- Wintrust’s Jason LeuVoy Taking on Expanded Role Following Retirement of John Marrinson

- SFNet Committee Spotlight: Emerging Leaders Committee

- Fraud Prevention and Resilience in Secured Finance: Highlights of SFNet’s Fraud Task Force White Paper

- SixCap Healthcare Finance Launches Integrated Healthcare Capital Platform Combining Asset-Based Lending and Real Estate

- The Power of Mentorship: A Conversation with Frank Grimaldi

Secured Finance at Scale: Why the SFNet 2025 Market Sizing Study Matters More Than Ever

February 9, 2026

By SFNet Data Committee

The Secured Finance Foundation, with oversight from the Study’s Steering Committee, has updated the 2023 Secured Finance Industry Market Sizing Study for the purpose of benchmarking, strategic planning, attracting capital and assisting in advocacy efforts on behalf of the industry. Click here for the 2025 SFNet Secured Finance Market Sizing Study.

Over the past decade, secured finance has quietly become one of the most important engines of capital formation in the U.S. economy. While public attention often focuses on traditional bank lending, capital markets, or private equity, the reality is that secured finance—spanning asset-based lending, factoring, equipment finance, supply chain finance, leveraged lending, private credit, and asset-backed securitization—supports trillions of dollars in business activity each year.

The 2025 Secured Finance Market Sizing Study, released by the Secured Finance Network (SFNet), provides the most comprehensive snapshot to date of this vast and interconnected ecosystem. Building on prior market sizing studies conducted in 2019 and 2023, the latest update confirms not only the scale of secured finance, but also its resilience, adaptability, and growing relevance amid economic uncertainty.

At a time when policymakers, regulators, and market participants are re-examining how capital flows through the economy, the findings offer a critical reminder: secured finance is not a niche corner of the financial system. It is a foundational pillar.

A $12-Trillion-Dollar Reality: Understanding the Full Scale of Secured Finance

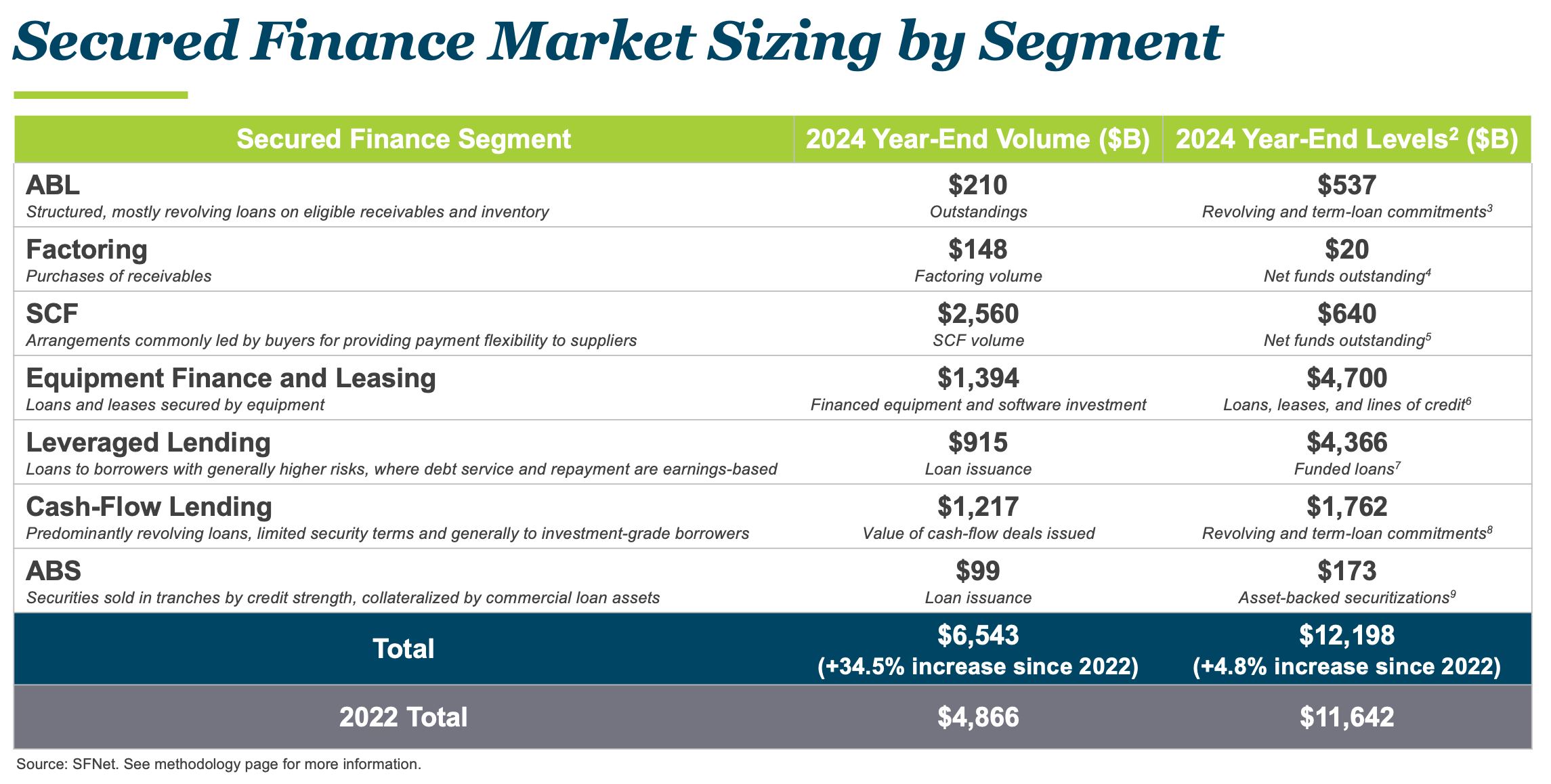

According to SFNet’s latest estimates, secured finance year-end levels totaled approximately $12.1 trillion as of Q4 2024 and year-end volume of $6.5 trillion, up 4.8% and 34.5% respectively since 2022. These figures encompass loans, leases, credit facilities, and securitized products supported by collateral across a wide range of asset classes. The scope of this market, which comprises seven major financing categories, underpins, either directly or indirectly, over one-fifth of the transaction volumes that made up the $29 trillion in 2024 U.S. Gross Domestic Product (GDP).

What makes this estimate particularly significant is its scope. Traditional financial statistics often capture only outstanding loans held by regulated financial institutions. SFNet’s approach, by contrast, reflects how secured finance actually operates in today’s market—integrating:

- Bank and non-bank lenders

- Private credit and direct lending platforms

- Undrawn commitments

- Capital-markets structures tied to secured assets

This broader lens reveals a secured finance ecosystem that rivals, and in some cases exceeds, more widely discussed segments of the financial system.

From 2019 to 2025: Evolution Through Volatility

SFNet’s first market sizing study in 2019 established a baseline for understanding secured finance before the global disruptions that followed. The second study, released in 2023, captured how the industry responded to the pandemic, supply-chain breakdowns, and a rapid shift in monetary policy.

The 2025 update reflects a more mature and diversified industry, one that has not only weathered volatility, but adjusted structurally. Secured finance providers increasingly operate alongside traditional banks, complementing regulated balance sheets with private credit, club deals, and capital-markets execution.

This evolution has allowed secured finance to expand even as other credit channels tightened.

Asset-based lending (ABL) remains a central pillar of the secured finance ecosystem. The Study approximates that ABL commitments reached $537 billion at year-end 2024, marking another year of steady growth.

Notably, ABL commitments have grown every year since 2018 and have consistently outpaced growth in traditional bank commercial and industrial (C&I) loans. This trend underscores ABL’s unique value proposition: collateral-driven underwriting, frequent monitoring, and flexibility across business cycles.

ABL continues to play a critical role in:

- Supporting mergers and acquisitions

- Financing restructurings and turnarounds

- Providing liquidity to businesses facing cyclical or transitional challenges

As interest rates moderated in late 2024 and into 2025, ABL lenders reported cautious optimism, supported by renewed transaction activity and disciplined portfolio management.

Factoring: Liquidity Where Timing Matters Most

Factoring remains an essential working-capital solution, particularly for small and mid-sized businesses operating in trade-exposed or cyclical industries. SFNet estimates that U.S. factoring volume totaled approximately $148 billion in 2024.

Because factoring transactions typically turn quickly, the Study estimates that net funds outstanding average roughly $20 billion at any given time, reflecting the high-velocity nature of receivables finance.

In an environment marked by payment delays, customer concentration risk, and supply-chain uncertainty, factoring provides immediate liquidity without adding long-term leverage, an increasingly valuable feature for borrowers navigating volatile markets.

Supply Chain Finance: Stabilizing Trade in an Uncertain World

Few segments illustrate the adaptability of secured finance as clearly as supply chain finance (SCF). The Study shows that SCF volumes have surged to $2.5 trillion in volume in 2024, up 161% from 2022, and expected to continue to accelerate as companies respond to:

- Geopolitical conflict

- Tariff uncertainty

- Reshoring and near-shoring initiatives

- “Just-in-case” inventory strategies

By financing trade receivables and payables, SCF helps suppliers get paid faster while allowing buyers to preserve liquidity—reducing friction across global and domestic supply chains.

As policymakers place increasing emphasis on supply-chain resilience, SCF has emerged as a practical, market-driven solution that aligns closely with public policy goals.

Equipment Finance and Leasing: Fueling Investment and Innovation

Equipment finance and leasing continue to benefit from long-term investment trends, including infrastructure spending, energy transition initiatives, and accelerating AI-related capital expenditures. According to industry forecasts cited in the Study, equipment and software investment is expected to grow at a healthy pace through 2026.

For secured finance providers, this segment represents both opportunity and responsibility: underwriting increasingly complex assets while supporting innovation across critical sectors of the economy.

Leveraged Lending and Private Credit: Expanding the Capital Stack

The Study also highlights the expanding role of leveraged lending and private credit within the secured finance ecosystem. Broadly syndicated loan issuance rebounded strongly in 2024 as borrowers refinanced debt and pursued new transactions in anticipation of lower rates.

Meanwhile, private debt assets under management have more than doubled over the past decade, reflecting sustained investor demand for yield and diversification. Together, these markets provide flexible, collateral-supported capital that complements both bank lending and public debt markets.

An “All-Weather” Industry in a Fragile Macro Environment

One of the Study’s most important conclusions is that secured finance has demonstrated remarkable resilience across economic cycles. Despite slowing job growth, affordability pressures, and ongoing policy uncertainty, SFNet’s confidence indices, which focus on ABL and factoring, show that most lenders expected conditions to either improve or remain stable heading into late 2025.

This resilience is not accidental. Secured finance relies on:

- Real, verifiable collateral

- Conservative advance rates

- Frequent monitoring and covenant discipline

These features help limit loss severity and systemic risk—qualities that are particularly valuable during periods of stress.

Policy Implications: Why Secured Finance Deserves Attention

For policymakers and regulators, the Study offers a clear message: secured finance is a stabilizing force, not a marginal activity. Regulatory clarity around secured lending, receivables finance, and collateral enforcement directly affects capital availability, especially for small and mid-sized businesses.

As debates continue around trade policy, tariffs, and financial regulation, understanding the role of secured finance is essential to avoiding unintended consequences that could restrict credit when it is needed most.

A System Worth Understanding and Protecting

The secured finance industry has grown larger, more interconnected, and more resilient over the past six years. The 2025 Secured Finance Market Sizing Study confirms what many practitioners already know: secured finance is a cornerstone of modern capital formation.

As economic uncertainty persists and policy debates intensify, the ability to clearly articulate the size, structure, and value of secured finance has never been more important. This Study provides that foundation, both for the industry itself and for the stakeholders who shape its future.

The Secured Finance Network will also be producing an SFNet Secured Finance Economic Impact Study later this year, which will enhance our understanding of how secured finance influences the broader US economy.