- Factoring Sector Slightly More Optimistic as Industry Expects Better Business Conditions and Portfolio Performance

- Asset-based loan commitments grew in 2023, with fewer new clients, but larger deals

- A Unique Journey to Secured Finance: Interview with Jacob Shoihet and Peter Spradling of Marco Capital

- SFNet Launches IMPACT Awards to Celebrate Excellence in the Secured Finance Industry

- Wintrust Receivables Finance Announces Closing of $3M Line of Credit for Growing Third-Party Logistics Company

Success By Lenders Working Together

By Darren Palestine and Mark Polinsky

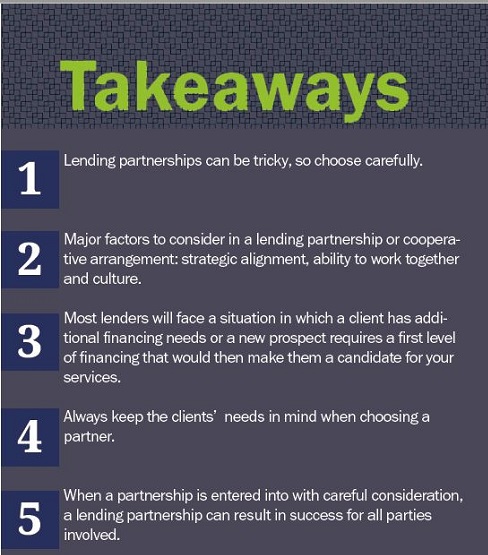

Partnerships in lending present a tricky landscape to navigate and we have all had good and bad experiences. There are many things to consider when choosing a partner. And partnerships can come in different formats, but on a basic level you have your lender and capital provider relationship. As you go deeper into synergistic relationships and different lending products, you have intercreditor partnerships, tri-party partnerships including the client, and other strategic alliances.

However, a few recent cases show that blind reliance on “incorporation by reference” can occasionally have disastrous (and unintended) consequences for secured lenders. These cases do not state that “incorporation by reference” can never be done. Still, the scrutiny that the courts in these cases applied before narrowly approving, or denying, attempts to validate key deal terms that were allegedly “incorporated by reference” may lead many lenders to question whether the space saving from incorporation by reference is worth the potential risk of having the propriety of “incorporation by reference” challenged at some point in the future in a “hindsight” review.

The major factors to consider in a lending partnership or cooperative arrangement are strategic alignment, ability to work together, and culture. Without all three elements present, the alliance can create a negative environment.

For strategic alignment, the focus is simple: Do the parties have a common goal in assisting a prospect or current client and do they have the same focus on how the partnership will benefit the client (and the respective firms)?

Partnerships to provide additional value to clients that might not be covered under our own lending criteria:

If you have been in this industry long enough, you have inevitably encountered a time when you have a client with additional financing needs that you can’t accommodate or a new prospect who could use a first level of financing that would then make them a candidate for your services. These situations often include inventory financing, purchase order financing, term loans, equipment financing, and other non-AR funding.

When you find yourself in this position, there are a variety of factors you should consider, ensuring you are selecting the best fit for you and the client. The main factors are:

- What does the client need and who is best to serve the need?

- If the company is not a current client, which firm would be strategically aligned to help you win the opportunity?

- What is the method of partnership? Will an intercreditor be necessary? Will a subordination be required? Is there participation? All of these require legal documentation that can be agreed on by both partners. This could halt the process so it is important to know if your legal documents align.

- Will partnering with another firm create the best overall fit for the client and what is the goal of the partnership for each party, including the client?

In this case, knowing your partner’s capabilities becomes a critical item when considering whom to bring in for an opportunity. Due to this, it can often be helpful to focus on a select group of regular partners amongst both the direct lending and consulting verticals.

Partnerships to help others provide additional services to their prospective or current clients

For lenders who offer a niche product, such as purchase order financing, it is easy to get swept up in the moment when you get a call from another lender who has a prospect to discuss with you. However, it is important to ensure you are working with a quality partner because you don’t want harm your own brand or partner on a bad deal.

When you find yourself in this position, there are a variety of factors you should consider, ensuring you are selecting the best fit for your business. The main factors are:

- Does the company and the individual you are working with have high character? Do you feel you can trust them? Have you worked with the partner before and have you and your clients had a good experience?

- Do they have the ability to work out difficult situations? You find out how good your partner is in times of difficulty. Are they only out for their interests or will they try to protect all partners?

- Flexibility – are they structured in a way that will allow them to be flexible if necessary?

- Do they have the financial wherewithal?

- Do the have good processes and organization? Is the partner easy to deal with and do they have the systems to ensure the process goes smoothly.

Case study – An example of when the partnership works

Recently Commercial Finance Partners turned to Gateway Trade Financing to help with additional financing for a prospective client. Commercial Finance Partners received a referral for a rapidly growing snowboard company looking to capitalize on orders from large distributors and seeking a financing solution that would not only help them build product, but also finance the resulting receivables due from their customers. While Commercial Finance Partners offers accounts receivable funding to our clients; the idea of providing any type of upfront payment to the supplier is out of scope for a normal transaction. While debating on how to fill the need, the idea of purchase order financing was presented to the borrower. Utilizing some of the methodology described, Commercial Finance Partners selected Gateway Trade Funding to review the purchase order financing. Having worked with Gateway as a referral partner before, we felt comfortable with the organizational culture and ability to deliver to our client. While we hadn’t worked out an intercreditor since the other transactions were agency based, we felt confident we could strategically align for the common goal.

Once we made initial progress with the client, we introduced Gateway and immediately the synergies were present. There was a smooth transition which included sharing of information with the client’s permission and we were able to get a mutual comfort with the client while, just as importantly, the client gained comfort with our collective approach. Both Gateway and Commercial Finance Partners then began intercreditor discussions. The initial review of the documents presented challenges; however, a conference call cleared up the items that needed to be addressed and the document was accepted by all parties, including the client.

The client was on a time crunch to start filling the seasonal orders and both finance companies stepped up to deliver what was conceptualized in the early discussions. Gateway Trade Funding, leveraging the back office and customer credit approvals for Commercial Finance Partners, opened up a letter of credit to the supplier, which allowed the foreign supplier to produce the product with a guarantee of payment. The product was produced, shipped, and then started being delivered to the various distributors and customers. As invoices were generated, Commercial Finance Partners provided the funding on the accounts receivable directly to Gateway per the tri-party agreement with the client. Gateway was able to close out the letters of credit through the funding from Commercial Finance Partners and the client was able to monetize the large bulk sales of products without having to obtain outside cash or utilize important resources that could be better devoted to marketing and further product development.

Working with another lender is often times difficult if a partnership is not selected correctly. You can find yourself at the mercy of another firm’s responsiveness and more critical issues such as underwriting quality, commitment to the transaction, and interaction with the client can lead to disastrous results if not vetted up front. When a partnership includes a common goal, a like-minded culture, an ability to share information as well as a level of operational and organizational trust, the end results are success for all parties, including the client.

About the authors:

Darren Palestine is the managing partner of Commercial Finance Partners, a Florida-based direct lender and loan consulting firm. Commercial Finance Partners provides funding solutions for small-to-middle market companies seeking non-traditional sources of capital and working capital. Through direct lending and partner programs, Commercial Finance Partners is the one-stop shop for any non-bank financing need.

Mark Polinsky is a principal at Gateway Trade Funding, where he is responsible for helping companies grow their business using purchase order financing. Mark offers his clients an unparalleled expertise having walked in their shoes for 25+ years starting, growing, and selling several businesses.