- Asset-based loan commitments grew in 2023, with fewer new clients, but larger deals

- A Unique Journey to Secured Finance: Interview with Jacob Shoihet and Peter Spradling of Marco Capital

- SFNet Launches IMPACT Awards to Celebrate Excellence in the Secured Finance Industry

- Wintrust Receivables Finance Announces Closing of $3M Line of Credit for Growing Third-Party Logistics Company

- Citigroup’s Shapleigh Smith Retiring; Shane Azzara to Head Asset-Based and Transitional Finance

The Staged Return to Normal

By Juanita Schwartzkopf

We all want to return to normal, or the new normal, as quickly as possible. The question businesses and their stakeholders need to ask themselves is what does normal mean and how can the return be funded.

For most companies, their working capital has been depleted during the shutdown as they struggled to pay employees and keep vendors satisfied, while dealing with impacts to sales and accounts receivable.

The staged return to normal, as defined on April 20, is summarized as follows:

Phase 1

Vulnerable individuals shelter in place.

Maximize physical distance when in public and no gathering of more than 10 people.

Minimize non-essential travel and adhere to isolation following travel.

Telework is desirable. Return to work in phases. Close common areas.

Schools, camps, daycare, etc. remain closed.

Visits to senior living facilities and hospitals are prohibited.

Sit down restaurants, movie theaters, sporting venues, places of worship can operate with strict physical distancing.

Elective surgeries can resume at outpatient facilities.

Gyms can open with physical distancing.

Bars remain closed.

Phase 2

Vulnerable individuals shelter in place.

Maximize physical distance when in public and no gathering of more than 50 people.

Non-essential travel can resume.

Telework is encouraged. Close common areas.

Schools, camps, daycare, etc. may reopen.

Visits to senior living facilities and hospitals are prohibited.

Sit down restaurants, movie theaters, sporting venues, places of worship can operate with moderate physical distancing.

Elective surgeries can occur at outpatient and inpatient facilities.

Gyms can open with physical distancing.

Bars may open with diminished standing room occupancy.

Phase 3

Vulnerable individuals may resume public interactions but should practice social distancing and minimize social interactions.

Low risk populations should minimize time spent in crowds.

Unrestricted staffing for employees.

Visits to senior living facilities and hospitals are allowed however diligent hygiene is requested.

Sit down restaurants, movie theaters, sporting venues, places of worship can operate with limited physical distancing protocols.

Gyms may be open but must adhere to standard sanitation protocols.

Bars may increase standing room occupancy where applicable.

Vulnerable individuals are considered the elderly and those with underlying conditions identified as high blood pressure, chronic lung disease, diabetes, obesity, asthma, and those with weakened immune systems.

That was interesting, but what does it mean?

First, it means there will be long-term impacts to businesses across the economy.

Second, it means there will be varying impacts based on the industry, the geographic location in which the company operates and the geographic location where it serves its customers, and the health of the employee base.

Third, it means the transition to the new normal will be extended and may be delayed based on the way the virus acts.

What happens to working capital?

Beginning in February, businesses felt the impact of the virus in many differing ways. But, across the board several things happened:

Accounts receivable collections slowed.

Inventory was either depleted or could not be sold.

Accounts payable were stretched.

The level of these working capital changes was offset in part by reduced expenses and in part by disaster loans, the CARES Act, and debt restructuring or payment deferrals.

Assuming the business makes it through the immediate impact of the virus, there will be ongoing issues with working capital. Many businesses used their working capital to fund operations and will not be able to generate levels of working capital needed to return to normal operating cycles.

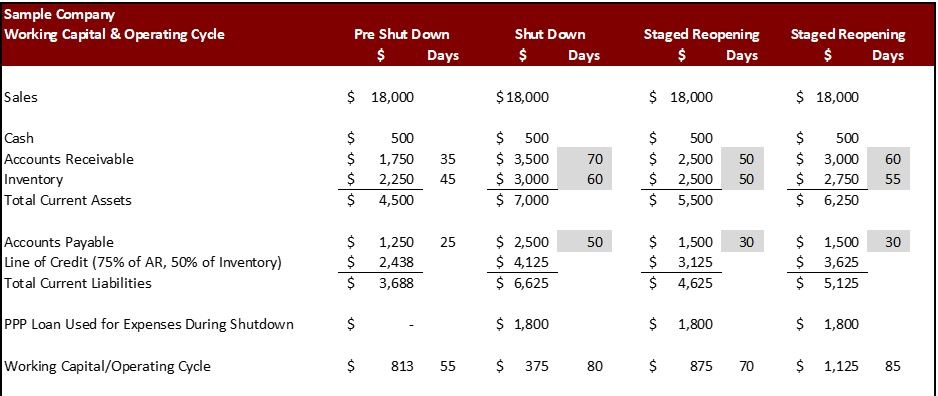

First, let’s look at the working capital and operating cycle of a sample company pre shut down, during shutdown, and under two different staged reopening situations.

During the shutdown the company’s accounts receivable stretched out, its inventory built, and its payables were able to finance some of the increase. The company also had the benefit of a PPP loan and used that to fund employees, rent and utilities during the shutdown.

In the first example of a staged reopening, the AR turnover was able to reduce from 70 to 50 days, well on the way to normal of 35 days, the inventory turnover decreased from 60 days to 50 days, and the AP turnover had to return to 30 days to ensure a good flow of product.

In the second example of a staged reopening, it takes the company longer to return its AR and inventory terms to closer to normal, but the AP turnover still had to return to 30 days to ensure supply.

During normal operations the Company’s operating cycle was 55 days. During the shutdown the operating cycle increased to 80 days. The two staged reopening situations arrived at an operating cycle of 70 days or 85 days.

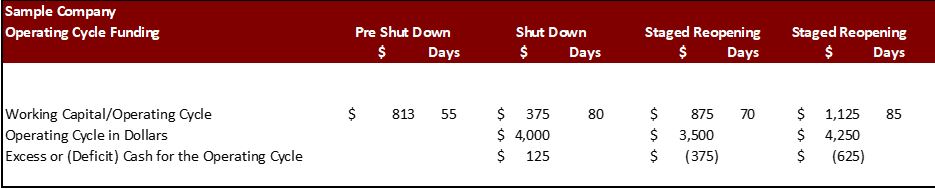

Using a return to the pre-shutdown revenue run rate means the first staged reopening situation will need $3.5 million, compared to estimated availability under a line of credit of $3.1 million. The company will have a $375,000 shortfall of cash to fund its operations.

In the second staged reopening situation, the company will need $4.2 million compared to availability of $3.6 million. The company will have a $625,000 shortfall of cash.

The PPP loan proceeds were required to fund payroll, rent and utilities and did not result in a paydown on the line of credit.

What does this mean?

Companies will be looking to their owners and their lenders to fund this shortfall. Lenders will be confronted with a wave of requests for overadvances or reduction in reserves. Owners will be asked to fund shortfalls. The question is how much is the liquidity need?

Considering working capital and cash management with the backdrop of the coronavirus is complicated. Let’s work through a few examples.

Accounts Receivable

In the first example, consider ABC company that provides materials to the restaurant industry. The restaurants went to extended payment terms as soon as ABC complied with the government shut down requests, resulting in ABC experiencing at least a 30-day extension for payments. Once the phased opening of restaurants occurs, the restaurants will not be back to normal operations, and will continue to request extended terms from ABC. ABC will want to keep its customers in order to increase the likelihood of collection and ongoing relationships.

In an example of a manufacturer of automotive parts (QRS), their customers have completely shut down during and product is not moving through the pipeline. As a result, payments have been extended, especially since the parts are special purpose and QRS is unable to sell the product to others. QRS will be holding both accounts receivable and inventory, and has less ability to influence payments because they are not a single-source provider.

Inventory

ABC has a shortfall of chemicals and cleaning products that its customers need, but has plenty of product that cannot be sold because people are not eating in the restaurants. Once the phased reopening occurs, product can begin moving again but the MIX of products being sold will not return to normal quickly. The mismatch of inventory will continue. ABC will have to locate sources for the product that is in high demand and will find other products to be slow moving. This will slow down the inventory turnover overall and will increase throughput needs for certain products.

For QRS, they have special purpose inventory that will not be needed until the automobile manufacturers are back online and use their own existing stock. QRS will be able to return to selling product, but timing will not return to normal as everything, down to the car dealers and the financing sources, will need to be back to work and functioning. Consumers may delay purchase of large ticket items until some stability in work and normalcy occurs. QRS may have trouble sourcing raw materials during a restart, as its suppliers may be having their own difficulties. This could result in a mismatch of the materials needed to manufacture products.

Accounts Payable

Vendors to companies are calling constantly to request payments to generate their own cash flow. Companies are trying to maintain working relationships with suppliers for products that can be sold during the shutdown and during the first phases of the return to the new normal. Companies are trying to protect their vendor relationships and trying to help their business partners.

ABC will be tempted to pay all of its vendors a little to keep everyone happy, but it may need to target only key suppliers and end of looking for new vendors for other items. ABC may be forced to pay for some slow-moving product in order to ensure a supply of fast- moving product. Rather than being able to do a COD approach with vendors, it may be requested to pay extra with each shipment in order to keep the fast-moving product flowing through the system.

QRS may be required to pay certain client-approved vendors in order to ensure QRS will be able to restart its manufacturing. It will be difficult to balance vendor needs, customer requirements and cash flow.

The Intertwined Cycle

One company’s accounts receivable is another company’s accounts payable. One company’s sales are another company’s inventory. More than ever before, all businesses are intertwined in struggling with financial performance and working capital management.

ABC’s receivables are from restaurants. Restaurants need consumers to generate their credit card receipts. Consumers will be slow to go back into tight spacing.

QRS needs vendors to provide materials for manufacturing and needs the car manufacturers to be building cars. The car manufacturers need dealers to be back operating, financing to be available, and consumers to be comfortable spending their money or taking on debt.

The playbook that was used in the past by companies to manage working capital and by lenders to deal with working-capital issues is, at best, a starting point, but the old playbook does not fully address the current situation.

To make it more personal, let’s consider interaction with Amazon under Covid-19. Prior to Covid, we could order products and receive them the next day. We were trained to wait until the last minute to order our supplies. We paid when shipped and we received anything we wanted right away. Now many items are sold out – we will need to keep larger inventories of supplies on hand, and we will need to use our cash to keep needed levels on hand. When Amazon doesn’t have products, we need to find alternative sources and then pay extra for shipping or encounter time delays. We have to substitute products we prefer with products that are available. If we have to pay more for products, we do that to ensure we have what we need.

These are the same issues every company is going to experience as it phases back into operations. And, all companies are going to experience this at the same time.

Working Capital Management Ideas

Make sure the sales and marketing team are over-communicating with their customers. A company will gain insight into accounts receivable payment patterns, changing purchase orders moving forward, and inventory status at the customer level.

The company’s management team needs to be meeting at least weekly to address vendor relationships and payment requests. A company will need to prioritize who to pay based on current needs for product, potential single-source issues after the phased return begins, potential sourcing volume problems after the phased return.

Vendors should be identified with a priority code using these concerns. Alternative vendors need to be identified and accounts established.

Inventory should be identified with a priority code and turnover rates by SKU need to be considered and adjusted. Substitutions should be identified where possible.

Companies with higher levels of liquidity entering February will be in a better position to weather these changes. But companies will be experiencing degrees of stress irrespective of their liquidity.

The weekly cash flow and borrowing-base forecast will be the key management tool going forward. CFOs and controllers need to have a base forecast built on what is currently known. Then the CFOs and controllers need to make adjustments in real time to see how a change in a customer’s payment impacts the ability to pay for supplies or for expenses.

Get ready!

Chaos and stress will be the normal environment. Companies and their lenders need to understand that and develop ideas to reduce stress. Planning and organization are key.

The operating cycle and working capital impact of the reopening is going to be somewhat lumpy and erratic, but a company needs to plan and forecast that transition back to normal.

The level of uncertainty is not an excuse to reduce reliance on forecasting but, rather, a reason weekly cash-flow and borrowing-base forecasting is even more critical than before.