B&W Announces Comprehensive Debt Refinancing Agreement as Financial Performance Improves

February 3, 2020

Source: Business Wire

Babcock & Wilcox Enterprises, Inc. (NYSE: BW) (B&W) announced today that the Company has amended its Credit Agreement to comprehensively refinance its debt in advance of its March 15, 2020 requirement. Under the terms of the Agreement, B. Riley FBR, Inc. has agreed to fully backstop $200 million in debt refinancing, which will be used to fully repay the existing revolving credit facility balance by May 11, 2020, and to provide an additional $30 million under Tranche A-4 of the Company’s last out term loans to support the Company’s growth. The Company’s senior lender syndicate has agreed to provide a new revolving credit facility on May 11, 2020 with $30 million of borrowing availability, in addition to increased availability for letters of credit. Finally, the Agreement sets a maturity date for the new revolving credit facility and letters of credit of January 1, 2022. Further details can be found in the Form 8-K filed with the SEC on February 3, 2020.

“This critical agreement represents a significant milestone for B&W as we build on the improvements we made in 2019 to return to profitability and position the company for growth. We appreciate the ongoing commitment of B. Riley FBR, Inc. and our lender group to support B&W’s future,” said Kenneth Young, B&W Chief Executive Officer. “We expect this agreement to provide the financial stability to drive B&W’s ongoing transformation. Now, we are able to continue to move forward and focus on enhancing our core strengths, delivering our world-class technologies and services to our customers, and generating sustained value for our shareholders.”

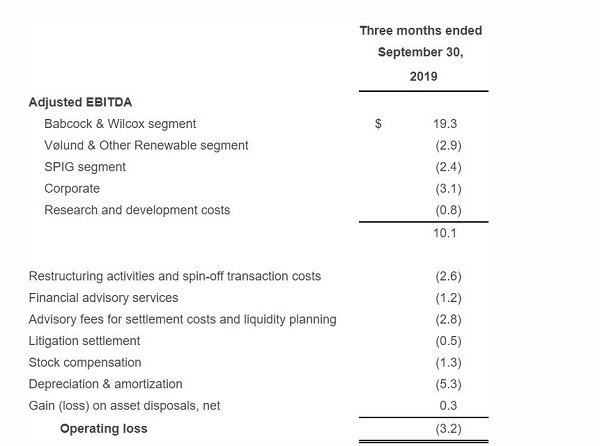

“With this key part of B&W’s transformation complete, we are now investing in growth opportunities across our portfolio in the U.S., Europe, the Middle East and Asia,” Young continued. “We expect our consolidated fourth quarter 2019 results to significantly outperform the third quarter’s consolidated operating loss of $3.2 million and adjusted EBITDA of $10.1 million, solidifying our turnaround and accelerating the business into an even stronger 2020. Our improvement over the past 12 months continues to boost bottom line performance and increase cash flows from strong recurring parts and services revenues, and we expect positive consolidated operating income in the fourth quarter of 2019, after 12 consecutive quarters of operating losses. Our improved balance sheet and overall financial performance enable our participation in new opportunities across all of our business segments, including renewable waste-to-energy, environmental equipment, aftermarket services, and operations and maintenance. We are leveraging a robust pipeline to drive new bookings as we emerge a stronger B&W, ready to execute our core strategy founded on technology, services and experience.”

A reconciliation of operating loss to adjusted EBITDA for the third quarter of 2019, as referenced in this release, and as previously disclosed, is included in Exhibit 1 to this release.

Exhibit 1

Babcock & Wilcox Enterprises, Inc.

Reconciliation of Adjusted EBITDA

(In millions)

This release presents the Company’s adjusted EBITDA, a non-GAAP financial measure. Adjusted EBITDA on a consolidated basis is defined as the sum of the adjusted EBITDA for each of the segments. At a segment level, the adjusted EBITDA presented is consistent with the way the Company's chief operating decision maker reviews the results of operations and makes strategic decisions about the business and is calculated as earnings before interest, tax, depreciation and amortization adjusted for items such as gains or losses on asset sales, mark to market pension adjustments, restructuring and spin costs, impairments, losses on debt extinguishment, costs related to financial consulting required under Credit Agreement and other costs that may not be directly controllable by segment management and are not allocated to the segment. The Company presents consolidated adjusted EBITDA because it believes it is useful to investors to help facilitate comparisons of the ongoing, operating performance before corporate overhead and other expenses not attributable to the operating performance of the Company's revenue generating segments. A reconciliation of operating loss, the most directly comparable GAAP measure, to adjusted EBITDA is included in the table below.

About B&W

Headquartered in Akron, Ohio, Babcock & Wilcox is a global leader in energy and environmental technologies and services for the power and industrial markets. Follow us on Twitter @BabcockWilcox and learn more at www.babcock.com.

Contacts

Investor Contact:

Megan Wilson

Vice President, Corporate Development & Investor Relations

Babcock & Wilcox

704.625.4944

investors@babcock.com

Media Contact:

Ryan Cornell

Public Relations

Babcock & Wilcox

330.860.1345

rscornell@babcock.com

.jpg?sfvrsn=f1093d2a_0)