- MidCap Financial Closes $15 Million Senior Revolving Credit Facility to Kewaunee

- CIT Northbridge Credit Serves as Sole Lead Arranger on $40 Million Credit Facility for Europa Sports Products

- TSL Express Daily Articles & News

- Midsouth

- LSQ Creates $15MM Invoice Finance Facility for Cell Phone Wholesaler

U.S. Xpress Enterprises Announces New $250 Million Revolving Credit Facility

January 28, 2020

Source: Business Wire

U.S. Xpress Enterprises, Inc. (NYSE:USX) (the “Company”) today announced the refinancing of its Senior Credit Facility.

Transaction Highlights

- New facility lowered interest rates and increased flexibility

- Former facility was fully paid off with proceeds of new facility and contemporaneous real estate and equipment financings

- Estimated availability of over $100 million following post-closing activities

Eric Peterson, Chief Financial Officer commented, “We appreciate the continued support from our lenders, with Bank of America, JP Morgan Chase Bank, Wells Fargo Bank, and Regions Bank all remaining in our bank group. The refinancing will support several of our goals including improved pricing, the ability to grow our borrowing base with the business, and adding flexibility to execute our plan to convert a significant portion of our fleet from operating lease financing to owned financing over time, to optimize our tax and trade-in positions. The new facility’s single financial covenant – fixed charge coverage, tested only if available borrowing falls below a threshold amount – will afford us significant flexibility toward executing this plan.”

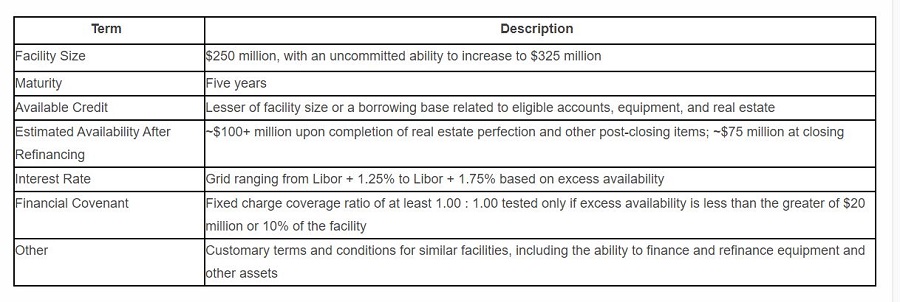

The new credit facility contains the following major terms:

The description above is not complete, and readers are referred to the Company’s Form 8-K filed with the Securities and Exchange Commission for additional information.

At closing of the new facility, the letter of credit fee and the applicable margin charged on outstanding borrowings declined 1.0% compared to the most recent pricing on the prior facility. After June 30, 2020 the letter of credit fee and applicable margin will fluctuate quarterly based on excess availability.

Contemporaneously with closing the new revolving credit facility, the Company is completing approximately $100 million in tractor and real estate financings, with proceeds used to pay off a portion of the prior credit agreement. In addition, the Company is completing the perfection process on real estate that is expected to bring available borrowing capacity to over $100 million in the near term.

In connection with the aforementioned transactions, the Company expects to record a non-cash write-off of approximately $0.5 million in deferred financing costs, and approximately $0.2 million in new financing costs, in the first quarter of 2020.

About U.S. Xpress Enterprises

Founded in 1985, U.S. Xpress Enterprises, Inc. is the nation’s fifth largest asset-based truckload carrier by revenue, providing services primarily throughout the United States. We offer customers a broad portfolio of services using our own truckload fleet and third‐party carriers through our non‐asset‐based truck brokerage network. Our modern fleet of tractors is backed up by a team of committed professionals whose focus lies squarely on meeting the needs of our customers and our drivers.

Contacts

U.S. Xpress Enterprises, Inc.

Brian Baubach

Sr. Vice President Corporate Finance and Investor Relations

investors@usxpress.com

In This Section