GlobalData Names top M&A Financial and Legal Advisers in South & Central America for Q1 2022

April 26, 2022

Source: GlobalData

Financial

Rothschild & Co and JP Morgan were top M&A financial advisers by value and volume in South & Central America for Q1 2022, finds GlobalData

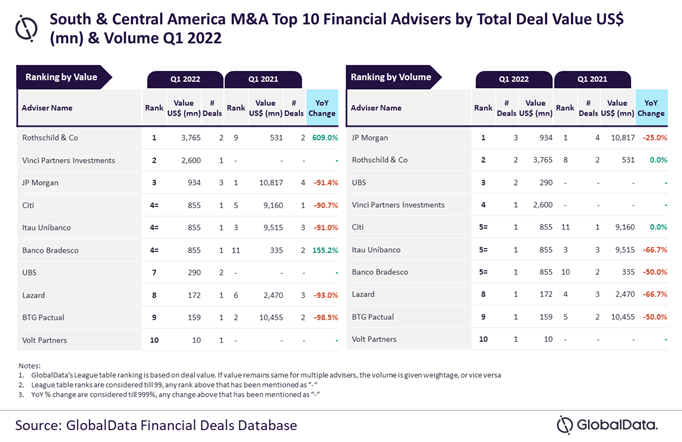

Rothschild & Co and JP Morgan have been identified as the top mergers and acquisitions (M&A) financial advisers in South & Central America region for Q1 2022, according to the latest Financial Advisers League Table by GlobalData. The leading data and analytics company’s Financial Deals Database reveals that Rothschild & Co achieved top ranking by value, advising on $3.8 billion worth of M&A deals, while JP Morgan led by volume, having advised on three deals.

According to GlobalData’s report, ‘Global and South & Central America M&A Report Financial Adviser League Tables Q1 2022’, a total of 273 M&A deals were announced in the quarter, with a total value of $20.3 billion.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Not only did JP Morgan top the volume ranking, but all of its three deals were worth more than $100 million. Resultantly, it occupied the third position on the ranking by value.”

“Meanwhile, all of the deals advised by Rothschild & Co were billion-dollar deals. It came rather comfortably ahead of Vinci Partners Investments, which advised on $2.6 billion worth of deals, but it is noteworthy that these two firms led the pack—with all others in the ranking not reaching the $1 billion mark.”

Analysis of GlobalData’s Financial Deals Database reveals other high rankers by value included Vinci Partners Investments, with deals worth $2.6 billion; followed by JP Morgan, with $934 million; Citi, with $855 million; and Itau Unibanco, with $855 million.

By volume, Rothschild & Co came second, with two deals; followed by UBS, with two deals; and Vinci Partners, with one deal.

* Valued more than or equal to $1 billion.

Analysis of GlobalData’s Financial Deals Database reveals other high rankers by value included Vinci Partners Investments, with deals worth $2.6 billion; followed by JP Morgan, with $934 million; Citi, with $855 million; and Itau Unibanco, with $855 million.

By volume, Rothschild & Co came second, with two deals; followed by UBS, with two deals; and Vinci Partners, with one deal.

* Valued more than or equal to $1 billion.

Legal

GlobalData names Demarest Advogados and Bronstein Zilberberg as top M&A legal advisers in South & Central America for Q1 2022

Law firm Demarest Advogados has been named the top merger and acquisition (M&A) legal adviser in the South and Central America region, based on the value of M&A deals on which it advised in Q1 2022. This is according to leading data and analytics company GlobalData’s Financial Deals Database, which reveals that the company advised on $2.6 billion worth of deals.

Furthermore, Bronstein, Zilberberg, Chueiri & Potenza Advogados (Bronstein Zilberberg) has also been held in equal recognition, as it advised on the highest number of deals in the quarter, which GlobalData’s Financial Deals Database reveals was 20 deals.

GlobalData’s latest report, ‘Global and South & Central America M&A Report Legal Adviser League Tables Q1 2022’, reveals that there was a total of 273 M&A deals announced in the region during Q1 2022, which were collectively worth $20.3 billion.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Deals on which Demarest Advogados advised represent over 10% of the total value for the quarter. These deals included Rede D'Or Sao Luiz’s acquisition of Sul America for $2.6 billion and GLA Brasil’s acquisition of 7% stake in Sky Servicos de Banda Larga from Globo Comunicacao e Participacoes (Deal value not disclosed).

“Meanwhile, Bronstein Zilberberg stole the show, when it came to deal volume. It was the only firm to reach double digits, which placed it firmly ahead of nearest competitor Machado Meyer Sendacz e Opice, with five deals. However, Bronstein Zilberberg had to settle for ninth position by deal value due to its involvement in relatively low-value transactions. The average size of deals advised by Demarest Advogados stood at $1.3 billion, while it was $20 million for Bronstein Zilberberg.”

Analysis of GlobalData’s Financial Deals Database reveals other high rankers by value included Sidley Austin, with deals worth $2.1 billion; followed by Machado Meyer Sendacz e Opice, with $1.1 billion; and Simpson Thacher & Bartlett, with $674 million.

By volume, Machado Meyer Sendacz e Opice came in second, with five deals; followed by Veirano Advogados, with five deals; and Barbosa Mussnich & Aragao Advogados, with five deals. Positions for companies achieving the same number of deals in the ‘advisers by volume’ ranking were determined by their total deal value as a secondary consideration.

.jpg?sfvrsn=f1093d2a_0)