- Cesar Silva Joins nFusion Capital as Senior Vice President, Business Development

- Patient Capital in Action: An Interview with Cambridge Savings Bank’s Yvonne Kizner and Cal Navatto

- The Growing Impact of Supply Chain Finance: Insights from SFNet's 2025 Market Sizing Study

- Secured Finance at Scale: Why the SFNet 2025 Market Sizing Study Matters More Than Ever

- Tiger Group Launches Investment Banking Division Led by Special Situations Veteran Jamie Lisac

The Digital Transformation is Severely Disrupting Retail: The Time for Action is Now

By Antony Karabus

The transformation of retail is creating new and significant challenges for traditional retailers. Antony Karabus, CEO of HRC Advisory, explores those obstacles and offers solutions to help retailers survive – and even thrive — during these tumultuous times.

The traditional retailer economic model has been severely disrupted and will not return to the historic model.

With digital growing so rapidly these days, retailers are not just competing with other brick-and- mortar stores; they are competing against the growing dynamic of the merchandise rental and resale market as well as Amazon, Wayfair and the universe of digital channels, including their own. As a result, some retailers face a real risk to their survival, while many others are experiencing significant declines in their operating earnings and working capital. And the digital phenomenon is not about to slow down anytime soon.

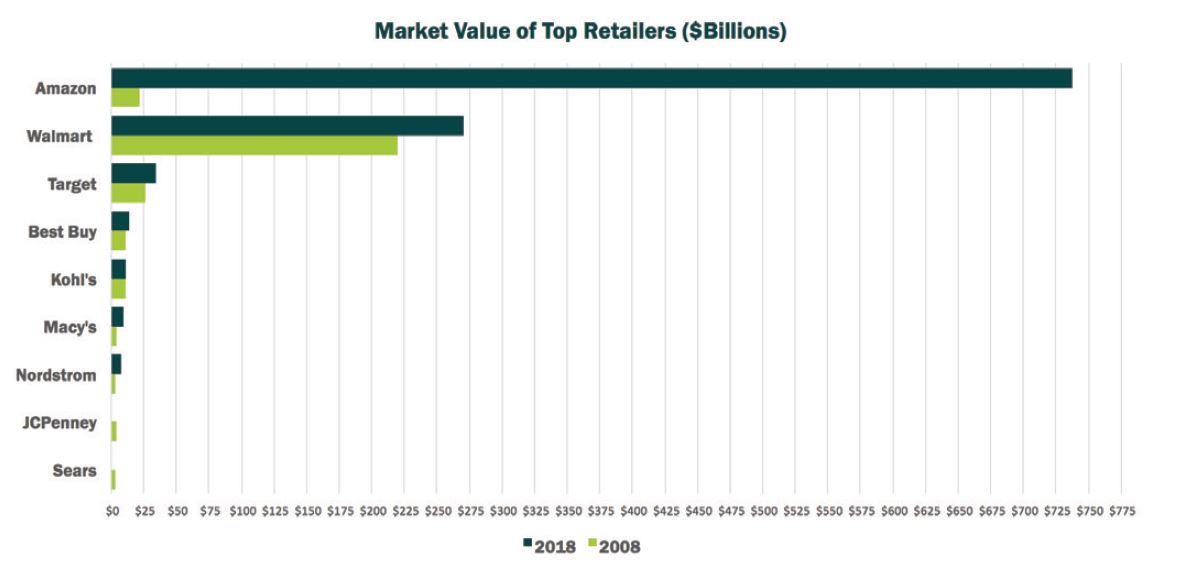

Consider this: While Amazon grows by more than 20 percent annually, most traditional retailers celebrate flat-to-slightly positive comparable sales (with many others experiencing significant negative comparable sales and profitability trends). The digital behemoth is adding incremental $20 billion in sales each year – on top of the $20 billion each previous year. That cumulative impact is substantial. And it is coming straight out of retail market share, leaving little growth for the remaining traditional retailers in their crosshairs.

Amazon is also continuously innovating and raising the bar. Determined to protect existing sales, traditional retailers are pressured to follow suit. But often they’re simply increasing their costs and complexity without bringing additional topline sales. When Amazon introduced Prime membership, for example, and its two-day free shipping guarantee (recently evolved to one-day), traditional retailers felt compelled to match that offering.

Though profitability is compromised by shipping costs, Amazon can make it work thanks to their 100-million-plus Prime membership base generating more than $10 billion in fees annually and the rapidly growing profit generated by Amazon Web Services (“AWS”). Traditional retailers don’t have the benefit of those membership fees and AWS profits to offset costs and fund the investments needed to make e commerce profitable.

So, while Amazon continues to expand its market share (representing almost 42% of total retail industry online revenue this year and anticipated to be increasing to 50% over the next few years due to its far faster growth rate), numerous traditional retailers struggle to maintain relevance and profitability on a less-than-equal playing field.

E-Commerce is Cannibalizing Store Sales

To remain competitive and play to their strengths of offering a physical experience that allows customers to “touch and feel” the merchandise, many brick-and-mortar retailers have adopted omni-channel offerings. The approach helps bridge the gap between their offline and online channels and provides both an offensive and defensive weapon against Amazon and other e-commerce-only retailers. But our survey of senior executives at more than 30 North American retail chains found

that, while omni-channel is vital, if not implemented properly, the move can lead to financial and customer-service related problems, thus undermining its benefits.

Additionally, for the majority of retailers, e-commerce represents a cannibalization of sales that were made previously through physical stores. The cannibalization means retailers have to add significant capital and operating expenses to achieve the same total sales level — or in many instances lower sales and profitability levels.

High Costs and Accompanying High Merchandise Returns from Digital Sales

Retailers may claim they do not care whether a customer shops online or in store – so long as they shop with them — but the reality is not so simple and the impact on profitability doesn’t support that claim. Revenue from multiple channels may equal prior total store sales, but this is only made possible by the addition of massive capital and operating costs, with no overall incremental sales bump.

The retail landscape has been transformed from a largely fixed-cost environment to an increasingly variable-cost one to serve digital and omni-channel sales. Our primary research with dozens of large retail chains found that digital sales now accounts for up to 15% — and as much as 40% or more for those with a digitally connected customer demographic — of total sales. And, for most retailers, up to 95% of those digital sales represent a channel shift from their brick-and-mortar stores, rather than incremental sales.

Inventory Investment Issues and Serial Returners Contribute to Complexities

As omni-channel-focused retailers try to determine the right inventory investment while ensuring ROI on the significant accompanying expense, unproductive inventory often gets “trapped” in the wrong store or distribution center. They are then faced with the high costs of addressing that issue — whether through transfers, deep markdowns, liquidation or write-offs.

Add to those challenges the additional costs of free shopping and excessive returns. In fact, studies conducted by our firm found that e-commerce returns is a serious issue for retailers and is severely undermining their profitability. Serial returns can be offset by firmer corporate policies. But most traditional retailers are resistant to firmly addressing the problem.

A Tailored Approach is Key

When seeking out advice from a consulting firm, lenders should make sure the firm understands the challenges facing retailers in the increasingly complex and competitive digital retail environment. Many firms offer cookie-cutter solutions to help retailers overcome those difficulties, whether imposing heavy store labor or marketing and headquarters cost reductions so they can announce big cuts.

Without completely discounting the value of that approach, the reality is that quick-cost reduction wins almost always cause greater problems, reversing many of those savings in the long run. Each retailer’s situation is unique, requiring a tailored approach to its turnaround and performance improvement efforts.

A bespoke solution is key, starting with diagnosing the underlying performance inhibitors and obstacles to the turnaround. Consultants should develop and partner with the retailer to implement a plan that not only drives improvements, but better positions the retailer for long-term sustainability – and even to thrive. It’s an approach that could prove especially important with the anticipated consumer slowdown, as the margin of error for retailers will then tighten due to a combination of fixed cost inflation and declining sales.

Solutions to Help Brick and Mortar Retailers Survive

In these circumstances, a retailer would be advised to raise the bar. By creating a compelling customer service experience and a seamless omni-channel offering,they can mitigate the loss of customers to Amazon or other competitors. Omni-channel is one of the strongest weapons retailers have in their arsenal, as it allows them to create new opportunities for customers to engage with their brand and increase sales.

When successful, omni-channel increases traffic and customer loyalty. But it’s not easy to get it right. Retailers must also make sure that their inventory is accurate and that it’s integrated across channels. And considering the complexity of omni-channel and the need to maintain profitability, retailers should define success before implementing or expanding their omni-channel.

Improving the Profitable Precision of Execution

Retailers must optimize margins and inventory management practices over the entire product lifecycle, from concept to exit. In this way, they can ensure that product is available where and when it’s needed to meet customer demand locally, while minimizing markdown and inventory liability. Finally, it’s vital that brick-and-mortar retailers put in place the right tools, processes, infrastructure and organization to best and most profitably enable their success in this new digital environment.

Retailers Need to Play to their Own Strengths

The financial performance of numerous traditional retailers in this evolving environment is taking a serious hit. They’re incurring high costs trying to meet and exceed customers’ needs across all channels, while meeting e-commerce demands and the invasion of Amazon. A bespoke approach with solutions tailored to each retailer can help them rise above and survive these difficult circumstances. For brick-and-mortar retail chains it’s no longer a question of whether to implement the solutions, but how soon they can get started and how they can best differentiate in this crucial journey.

Top Five Questions for Retail Lenders and Investors to Consider

- How differentiated is the retailer’s value proposition?

- How impacted is their business by Amazon or Wayfair?

- How sharp is their execution precision?

- How does their P&L benchmark to their peers?

- How strong are their end-to-end merchandising and inventory management processes and tools?

.jpg?sfvrsn=f1093d2a_0)