies in the jewelry, tools, grocery, furniture and other retail categories. As the Perfect Storm approaches, each company will need to evaluate their own risk exposure and plan accordingly in collaboration with their trusted lending partners.

.jpg?sfvrsn=f1093d2a_0)