- Wintrust’s Jason LeuVoy Taking on Expanded Role Following Retirement of John Marrinson

- SFNet Committee Spotlight: Emerging Leaders Committee

- Fraud Prevention and Resilience in Secured Finance: Highlights of SFNet’s Fraud Task Force White Paper

- SixCap Healthcare Finance Launches Integrated Healthcare Capital Platform Combining Asset-Based Lending and Real Estate

- The Power of Mentorship: A Conversation with Frank Grimaldi

Secured Finance Executives Predicting Modest Growth in 2024

January 22, 2024

By Myra Thomas

2023 wrapped up to be a year plagued by inflation, interest rate hikes, and high borrowing costs. The historically tight labor market also left many businesses struggling for workers and watching labor costs rise. Political uncertainty and war added to the tumult. The conflict between Israel and Hamas, as well as the Ukraine and Russia, continued to shape the global economic picture, particularly for the Eurozone. Given the macroeconomic factors, an increasing number of companies turned to secured lenders to boost liquidity when traditional loans were simply out of reach. Asset-based loans and factoring arrangements remain an option for borrowers, particularly during times of economic turbulence. With signs pointing to a slow recovery, secured lenders are expecting that the New Year will bring modest growth for the industry.

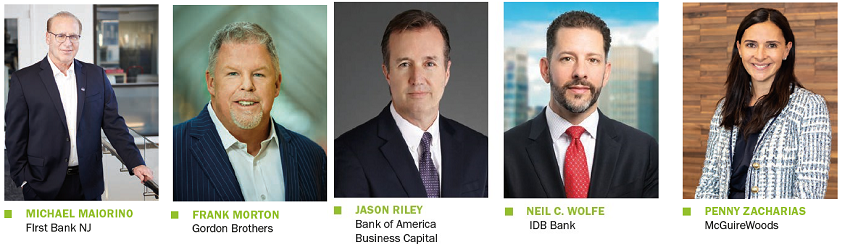

According to Jason Riley, Central and West Region portfolio and underwriting manager at Bank of America Business Capital, most of the bank’s clients have adapted to the new normal. “They’ve made adjustments to react to what’s happening in the external environment,” he says. Secured lenders are responding to the economic upheaval by making sure to properly structure and monitor loans. Fortunately, businesses are benefitting from the expertise that secured lenders provide. “We stay in close contact with our clients to help them navigate through tough situations,” notes Riley. “The way we structure our deals and monitor our credits, we’re able to offer our clients a lot of flexibility to manage through difficult conditions.” No matter the client, there can always be company-specific or industry-specific challenges, and secured lenders are there to provide assistance with those challenges.

A Mixed Bag for Secured Finance

Companies are particularly attracted to the covenant-light structures that asset-based loans can provide, especially with traditional lenders tightening up lending standards. “I think we will continue to see that in 2024, especially with continued industry volatility and economic headwinds,” Riley notes. While it’s difficult to predict how the economy will shake out in 2024, secured lending remains relatively infl ation-proof. Riley notes that secured lenders are remaining supportive of their borrowers, maintaining strong underwriting standards while doing so.

Please click here to read the full article.

About the Author

© 2026 Secured Finance Network