- Interview With SFNet’s Supply Chain Finance Convergence '26 Keynote, Financial Times' Robert Smith

- Appointing Independent Directors to Distressed Companies: An Alternative to Bankruptcy

- Gordon Brothers Bolsters Investment Committee with Janet Jarrett Appointment

- Buchalter Welcomes Back Commercial Finance Partner in LA

- Tariffs in Flux: Supreme Court Limits, New Proposals, and the Secured-Finance Credit Outlook

The State of Lender Finance

November 19, 2025

By Michele Ocejo

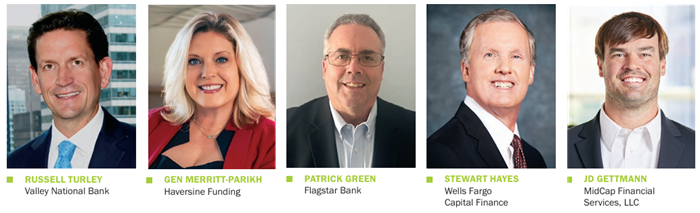

In a rapidly evolving financial landscape, lender finance has emerged as a dynamic and competitive sector. To gain a deeper understanding of the current trends, challenges, and priorities shaping this space, we spoke with five industry veterans: Russell Turley, first vice president, commercial banking team leader, Valley National Bank; Gen Merritt-Parikh, co-CEO, Haversine Funding; Patrick Green, SVP, head of Lender Finance, Flagstar Bank Stewart Hayes, managing director/SVP, Wells Fargo Capital Finance; and JD Gettmann, managing director, head of lender finance, MidCap Financial Services, LLC.

The demand for lender finance has remained robust over the past year, driven by various sectors and evolving market dynamics. Turley observed, “We have seen consistent demand for more capital from our clients and from the broader market, specifically from asset-based lenders. We have also seen more consolidation via M&A, and I think this activity will continue as an older generation looks to exit and as larger lenders look to diversify via geography and/or product set.”

Green echoed this sentiment, noting, “Demand this year has been relatively consistent, both in the commercial finance and consumer finance segments. On the commercial finance side, ABLs, small business lenders, and equipment finance companies have been robust, while in consumer finance, direct consumer lenders, both auto and non-auto, have been active. Increased activity in some of these spaces was driven in part by the pending tariff situation. We anticipate activity to remain strong over the course of the next year. The bigger question may be what bank appetite will be over that period. Certainly, if some banks pull back, it will afford more opportunities for those who are ingrained in the space.”

Merritt-Parikh highlighted the shift from banks to private credit, stating, “Banks are tightening while private credit expands, so non-bank capacity is filling the gap. For us, activity is strongest in logistics, manufacturing/near-shoring, healthcare, and some seasonal and disaster-recovery pockets. Into the next 6–12 months, we expect lenders to run a bit tighter with increased reserves, cleaner reporting, and step-up facilities. Overall, demand should remain elevated.”

Hayes added, “There is strong interest and support from institutional investors to the non-bank lending space, and we expect lender finance activity to non-bank lenders to remain high. Additionally, there have recently been several new entrants in the nonbank ABL market and multiple new entrants in the equipment finance space.”

Gettmann emphasized the competitive landscape, saying, “Competition in the lender finance space has definitely intensified... the days of white space in the lender finance market are in the past. On a go-forward basis, I don’t see the competitive landscape getting any easier. I think the space has been an area where a solid risk/return profile can be achieved for experienced market players and that should continue to drive demand for assets.”

Please click here to continue reading.

.jpg?sfvrsn=f1093d2a_0)