- Patient Capital in Action: An Interview with Cambridge Savings Bank’s Yvonne Kizner and Cal Navatto

- The Growing Impact of Supply Chain Finance: Insights from SFNet's 2025 Market Sizing Study

- Secured Finance at Scale: Why the SFNet 2025 Market Sizing Study Matters More Than Ever

- Tiger Group Launches Investment Banking Division Led by Special Situations Veteran Jamie Lisac

- 2025 Ends on a High Note for Syndicated ABL: Strong Finish Despite Uneven Trends

US Bank Balance Sheets Swell With Commercial Loans and Fed Liquidity

By S&P Global Market Intelligence

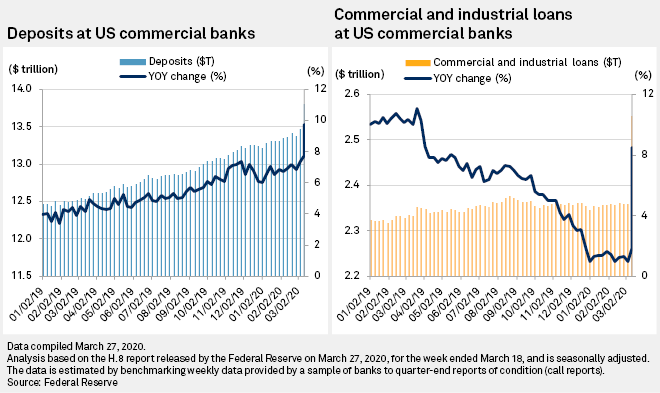

A corporate scramble for cash and massive injections of liquidity by the Federal Reserve are reverberating across the balance sheets of U.S. commercial banks, with commercial and industrial loans registering the biggest week-over-week increase in more than 45 years.

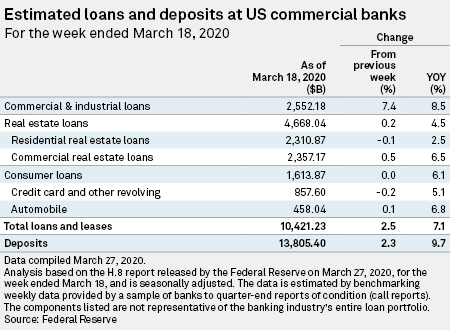

C&I loans jumped 7.4%, or $176.17 billion, during the week ended March 18, according to seasonally adjusted data in the Fed's latest H.8 report on bank assets and liabilities. The data covers a week during which the crisis caused by the new coronavirus pandemic escalated rapidly. The Trump administration declared a national emergency March 13, and states placed increasing restrictions on public gatherings and business activity aimed at slowing the spread of the virus.

Corporations have drawn down more than $150 billion across more than 200 credit facilities since March 5 to stockpile cash and brace for disruptions in revenues, according to data from LCD News. That compares with the more than $2 trillion in unused C&I credit commitments banks had outstanding at the end of 2019, according to data from S&P Global Market Intelligence.

Banks also had about $400 billion in unused commercial real estate lines at the end of 2019. CRE loans were up 0.5%, or $11.11 billion, during the week ended March 18, according to the Fed data.

Heavy use of credit lines has raised concerns that bank capital cushions will become strained as balance sheets grow and borrowers hit by the pandemic expose lenders to credit risk. Banks do have the ability to cancel some commitments and invoke contractual protections against lending to distressed borrowers, however.

Increased line utilization and borrowing also generates revenue, and much of the defensive cash corporations are accumulating is being "recycled" into bank deposits, according to Fitch Ratings.

Large banks entered the crisis with strong liquidity and capital positions, and banks like Bank of America Corp., JPMorgan Chase & Co. and Wells Fargo & Co. stand "to be the benefactors of this deposit growth as they are more likely to hold the operating accounts of the large corporates," Fitch said in a March 25 report.

Massive bond purchases and aggressive emergency lending that have lifted the Fed's balance sheet to a record size have also driven deposits higher. Overall, deposits at commercial banks in the U.S. increased 2.3% from the previous week and 9.7% from the year prior to $13.805 trillion at March 18, according to the Fed data. The weekly increase was the largest since September 2008, during the last financial crisis.

Deposits at the 25 banks with the most assets increased 3.7% from the week prior, compared with an increase of 1.1% at smaller banks.

Some of the pressure on corporations to tap bank lines has eased as Fed interventions have helped to thaw the markets for investment grade and even high-yield debt. Investment grade issuers account for about half the revolving credit line borrowing LCD News has tallied since March 5. A majority of the borrowing has been by firms in "consumer discretionary" businesses including retail, restaurants and automobile manufacturers.

Analysts at BofA Global Research estimated that the corporate drawdowns have brought investment grade line utilization to a range of 17% to 20% of the amount available, up from an estimate of 12% in the fourth quarter of 2019, but still short of utilization rates of about 30% during the previous financial crisis. The Fed's programs "effectively provide very large backstop credit lines to U.S. corporates," the analysts wrote in a March 24 note.

The increase in C&I loans accounted for most of the $252.46 billion, or 2.5%, increase in total loans and leases at commercial banks in the U.S. during the week ended March 18. On a percentage basis, that was also the largest weekly increase since the last financial crisis, excluding the end of the first quarter of 2010, when securitized loans were consolidated onto balance sheet because of a change in accounting rules.

Consumer credit card loans slipped about 0.2%, or $1.49 billion, during the week ended March 18.

.jpg?sfvrsn=f1093d2a_0)