- Wintrust’s Jason LeuVoy Taking on Expanded Role Following Retirement of John Marrinson

- SFNet Committee Spotlight: Emerging Leaders Committee

- Fraud Prevention and Resilience in Secured Finance: Highlights of SFNet’s Fraud Task Force White Paper

- SixCap Healthcare Finance Launches Integrated Healthcare Capital Platform Combining Asset-Based Lending and Real Estate

- The Power of Mentorship: A Conversation with Frank Grimaldi

Middle-Market Lending in Q3 2025: A Tale of Repricing Waves, Fundraising Strength, and a Shifting Yield Landscape

September 23, 2025

By The Secured Lender Editorial Team

In a quarter defined by opportunistic repricings, record private debt fundraising, and continued strength in middle-market CLO issuance, Q3 2025 is shaping up as a pivotal moment for U.S. middle-market lending. According to LSEG LPC’s latest Mid-Quarter Trends report, investors and issuers alike are recalibrating in response to macro stability, declining spread volatility, and persistent appetite for yield—even as new money activity retreats and secondary pricing shows signs of softening.

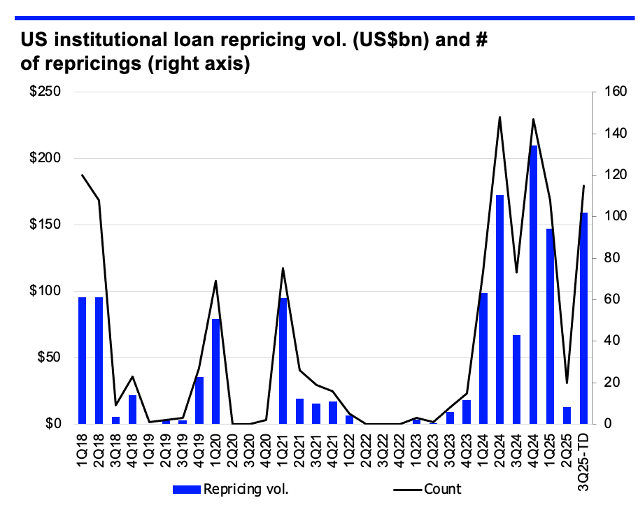

A Repricing Tsunami Reshapes Institutional Loan Markets

The most striking development in Q3 has been the resurgence in repricing activity across the institutional market. Repricing volume has soared to nearly $160 billion, up dramatically from just $13 billion in Q2. Repricing now accounts for two-thirds of total refinancing loan volume, compared to only 22% the prior quarter.

The average spread cut from these repricings came in at 43.5 basis points, a slight moderation from Q1’s 58.6 bps but still indicative of a borrower-friendly environment. This aggressive refinancing reflects both tighter primary market spreads and a desire among issuers to lock in lower costs ahead of potential economic uncertainty in 2026.

While overall leveraged loan refinancing volume totaled $309 billion quarter-to-date, new money share fell to just 24%, down sharply from 45% in Q2—a telling sign that most market activity is currently driven by opportunistic repricing rather than growth financing or acquisition-led borrowing.

Middle-Market CLOs Stay Hot as Fundraising Surges

Middle-market CLO activity continues to flourish. As of early September, MM CLO volume has reached $9 billion in Q3, contributing to a robust $138.8 billion year-to-date across 287 CLOs. Notably, average middle-market CLO issue sizes have increased to $537 million, up from $487 million in 2024, signaling growing manager confidence and larger deal appetite

Tightening spreads are another bright spot. AAA spreads on MM CLOs narrowed by 8 basis points to 155 bps, mirroring broader compression in the BSL CLO space (down 6 bps to 131 bps). While investors still demand a premium for middle-market risk, the gap is narrowing, reinforcing the sector’s resilience.

Tightening spreads are another bright spot. AAA spreads on MM CLOs narrowed by 8 basis points to 155 bps, mirroring broader compression in the BSL CLO space (down 6 bps to 131 bps). While investors still demand a premium for middle-market risk, the gap is narrowing, reinforcing the sector’s resilience.

Meanwhile, middle-market direct lending fundraising hit $40 billion so far this quarter. Of that, private debt funds accounted for $31 billion and MM CLOs added $9 billion. These figures underscore a robust investor appetite for private credit platforms—driven by relatively stable returns, defensive structures, and low default rates.

Secondary Pricing Divergence Raises Caution Flags

Despite strength in primary markets, the secondary market for institutional middle-market loans has softened. The average bid fell 265 bps since June, reaching 92.16 at the end of August. Nearly half of MM institutional loans are now bid below 90, a reversal from earlier in the year when pricing was firmer. Only 22% of loans are bid at 99 or higher, reflecting a sharp decline from prior quarters

This divergence between primary and secondary markets may indicate a bifurcation in investor sentiment: strong appetite for new issues (particularly repricings and first-lien deals), but increasing selectivity—and possible fatigue—on the back end of the curve.

Yields and OIDs Reflect a Competitive Issuance Landscape

In the institutional middle market, yields have continued to tighten. First-lien institutional yields dropped to 8.59% year-to-date, down 156 bps from 2024, narrowing the yield premium over large-cap issuers by 55 bps. Among ratings tiers, single-B issuers priced at 7.7%, while double-B names priced at 6.7%, widening the average yield gap to 100 bps—up from 87 bps in Q2.

The average original issue discount (OID) also moved tighter, hitting 99.67 in Q3, a 45 bps improvement over last quarter. Together, these pricing trends suggest a borrower-favorable market where demand is allowing tighter execution and reduced discounts.

Supporting this trend, there have been 51 downward price flexes and only 5 upward flexes in the U.S. syndicated loan market so far in Q3, according to LSEG LPC. That ratio speaks volumes about the leverage borrowers currently hold during syndication.

Syndicated Middle-Market Volume Mix: Non-Sponsored Still Leads

Syndicated middle-market loan volume totaled $23.3 billion so far in Q3. Of this, $9.2 billion (39%) was new money, while the rest was refinancing. Non-sponsored syndicated issuance continues to dominate, contributing $16.2 billion, with M&A activity accounting for only $971 million—just 6% of the non-sponsored total.

On the sponsored side, syndicated MM volume reached $7.1 billion, with $1.26 billion earmarked for M&A and new money representing 43% of the total. Though lower than historic highs, this indicates modest improvement in private equity deal flow compared to earlier in the year.

A Market in Motion

The Q3 2025 middle-market lending environment reflects a fascinating blend of bullish and cautious forces. Repricing waves and CLO strength are signs of vitality, while declining secondary prices and a drop in new money activity signal undercurrents of restraint. Investors continue to show confidence in private credit and syndicated loans—but they’re also scrutinizing credits more carefully.

For now, the market remains borrower-friendly, particularly for first-lien institutional issuers with solid credit stories. However, with macroeconomic uncertainty on the horizon and deal appetite shifting toward refinancings and repricings, the next phase of the cycle may depend on how new M&A pipelines evolve—and how much longer the current pricing leverage holds.

Sources:

LSEG LPC, Mid-Quarter Trends – September 2025, LSTA Secondary Pricing Data, LSEG Lipper Fund Flows

ChatGPT was utilized in the creation of this article.

.jpg?sfvrsn=f1093d2a_0)