- SixCap Healthcare Finance Launches Integrated Healthcare Capital Platform Combining Asset-Based Lending and Real Estate

- The Power of Mentorship: A Conversation with Frank Grimaldi

- Interview With SFNet’s Supply Chain Finance Convergence '26 Keynote, Financial Times' Robert Smith

- Appointing Independent Directors to Distressed Companies: An Alternative to Bankruptcy

- Gordon Brothers Bolsters Investment Committee with Janet Jarrett Appointment

Resilient and Strong: Q3 2025 ABL Market Sets Record Amid Macro Uncertainty

November 10, 2025

By The Secured Lender Editorial Team

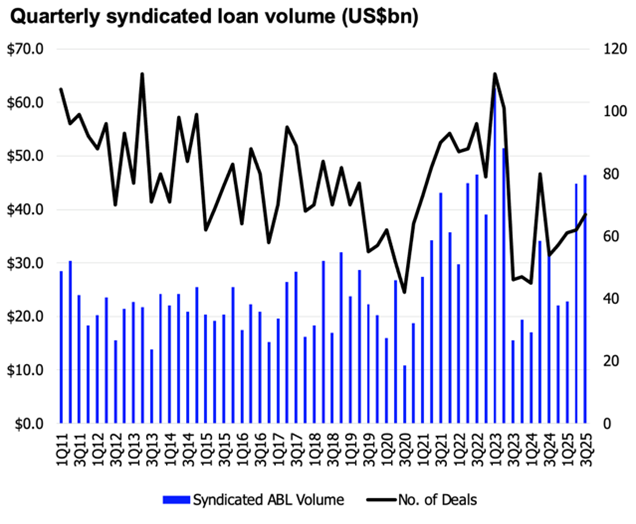

Amid a backdrop of rapidly changing geopolitical risks, trade policy recalibration, rising concern over the labor market and consumer spending and tepid M&A activity, the U.S. asset-based lending market delivered the highest quarterly volume on record excluding the volume relating to LIBOR cessation in 2023. Data released by LSEG Data and Analytics and the Secured Finance Network (SFNet) confirm what market participants already sensed: 2025 is shaping up to be one of the strongest years for ABL issuance in history, thanks in large part to structural demand for liquidity, a significant level of maturing facilities coming back to market, sponsor-led transaction momentum, and the enduring appeal of secured credit in both the bank and non-bank lending markets.

Syndicated ABL Issuance Surpasses 2024 Total — With a Quarter to Go

According to LSEG, syndicated ABL issuance in Q3 2025 reached $46.5 billion, a 45% year-over-year increase. Year-to-date (YTD) volume through the first nine months of 2025 now totals $114 billion, already surpassing all of 2024 by over 8%.

Refinancing activity surged in the quarter with $78.7 billion raised YTD—14% higher than the same period in 2024. New money in 1–3Q25 hit $35.4 billion, outpacing every full-year tally since 2022. In Q3 alone, new asset volume totaled $14.4 billion, on par with Q2, but nearly 180% above Q3 2024 levels. This surge was fueled by a strong uptick in sponsor activity and a handful of billion-dollar corporate deals. While there were several large acquisition financings in the quarter, most of the new money volume was driven by existing borrowers coming back to market with upsized facility size.

Sponsor-Backed Lending Breaks Records

Q3 2025 marked a high point in sponsor-driven ABL lending climbed 5% quarter-over-quarter, totaling $22.7 billion for the quarter and $51.7 billion YTD—more than double the year-ago total. Notably, new lending to sponsor-backed issuers doubled from Q2 to Q3, reaching a record-breaking $9.8 billion in Q3.

Spread and Pricing Trends: Flat Averages, Subtle Tightening Beneath the Surface

On the pricing front, average pro-rata drawn spreads in Q3 held flat at TSOFR +182 bps, while undrawn spreads remained at 27.4 bps. However, dispersion reveals important undercurrents:

- Roughly 65% of loans priced at TSOFR +175 bps or lower,

- Less than 10% of loans priced at TSOFR +250 bps or more, indicating strong demand from banks for credit across the risk spectrum.

- Retail ABL spreads fell 20 bps to TSOFR +152 bps, while non-retail spreads rose slightly to +186 bps—pointing to bifurcation by sector.

This trend of marginal spread tightening for higher-quality credits and modest widening for edge-case borrowers echoes recent commentary in The Lead Left and S&P Capital IQ’s leveraged finance updates.

Sector Spotlight: Retail Leads, But Manufacturing and Wholesale Gain Ground

Retail and supermarket borrowers led Q3’s sector mix, accounting for $27.8 billion (23.6%) of total volume. Wholesale followed at $20.6 billion, and manufacturing closed in at $17 billion.

Notably, average ABL deal size rose to $584 million, up from $533 million in H1. Thirty-seven deals in the first nine months exceeded $1 billion—including an amend and extend for United Rentals and Albertson’s Inc. and the acquisition financings for Walgreens Boots Alliance

Tenors Stretch Amid Confidence in Credit Quality

Longer-dated ABLs are the norm. In Q3, nearly 90% of ABLs carried five-year terms, up 19 percentage points from earlier in the year. This confidence in credit durability—despite persistent inflation and uncertainty over the direction of the economy—signals robust liquidity in the banking sector and overall lender comfort with ABL structural protections.

The first three quarters of the year have seen a significant outward shift in the ABL maturity wall. At the end of 2024 64.1% of outstanding commitments were scheduled to mature prior to the end of 2027. As of 9/30/25 that percentage stands at 39.6%. Over 44.4% of the market dollars mature in 2029 or later, showing the impact of recent refinancing volume. That still leaves $67.7 billion maturing over the next 6 quarters, which will likely come back to market soon for extensions. This financing activity will provide opportunities for bank syndicates to change via refinancings.

Macro Context: The Fed Holds, Credit Remains Selective

The Federal Reserve maintained its cautious pause through Q3, citing sticky inflation in services and uncertainty surrounding tariff-driven price dynamics. While the most recent Senior Loan Officer Opinion Survey (SLOOS) indicated slightly looser standards for C&I loans at large banks, appetite remains strong

ABL utilization rates ticked marginally higher among both bank and non-bank participants in SFNet’s Q1 2025 survey, and anecdotal evidence from SFNet’s June Market Pulse webinar suggested the trend continued into Q3. Lenders are seeing increased drawdowns, often tied to inventory builds ahead of tariff hikes and liquidity needs related to tighter fiscal policy.

Looking Ahead: What to Watch in Q4 and 2026

The ABL market enters Q4 2025 with strong momentum but faces key inflection points:

- Tariff Watch: If trade restrictions escalate further, working capital strains could increase—amplifying demand for flexible borrowing structures like ABL.

- Fed Policy: Markets still anticipate a 25–50 bps cut by year-end, but recent inflation readings and global political risk may push cuts into 2026.

- CLO Liquidity: CLO issuance has been erratic, but if spreads stabilize, CLOs could re-enter the market for floating-rate collateral, including ABLs.

- Middle Market M&A: PitchBook and Preqin forecast an uptick in sponsor-to-sponsor activity in late 2025 and early 2026. If realized, this could further bolster demand for ABL revolvers and bridge financings.

Conclusion: ABL Powers Through the Noise

Q3 2025 reinforced what secured lenders already knew: asset-based lending thrives on volatility. As traditional lenders pull back and borrowers seek more tailored, collateral-driven structures, ABL continues to offer a reliable, scalable, and dynamic option for both investment-grade and sub-investment-grade credits.

With total issuance, new money, and sponsor-driven volumes all surpassing multi-year highs, the market is not just surviving 2025—it is flourishing. Barring a macro shock, 2025 may well go down as one of the most pivotal years in the modern history of asset-based finance.

This article was written with the assistance of ChatGPT.

.jpg?sfvrsn=f1093d2a_0)