- First Eagle Investments to Acquire Napier Park Global Capital, Expanding Alternative Credit Capabilities

- Emerging Neobanking Solutions: US Capital Global Partners with Zyng Corp. on Capital Formation Strategy

- Gordon Brothers Acquires Durkin Group Enhancing Services to Include Field Examinations

- Wolters Kluwer Compliance Solutions Shares Insights in Response to Silicon Valley Bank and Signature Bank Collapse

- Interactive ABL Data Test

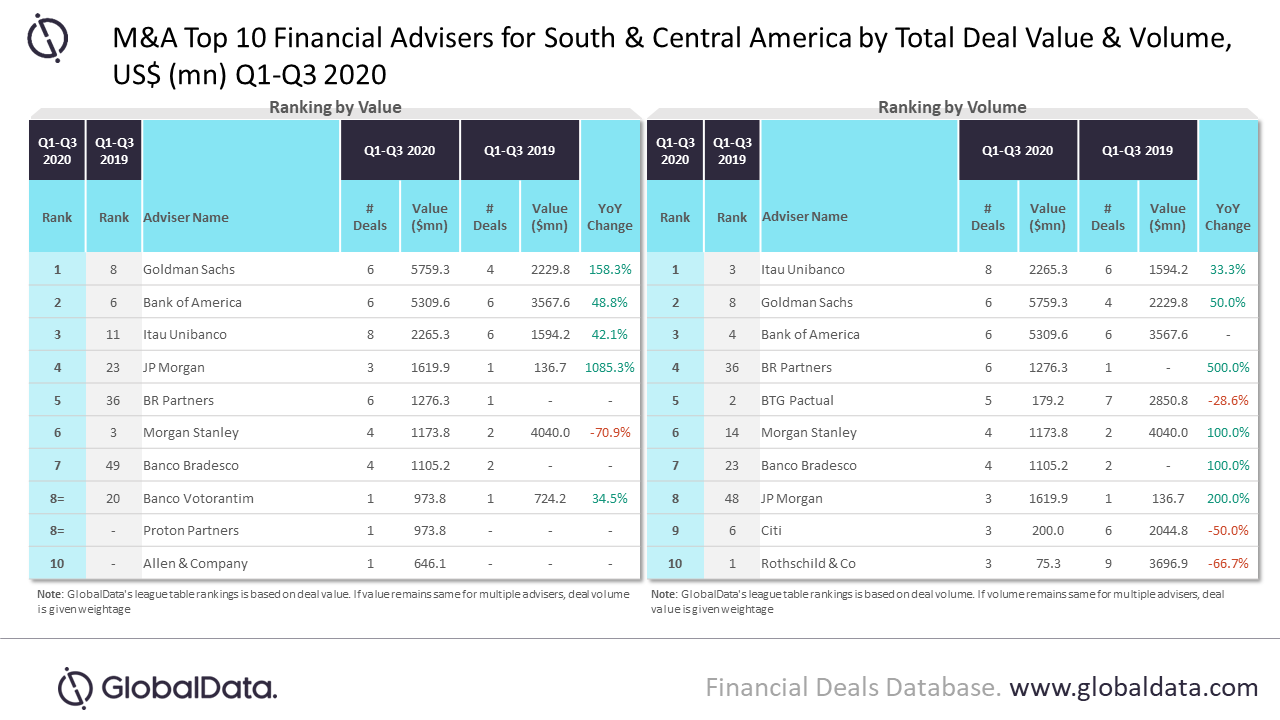

Goldman Sachs and Itau Unibanco Were top M&A Financial Advisers by Value and Volume in South & Central America for Q1-Q3 2020, Says GlobalData

October 28, 2020

Source: GlobalData

Goldman Sachs and Itau Unibanco were the top advisers for mergers and acquisitions (M&A) in South & Central America by value and volume, respectively, in Q1-Q3 2020, respectively, according to GlobalData, a leading data and analytics company.

According to GlobalData’s report, ‘Global and South & Central America M&A Report Financial Adviser League Tables Q1-Q3 2020’, during this period, 693 M&A deals were announced in the region, which marked a 30% decrease over the 990 deals announced during the same period in 2019. Deal value also decreased by 45.7% from $65bn in Q1-Q3 2019 to $35bn in Q1-Q3 2020.

Aurojyoti Bose, Financial Deals Analyst at GlobalData, comments: “Goldman Sachs achieved first place on GlobalData’s ranking for deal value by advising on six deals worth US$5.8bn - the highest value among all advisers studied. Meanwhile, Itau Unibanco led in terms of volume having advised on eight deals worth $2.3bn.

“Itau Unibanco advised on a relatively higher number of deals but lagged behind Goldman Sachs in terms of value by a huge margin. The average size of deals advised by Goldman Sachs stood at $959.9m while Itau Unibanco saw just $283.2m. Goldman Sachs not only led in terms of value but also occupied second position in terms of volume.”

Bank of America lost the top position by value to Goldman Sachs by a whisk and occupied the second position by advising on six deals worth $5.3bn. Itau Unibanco occupied the third position by value followed by JP Morgan with three deals worth $1.6bn.

Goldman Sachs occupied the second position by volume followed by Bank of America. BR Partners occupied the fourth position by volume with six deals worth $1.3bn.

For more information

To gain access to our latest press releases: GlobalData Media Centre

Analysts available for comment. Please contact the GlobalData Press Office:

EMEA & Americas: +44 207 936 6400

Asia-Pacific: +91 40 6616 6809

Email: pr@globaldata.com

For expert analysis on developments in your industry, please connect with us on:

GlobalData | LinkedIn | Twitter

Notes to Editors

• Quotes are provided by Aurojyoti Bose, Lead Analyst at GlobalData

• The information is based on GlobalData’s Financial Deals Database

• This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

• You are welcome to quote information from the attached report, with reference to ‘GlobalData’

Methodology for League Tables

GlobalData league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through an adviser submission forms on GlobalData, which allows both legal and financial advisers to submit their deal details.

For league tables, we have considered M&A including asset transactions, venture capital and private equity deals where advisors were involved.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

In This Section