Analysts Increase 2025 Loan Growth Estimates After Better-Than-Expected Q2 2025

August 18, 2025

Source: S&P

Equity research analysts ratcheted up their 2025 loan growth outlook for the US bank sector after better-than-expected financial reports during the second-quarter earnings season.

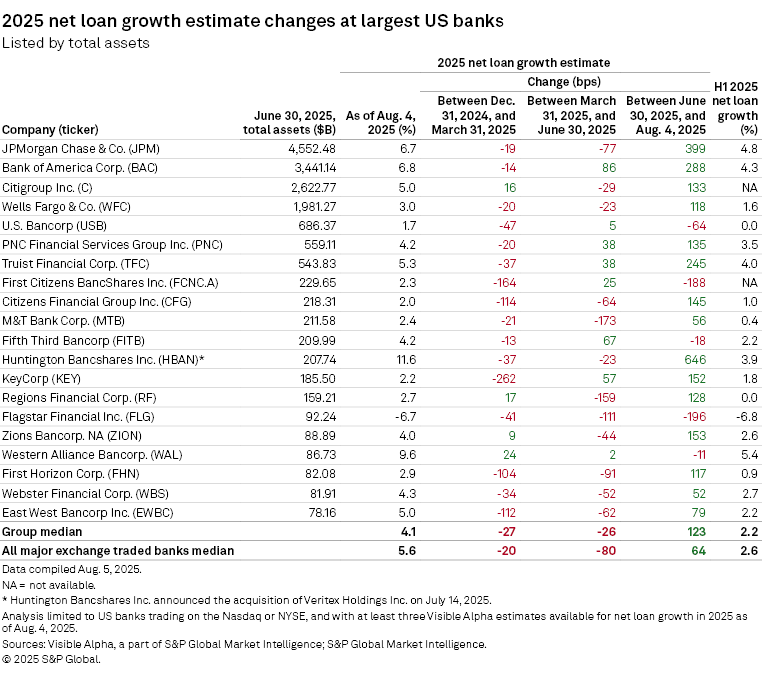

Analysts' net loan growth rate expectations for the full year rose 123 basis points — to 4.1% on a median basis — as of Aug. 4 from June 30 for the 20 US public banks with the most assets at the end of the second quarter, according to an S&P Global Market Intelligence analysis of Visible Alpha data. Visible Alpha is a part of S&P Global Market Intelligence. The group of all major exchange-traded banks had a smaller increase of 64 basis points since June 30 but a loftier estimated loan growth rate of 5.6%.

The analysis was limited to US banks with at least three Visible Alpha estimates for 2025 net loan growth as of Aug. 4. While the full-year loan growth expectations increased, second-half estimates dipped after the second-quarter totals exceeded forecasts, the analysis found.

The actual second-quarter growth eclipsed the change in estimates for all but four of the top 20 banks: Citizens Financial Group Inc., Huntington Bancshares Inc., KeyCorp and Flagstar Financial Inc. On an aggregate basis, the actual growth was higher than the change in estimate by $12.90 billion for the top 20 banks and by $64.65 billion for the larger selection of banks.

Still, the increase in full-year estimates marks a reversal as analysts lowered loan growth numbers earlier in 2025.

Median loan growth estimates for 2025 declined during the first half of the year, as President Donald Trump's April 2 announcement of a new US tariff plan sent stock values down amid elevated market uncertainty. For the top 20 banks, the median net loan growth estimate fell 27 basis points in the first quarter and another 26 basis points in the second quarter. For all exchange-traded banks, the estimate fell 20 basis points in the first quarter and 80 basis points in the second quarter.

Best Q2 2025 loan growth rates

JPMorgan Chase & Co.'s net loans grew $56.55 billion sequentially in the second quarter to $1.387 trillion. This 4.3% growth rate was the biggest among the 20 largest banks. Most of the growth was in the wholesale category, with smaller increases in credit card and consumer, excluding credit card. For the second half of 2025, analysts are forecasting JPMorgan to add another $24.65 billion to its net loan balance, bringing the full-year growth to 6.7%.

Truist Financial Corp. had the second-highest growth rate among the 20 largest banks, at 3.4% in the second quarter. More than half of the increase was from the commercial and industrial (C&I) book. During a July 18 earnings call, Truist Executive Chairman and CEO William Rogers Jr. said, "Average C&I growth was driven by all of our industry banking groups with particular strength in [financial institutions group] and energy, middle market lending and structured credit." Truist also experienced growth in all consumer categories as well as commercial real estate. Overall, analysts are projecting weaker net loan growth in the second half of the year: 1.3% relative to the balance at June 30.

Bank of America Corp. was the only other top 20 bank to exceed 3% linked-quarter loan growth. CFO Alastair Borthwick said on the company's July 16 earnings call that all commercial lending segments grew during the quarter. For middle-market lending, there was "a nice increase in revolver utilization during the quarter as clients navigated the current environment." For global corporate banking, Bank of America "had a little more demand from our larger corporate clients," Borthwick said. Analysts are projecting second-half loan growth of 2.4%, down from 4.3% in the first half.

Highest expected growth rates for the rest of 2025

Among the top 20 banks, Huntington has the highest expected second-half growth rate at 7.3%, heavily influenced by the bank's pending acquisition of Dallas-based Veritex Holdings Inc., which was announced July 14 and is expected to close early in the fourth quarter. Veritex reported $9.41 billion in net loans as of June 30, mostly covering the estimated $9.80 billion in second-half growth for Huntington.

Huntington had one of the best first-half growth stories in the sector, with period-end net loans growing 3.9%, well above the 2.2% median for the top 20 banks. C&I drove the growth, with the auto segment also a notable contributor. The company's initiatives — including but not limited to Texas, the Carolinas, the financial institutions group and fund finance — comprised about 40% of average loan growth in the second quarter and approximately half in the first quarter. On a stand-alone basis as of July 18, Huntington raised its average loan growth guidance for 2025 to a range of 6% to 8%, up from the April 17 guidance range of 5% to 7%.

When excluding acquisitions that are expected to affect second-half growth, Western Alliance Bancorp. has the highest loan growth trajectory in the top 20 group. Analysts are estimating 4.1% growth in the second half of 2025 after 5.4% growth in the first six months of the year. More than two-thirds of the second-quarter growth was from C&I, according to Western Alliance Vice Chairman and CFO Dale Gibbons on the company's July 18 earnings call. Gibbons said the company continues to gather momentum in the innovation and technology banking segment, which showed quarterly growth of over $150 million, "following competitor disruptions over the past two years."

Analysts are projecting that both Regions Financial Corp. and East West Bancorp Inc. will grow net loans by 2.7% in the second half of 2025. Regions Financial kept its net loan balance steady at $95.71 billion from year-end 2024 to June 30, while East West racked up 2.2% growth.

Potential loan growth headwind

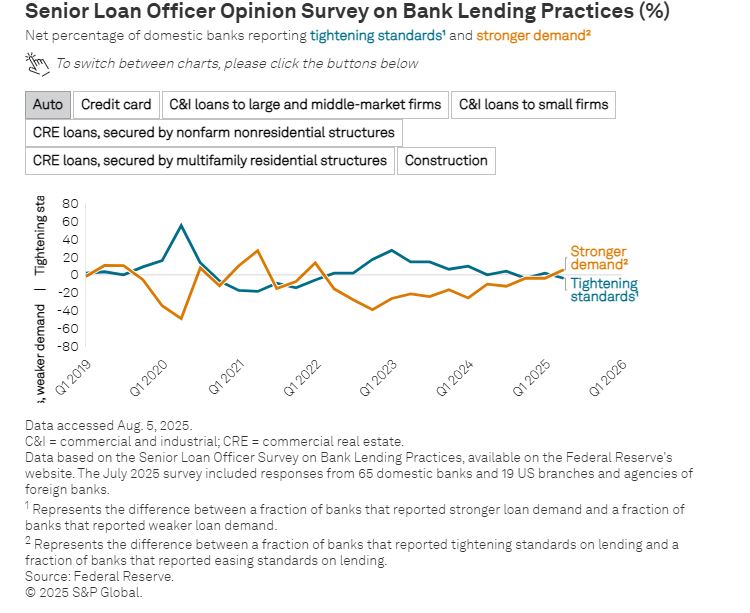

Results from the most recent Senior Loan Officer Opinion Survey on Bank Lending Practices indicated that many banks reported some loan demand softness.

A greater percentage of banks that responded to the survey — which was conducted from June 18 to July 2 — reported less demand for C&I loans, which was a driving force for large bank loan growth in the second quarter.

The Federal Reserve said reasons given for softer demand included "lower customer investment in plant or equipment as well as decreased customer financing needs for merger or acquisition and inventory." The Fed also noted that banks "cited customers’ decreased accounts receivable financing needs, lower precautionary demand for cash and liquidity, higher internally generated funds, and alternative sources for borrowing as important reasons for weaker demand."

Additionally, banks reported that demand for CRE lending across the spectrum declined in the second quarter, while demand was up for auto loans.

.jpg?sfvrsn=f1093d2a_0)